A WSJ article earlier this week cited Panasonic as saying that “Tesla has backed away from an agreement to buy all of the output from a solar-panel factory it operates with Panasonic Corp.” While this sounds like Tesla violated an agreement, Tesla says otherwise.

According to a Tesla spokesperson: “We continue to use cells and solar modules produced in Buffalo by Panasonic…in line with our contract, which contains no requirement of exclusivity. We anticipate using the full production capacity of Gigafactory 2 over time as we reach higher output and installation volumes.”

Tesla has been having problems on the installation front for its solar panels, and the fact that its hard to get Musk’s approval on the esthetics aspect of any product means that only one type of panel is now being installed – textured black. That and other issues have created a slowdown in installations, and this has created a slowdown in component acquisition from its partner, Panasonic.

In an earlier report, we mentioned that Panasonic had not signed any agreements with third parties for its solar components. But the deal terms were revised earlier this year, and the company is now reportedly selling panels under its own brand as well as to other companies.

As it turns out, this may not be a bad thing. Panasonic is facing a slowdown in demand back in Japan for its panels, and that’s related to subsidies getting cut and overall solar panel demand softening in the land of the rising sun. The altered deal with Tesla now puts pressure on Panasonic to boost U.S. sales, but the Trump-initiated tariff increases on Chinese panels could be a way out of this predicament. Panasonic says that demand in the U.S. for domestic-made panels was “intact.”

Tesla’s (and Musk’s) focus of late has been on ramping up production of the Model 3 electric car. While it’s possible that this has affected the SolarCity side of the business that operates in the Buffalo factory dubbed Gigafactory 2, it appears to be a short-term problem. For its part, Tesla is still committed to buying up Panasonic’s full production at Gigafactory 2 once installation volumes are back up. Meanwhile, Panasonic’s plans to invest $271 million in the facility remain unchanged.

The relationship between the two companies goes as far back as 2010 when Panasonic first started providing batteries for Tesla EVs. That relationship later matured into a joint investment deal for Gigafactory 1 in Nevada, where Panasonic is even now open to increasing its investments if Tesla requires.

What appears to be a rift forming between the two partners may well be a temporary setback that Panasonic is absorbing by diverting inventory to other companies for retail sales. It is not uncommon for a manufacturer to compensate for weak sales figures in one channel by diverting them to another to make sure its own inventories don’t go out of hand. That’s exactly what seems to be happening in this case.

This is a crucial partnership for the EV market. The companies jointly designed the 2170 battery cells that go into the Model 3, and the cell format and chemistry are said to be more advanced than anything else currently ready for mass production. That means this partnership is going to be – indeed, has to be – kept alive and well for a long time to come.

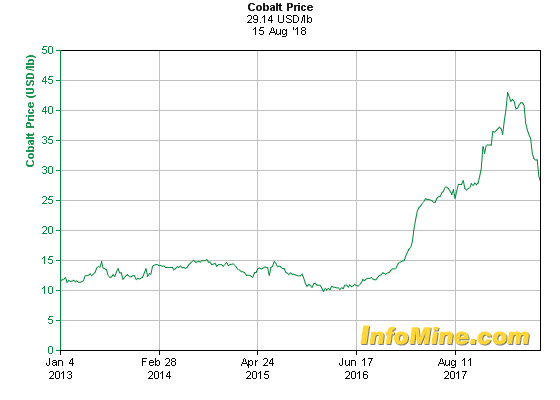

The whole purpose of working on such a design was to try and reduce the cost by increasing battery density and cutting cobalt content, among other things. Cobalt prices have sky-rocketed in the past few years and remain volatile, so its absolutely critical that these two companies continue to live in harmony to widen the gap between Tesla and other EV makers, at least from a mass-market perspective.

The problems at Gigafactory 2 haven’t affected that relationship, and I think Panasonic is very understanding of Tesla’s problems with solar installation numbers. The Japanese company has been quite accommodating of Tesla’s short-term predicament, even defending the company in public. That’s not going to change as long as Tesla and Panasonic jointly lead the electric car battery market. Chinese contenders like CATL have already overtaken Panasonic by size, but they’re primarily focused on supplying to China’s massive commercial electric vehicle segment. Panasonic still leads the field when it comes to electric cars, and Tesla’s very much part of that success equation.

Since Panasonic has hitched its wagon to Tesla, it’s very unlikely that the Japanese electronics giant is going to jeopardize that relationship because of minor issues with solar panel components, which is a much smaller business right now. The Model 3 is everyone’s focal point right now, and nothing is going to change that for a while.