Tesla is yet to decide on a date to report its third-quarter 2018 results but the early signs indicate that the much-maligned electric car maker is well on its way to break plenty of records.

-

Tesla may easily beat consensus revenue and earnings estimates for the quarter as Q3 delivery numbers came in well above market expectations.

-

Concerns about Tesla missing its self-declared target of 6000 Model 3 units per week in the last week September and cash position will continue to weigh down on the stock.

What works in favor of Tesla?

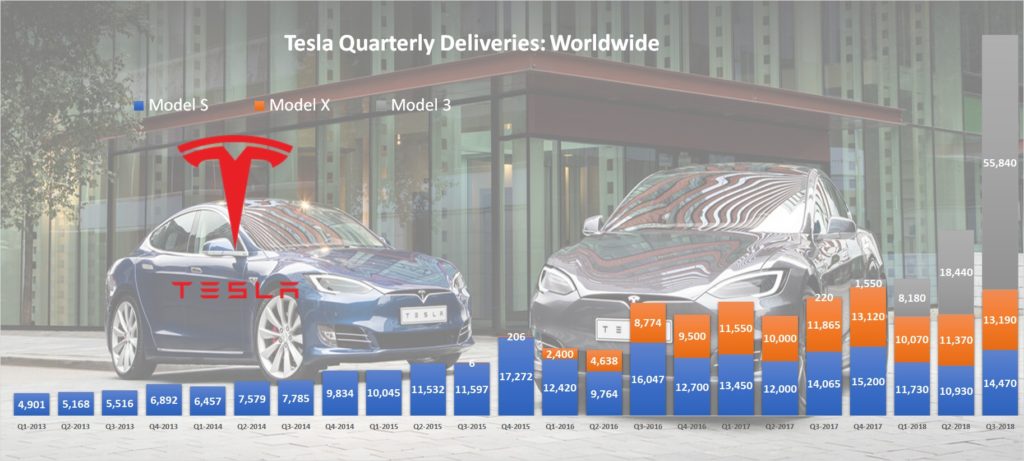

Tesla surprised the market when it announced that the company delivered 83,500 Model S/3/X in Q3, well above the consensus delivery estimate of 80,500 units.

Consensus delivery estimates for Model 3 (55,600) was very close to official numbers (55,840), but analysts missed Model S and X delivery estimate by a wide margin.

As per this Barron’s report, J.P. Morgan analyst Ryan Brinkman now expects a quarterly loss of $1.35 per share, better than the loss of $1.66 per share he previously expected.

Expect more analysts to follow suit because Wall Street analysts got their estimates wrong on higher priced Model S and Model X, not on Model 3. If we assume the average selling price of Model S and X to be at $90,000, for every additional 1000 units Tesla will bring in $90 million in revenue.

The market was bearish on Model S and Model X sales as conditions in China, the second largest market for Tesla, was not favorable due to the ongoing trade war. Tesla noted in its third-quarter delivery report that the company is now operating “at a 55% to 60% cost disadvantage compared to the same car locally produced in China.”

But Tesla managed to deliver 14,470 Model S and 13,190 Model X, a total of 27,660 units during the quarter, keeping them on track to deliver 100k units for the year. Though Tesla does not release regional sales figures, it’s not that hard to guess that Tesla must have compensated its weakness in China by improving sales in the United States and other international markets.

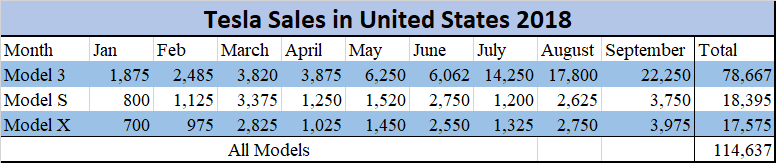

In the United States, Tesla has sold 35,970 Model S and X in the first three quarters of 2018, compared to 34,920 units the company sold during the same period last year.

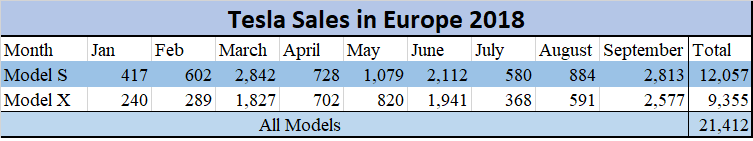

In Europe, Tesla sold 21,412 Model S and X this year, compared to 19,335 units the company sold last year.

Tesla increasing Model S and X sales in the United States and Europe does add a lot of positive spin going into third-quarter results. Simply put, Tesla has now delivered 71,760 Model S and X in the first three quarters of 2018 leaving the company a delivery target of 28,240 units for the fourth quarter.

Tesla delivered 28,320 Model S and X during the fourth quarter of 2017. All Tesla has to do now is to repeat its last year performance and they will reach their 2018 guidance of 100k Model S and X deliveries. This certainly puts to rest all questions about lackluster Model S and X sales affecting Tesla’s performance in 2018.

What might work against Tesla?

The two factors that will have the most impact on Tesla’s short-term valuation is the amount of profit or loss the company reports in the third quarter and the amount of cash the company is left with.

Tesla started of 2018 with $3.37 billion cash on hand, which came down to $2.665 billion by the end of the first quarter and $2.236 billion by the end of second quarter. Though the cash bleed has been on a downward slope since the start of the year, not many believe that Tesla will be able to stop the bleed.

The less the cash spent during the third quarter, the better the sentiment will be.

Tesla CEO Elon Musk expressed confidence during the second quarter 2018 earnings call that the company will soon be in a position to pay off its near-term debt using internally generated cash flow. Tesla will have to become cash flow positive and spend as little of its cash in the third quarter to make that happen.

Tesla expects to be cash flow positive and GAAP Profitable in Q3 and Q4-2018. The company has pulled several levers such as increasing unit price, slashing its workforce by 9%, shutting down several solar facilities and so on.

Though the effect of cost-cutting measures will be felt in Tesla’s third quarter financial statements, it will be important for Tesla to show some evidence that it will be sustainably profitable and third quarter profits are not due to one-time-only efforts. If Tesla reports a loss, it will undoubtedly raise a lot of questions about the company’s future and weigh heavily on the stock.

What does it mean for long-term investors?

Tesla has always been a roller coaster ride for long-term term investors and the ride got a little bit bumpier in the past few months, thanks to CEO Elon Musk and his highly active Twitter account. Things are not going to change now.

Tesla is a volatile stock.

Volatility will continue as we inch towards third quarter results and the up-down movement should continue even after fourth-quarter results are out. Tesla will have to report at least two to three profitable quarters to decisively change market sentiment into a positive one.

Until that happens, Tesla will keep moving sharply on news. Tesla will break plenty of records in the third quarter, but the onus will be on the company to make right on its past promises. GAAP Profits and Cash Flow Positive.

If Tesla achieves those two rare feats, the market will forget everything that happened in the last few months.

Tesla: Outlook for Q3-18

-

Model 3 gross margin should grow significantly to approximately 15% in Q3 and to approximately 20% in Q4 predominantly due to continued reduction in manufacturing costs and to some extent an improving mix.

-

Our target of delivering 100,000 Model S and Model X vehicles this year remains unchanged.

-

For the rest of this year, total non-GAAP operating expenses should remain relatively stable at Q2 levels excluding restructuring costs,as a result of our overall drive towards operating efficiencies.

-

Our total 2018 capex is expected to be slightly below $2.5 billion, which is significantly below the total 2017 level of $3.4 billion.

-

In the second half of 2018, we expect, for the first time in our history, to become both sustainably profitable and cash flow positive.

(From Q2-18 Shareholder letter)