Tesla will release its much anticipated third quarter 2018 results on Wednesday, October 24, 2018. (3:30pm Pacific Time / 6:30pm Eastern Time). It’s a bit earlier than usual because Tesla generally takes nearly a month to report quarterly results after the quarter end. Tesla released its Q3-2017 report on November 1, 2017.

What to expect?

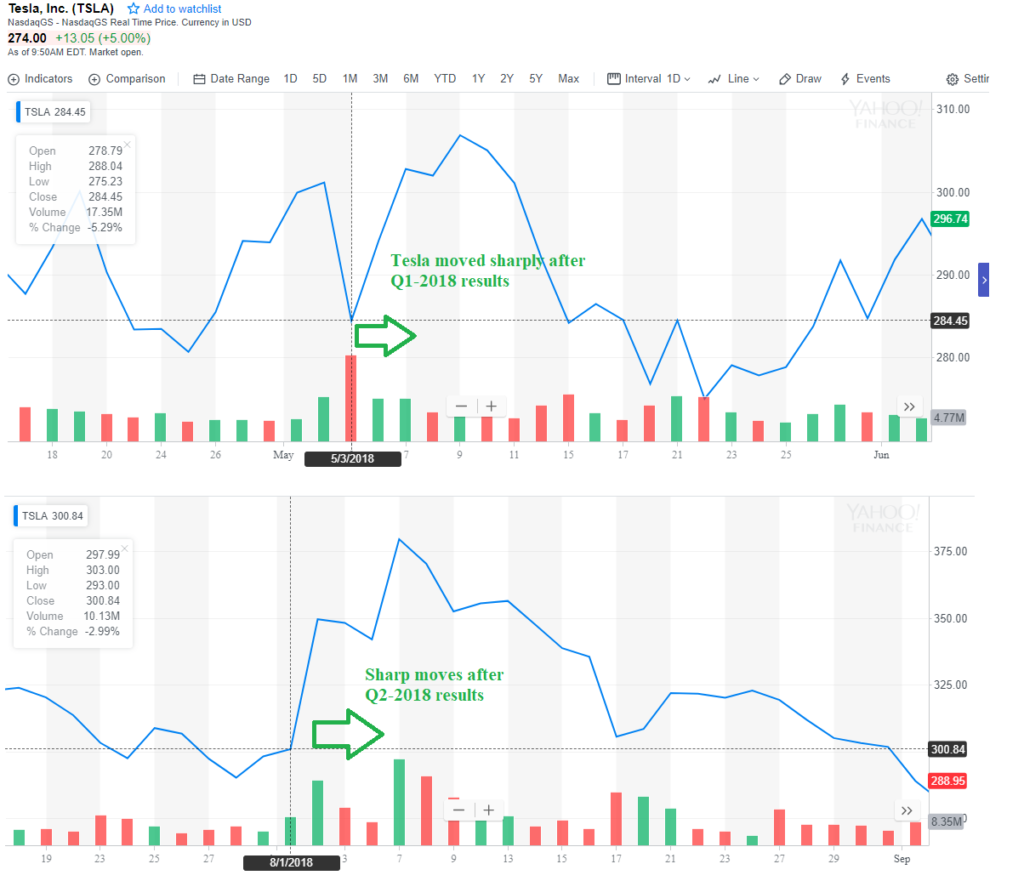

Tesla moves big on news and the stock price tends to swing wildly in the week after the results.

As you can see from the chart above, Tesla moved sharply in the week after Q1 and Q2-2018 results were announced and things are not going to much different this time. On both the occasions the stock price surged right after the results only to pare all the gains over time.

As you can see from the chart above, Tesla moved sharply in the week after Q1 and Q2-2018 results were announced and things are not going to much different this time. On both the occasions the stock price surged right after the results only to pare all the gains over time.

Out of all the numbers that will be dissected in the company’s Q3 report, Tesla’s cash position and Net Loss/Profits will remain the most scrutinized ones. Tesla exited the second quarter with $2.236 billion cash on hand. How much cash the company is left with at the end of the third quarter becomes all the more critical because there is a $230 million convertible that’s due on November 1, 2018.

“Our default plan is we pay, we start paying off our debts. I don’t mean refinancing them,

I mean paying them off. For example, there’s a convert that’s coming due soon, a couple

hundred million, $900 million, something like that. We expect to pay that off with

internally generated cash flow,” said Tesla CEO Elon Musk during the second quarter earnings call.

If Tesla reports Q3 profits then it will allow the company to strengthen its case to repay debt using internally generated cash flow instead of raising funds to meet its obligations. This will not only improve market sentiment but will also force short sellers to re-evaluate their position.

Tesla has two debt repayments due:

Due on Nov. 1: $230 million SolarCity convertible

Due on March 1, 2019: $920 million from a Tesla convertible

The Guidance: From Q2-2018 Shareholder Letter

-

We expect to produce 50,000 to 55,000 Model 3 vehicles in Q3 (2018).

-

Model 3 gross margin should grow significantly to approximately 15% in Q3.

-

We are expecting that the negative margin of our Services and Other business will narrow by the end of this year.

-

For the rest of this year, total non-GAAP operating expenses should remain relatively stable at Q2 levels excluding restructuring costs, as a result of our overall drive towards operating efficiencies.

-

Our total 2018 capex is expected to be slightly below $2.5 billion, which is significantly below the total 2017 level of $3.4 billion.

Wall Street’s third-quarter expectation:

-

Tesla delivered 83,500 units during the third quarter of 2018, beating the consensus wall street estimate of 80,500 units.

-

Though most analysts remain skeptical about Tesla eking out a profit during the quarter, the delivery beat forced them to update their third-quarter revenue and earnings estimates.

-

Notable analysts Ryan Brinkman (J.P Morgan) and David Tamberrino (Goldman Sachs) reiterated their bearish stance on Tesla with a price target of $195 and $210.

-

-

Data from Yahoo and Wall Street Journal show that wall street consensus revenue estimate for the quarter at $6.3 billion and a net loss of 0.7 cents.

-

According to CNBC, Tesla shares jumped today “as a noted short seller Andrew Left of Citron Research said he is now betting on the stock ahead of the company’s earnings report on Wednesday.”