The Tesla Semi seems to be undergoing rigorous road tests. More than one has been spotted far away from their home in Fremont, California, over the last few days. The first one was seen in New Mexico (600+ miles away), and another one was spotted much further away, in Catoosa, Oklahoma (2,000 miles away), at a Supercharger station.

The all-electric Class 8 truck is expected to have a 500-mile range on a full charge, and 400 miles on an 80% charge that will take about 30 minutes on a “Tesla Megacharger” that will have an estimated 1-megawatt output.

Musk confirmed in March this year that testing was underway, and it looks like real-world tests are still going on. With the production start only about a year away, there’s a lot to be done if the company wants to break into the highly competitive commercial trucking segment.

New Class 8 trucks are tested rigorously before being sent to production, but Tesla’s real-world testing has to prove that it can stand up to and go beyond the performance levels of a typical Class 8 tractor-trailer configuration while achieving an operating cost factor that would make it an attractive switch for freight operators.

That’s the only way they can break into the market. Their success with consumer-focused EVs doesn’t necessarily mean they’ll have an easy time of it on the commercial side.

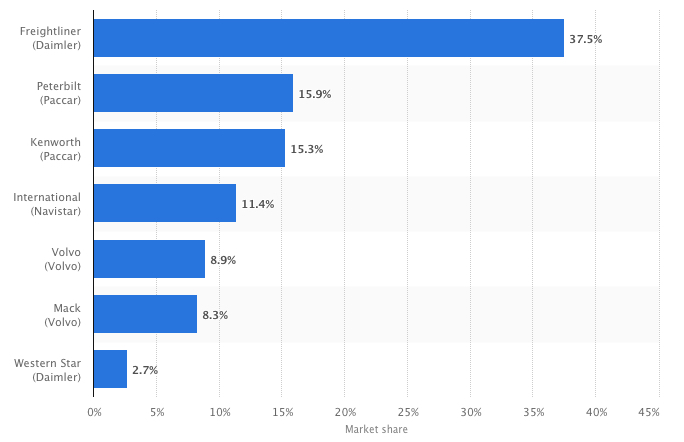

Who are the biggest players in this segment in the United States that Tesla is up against?

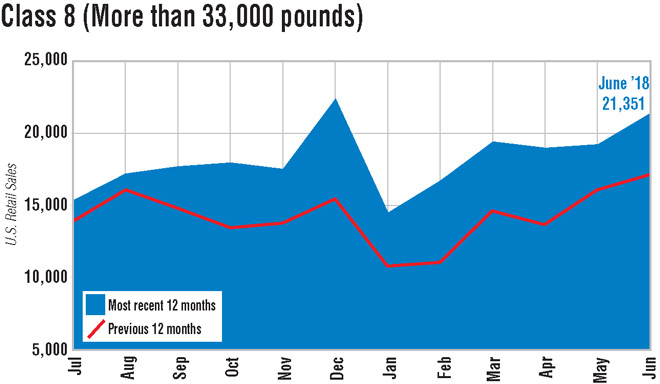

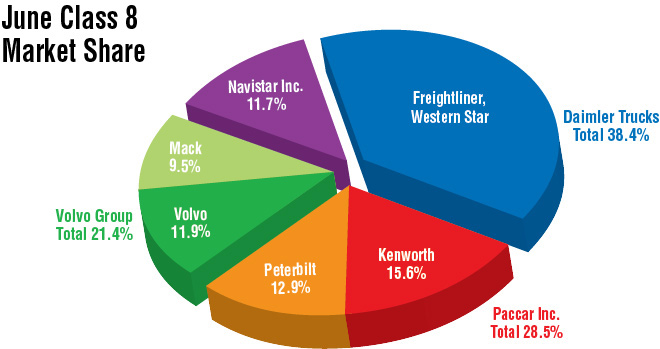

Daimler, Paccar and Volvo pretty much owned this space by the end of 2017, and nothing much has changed in the last several months. Sales peaked for this year in June, at 21,351 compared to the year-ago period sales of 17,310, but a lot of that has to do with back-logged orders because of certain parts not being available after the trucks come out of the assembly line (red-tagged trucks.) Overall, sales levels have improved by about 30% year-over-year, which is great news all around.

In terms of market share, there has been some movement. Year-to-date, market leader Freightliner lost a couple of percentage points compared to last year; Navistar’s International Truck saw the biggest market share growth of 2.6%; Volvo improved by 1.7%; Peterbilt (Paccar) and Mack Trucks’ (Volvo) market share has dipped slightly, and Kentworth (Paccar) pretty much held steady.

Overall, Daimler, Paccar and Volvo nameplates lead the field, with Navistar and others bringing up the rear among the top sellers.

This is what Tesla Semi is up against when it comes out next year. Sure, EVs are more sustainable, require almost zero maintenance and have longevity on their side. But they are yet to prove themselves against the mass-market diesels that currently rule the roads.

The good news for Tesla is that the backlog of orders versus deliveries currently stands at about 220,000, almost as much as the highs of 2006. Those levels won’t remain indefinitely as deliveries catch up with orders, but the overall health of the trucking segment in terms of sales growth indicates that the timing is right for Tesla to introduce the Semi. Hopefully, there won’t be any major delays or bottlenecks hampering it the way the Model 3 struggled during its early months of production.

Like? Here’s More…

Musk Says Tesla Model 3 Battery Achieves Best Cost. What about the Tesla Semi?

Wal-Mart Pre-orders 15 Tesla Semi Tractor-Trailer Big Rigs for U.S., Canada