Tesla wants to build a huge factory in China and begin investing more heavily in the Model Y. But with what money? —— questioned ‘TheStreet’ author Bret Kenwell.

He is right.

Tesla cannot build a Gigafactory in China, without billions on hand. The one in Nevada burned $2.3 billion dollars from Tesla’s locker in the last four years and still remains hungry for cash.

According to initial plans, Gigafactory 1 was estimated to cost $5 billion and Tesla’s contribution was expected to be about $2.0 billion over a five year period. The rest was from Tesla’s partner Panasonic.

But Tesla has already spent nearly $2.3 billion. and capacity is still few quarters away (at-least) from reaching 500,000 cars per year. It’s quite possible for Gigafactory 1 costs to go over $6 billion.

Tesla is now planning to integrate battery and car production in future Gigafactories.This could push the cost of building them even higher.

Tesla’s past mistakes and experience in manufacturing will certainly help save some of those costs, but no one has any doubt that the next Gigafactory is going to cost billions. The only question is, will it be less than $5 billion or more than $5 billion?

Money that Tesla does not have.

Tesla finished its first quarter 2018 with $2.665 billion cash. Gordon Johnson, managing director at Vertical Group, told TheStreet that “he and his team believe Tesla will exit the quarter with less than $1 billion in cash.”

Tesla went from building a little more than 2k cars/week (Model 3) at the end of first quarter 2018 to 5k cars/week at the end of second quarter. A production ramp like that is not going to be cheap and Tesla may have had to spend more than a billion dollars for its second quarter production ramp.

Where is the money for Gigafactory 3, Tesla Semi, Model Y and other future projects?

Even if Tesla becomes profitable, generating billions of dollars in profits is not going to happen in a hurry, which means they need to raise money if they want to multiply their production further.

People are not questioning Tesla’s ability to build or sell cars, at least not anymore. But a lot of them keep questioning Tesla’s financial position, it’s cash burn and long term business viability.

Charles Morris at Evvanex, explained Tesla’s on-going perception struggles in a way no one else has.

He said, “Companies in hyper-growth mode invest more money in developing new products than they bring in from sales of existing products. To keep the party going, they must continually raise new capital by issuing stock or bonds.

Thus, they are vulnerable to bad news, real or invented, that adversely affects their stock price and/or bond ratings.

Tesla, which has been posting hefty quarterly losses for years, is the epitome of this kind of funding model, and that presents a huge opportunity for short sellers: convince enough people that the company’s in financial trouble, and soon it will be.

As investor confidence declines, the stock price goes down and bond interest rates rise, making it more expensive for the company to raise the capital it requires, and a vicious cycle (or a virtuous one from the short sellers’ point of view) starts spinning faster and faster.”

The one good thing that the shorts and the constant negative news about Tesla has done is – It has made the company well aware of the need to become profitable.

True

— Elon Musk (@elonmusk) July 5, 2018

To be clear, Tesla has no other choice.

Every additional quarterly loss will only make the short side of Tesla story sound more realistic than it actually is. If Tesla wants to break the vicious cycle, it needs to show the world that it can bring in the profits.

Tesla has made a series of moves in the last few months to reduce spending. The company slashed 9% of its salaried workforce, increased Model S and Model X price, and Elon asked his team to freeze spending on all projects that costs more than a million dollars annually until he approves it and so on.

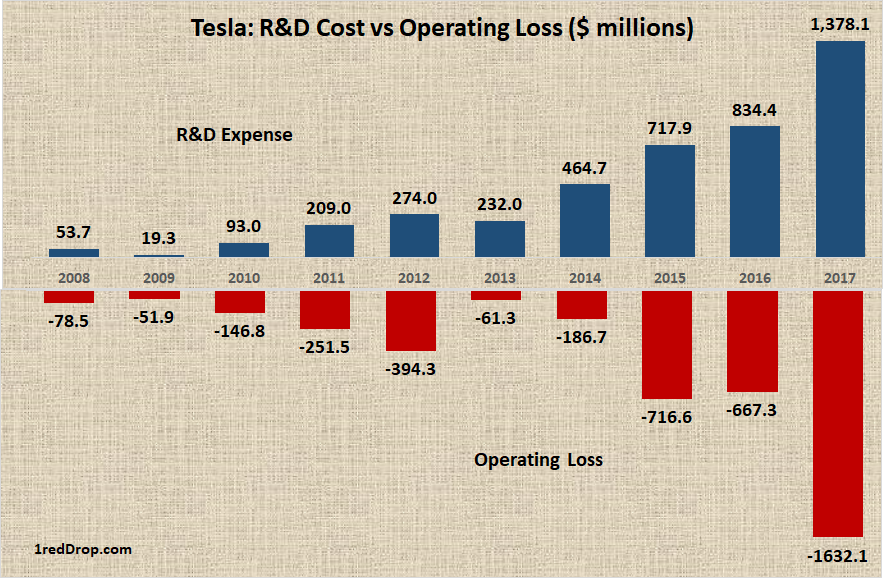

In 2017, Tesla spent $1.378 billion in R&D, accounting for nearly 12% of the company’s revenue. SG&A accounted for 21% of revenue, taking total operating expense to nearly 33% of Tesla’s revenues.

To become profitable, Tesla needs bring operating expense below its gross profits. If we use Tesla’s four year avg gross margin of 24%, then Tesla’s job is to bring down its operating expense as % of revenue under 24%.

If Tesla sells 360,000 Model S/3/X over the next four quarters; 100,000 Model X and S at an average selling price of $90,000 and 260,000 Model 3 at an average selling price of $50,000, Tesla’s automotive revenue alone will reach $22 billion. Add another two billion from Tesla’s Energy generation, storage and Services business, Tesla’s total revenue at 360,000 units will get closer to $24 billion.

24% of $24 billion is $5.76 billion. Will Tesla be able to contain its Operating Expense under $5.76 billion in the next 12 months?

Tesla’s operating expense in the last four quarters grew sequentially at an average of 3.37%. Tesla is already building 7000 cars per week. Even if we assume Op.Ex to continue its current trend of sequentially growing by 3.37% over the next four quarters, Tesla’s Op. Ex will only reach $4.581 billion – well below their gross profits during the period.

We are only projecting production to reach 360k, which Tesla can achieve without any further production increase as they are already building 7000 cars per week. So even freezing Op.Ex spending or even reducing it over the next four quarters is highly possible. If Tesla does that, it will further increase their operating profits over the next four quarters.

Tesla will enter into the third quarter with a depleted cash position. It is a disadvantage.

But the real advantage is Tesla can sell 7,000 cars every week, bringing in the cash. This is possibly why Tesla kept saying that there is no need for them to raise more funds this year, simply because there is actually no need, unless Tesla starts building Giga 3 or starts building capacity for new products.

That’s not going to happen and we all know why.

Tesla can play the waiting game, because they are already there at a position of production strength, thanks to their second quarter production hell.

Now they need to prove the world that they can be a profitable auto company and then hit the markets for additional funding.

Note:

Tesla delivered 103,020 Model S/3/X in 2017, out of which 1,770 were Model 3. Total Automotive revenue for the year was $8,534,752,000. Automotive revenue/Total units sold =$82,845. The average selling price assumption of $90,000 for Model S and X is not grossly incorrect.

Model 3 average selling price of $50,000 is extremely conservative as Tesla Model 3 Performance version costs $64,000, Long Range Version starts at $54,000. At an ASP of $50K, Tesla can even launch its $35K Model 3.

Current Production rate is around 7000 cars per week. Annual production run rate is 364,000 units. (52 weeks). Planned Gigafactory capacity is 500,000 units per year.

We’ve gone from ~1000 S/X deliveries per week in US last year to ~6000 S/3/X. It’s like hitting a square wave.

— Elon Musk (@elonmusk) July 23, 2018

Source:

TheStreet: https://www.thestreet.com/investing/stocks/tesla-must-raise-billions-in-cash-if-elon-musk-still-wants-to-make-cars-14656380

Charles Morris, Evvanex: https://cleantechnica.com/2018/07/21/is-perceived-solvency-the-real-reason-jim-chanos-is-short-tesla/

Tesla Press Release: http://ir.tesla.com/press-releases