Tesla surprised Wall Street by reporting a profitable third quarter, the third time in the company’s history. Tesla reported GAAP net income of $311 million while increasing cash and equivalents by $731 million.

Wall Street analysts were indeed blindsided when Tesla delivered 84k units during the third quarter as the market expectation was only for 80.5K units. Though the market had enough time to digest the impact of additional deliveries, the biggest surprise for the quarter came in the form of Model 3 gross margin.

CEO Elon Musk told analysts during the Q3 earnings call that the company achieved a gross margin of 20% for Model 3, way more than the guidance of 15%. This certainly threw analyst estimates off the chart, allowing Tesla to post adjusted earnings of $2.90 per share, well above the market’s expectation of 19 cents loss per share.

CFO Deepak Ahuja added a bit more clarity into how Tesla achieved higher than the expected gross margin on Model 3.

He said, “Our improvements on the cost side were in every aspect of cost. So clearly, our manufacturing labor hours improved significantly – our overall manufacturing costs dropped almost 30% sequentially Q2 to Q3. We produced more volumes, so we had better fixed cost absorption. We have far less scrap. Our yield on each of the lines across both factories improved significantly.”

Key Points:

-

Tesla delivered 84K Model S/3/X during the third quarter, 80% more than what the company delivered in all of 2017.

-

Tesla built 5,300 Model 3s in the last week of Q3.

-

“Labor hours per Model 3 decreased by more than 30% from Q2 to Q3, falling for the first time below the level for Model S and X.”

-

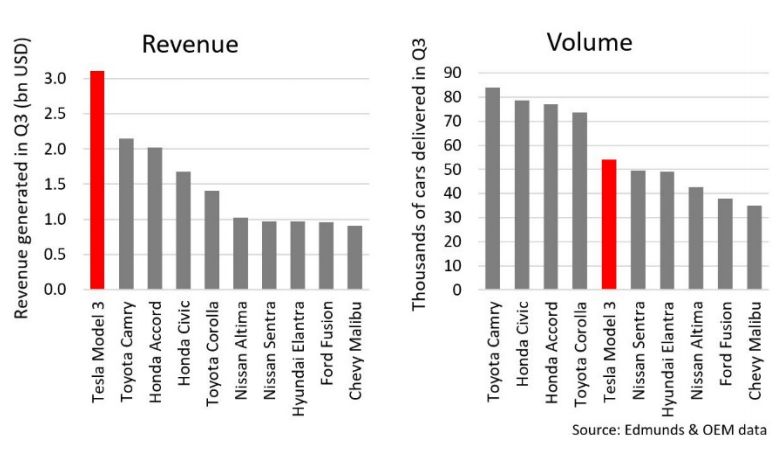

According to CEO Elon Musk, Tesla Model 3 has become the best selling car in the United States by revenue and 5th in sales volume

-

Tesla expects to report positive net income and cash flow in Q4-2018.

-

Model 3 deliveries in Europe and China will begin early next year.

-

Over the long term, Tesla plans to build Model S and X exclusively in California, while localizing Model 3 production in Europe and China

-

Tesla’s current operating plan is to pay off debts through internally generated cash flow, reduce the debt load and overall leverage of the company. Tesla repaid $82.5 million of bonds in Q3.

-

Tesla started rolling out company-owned body shops in the United States.

-

During Q3, the company opened four store and service locations, increased Mobile fleet to 373 vehicles and added 44 supercharger locations.

Cash on Hand and Capital Expenditures

Tesla exited the third quarter of 2018 with cash and equivalents of $2.967 billion compared to $2.236 billion the company had at the end of the second quarter of 2018. Tesla has enough cash on its balance sheet to handle its debt repayments that are due over the next six months.

Tesla’s Capex for the quarter came in at $510 million, lower than the $609 million and $655 million the company spent in the first and second quarter of the current fiscal.

Fourth Quarter Guidance

-

Tesla reietrated its target of delivering 100,000 Model S and Model X in 2018

-

Expects Model 3 gross margin to remain stable in Q4.

-

Gross margin for Model S and X may decline slightly in Q4, due to the sequential increase in tariffs in Q4 from Chinese sourced components.

-

Q4 operating expense should grow slightly compared to Q3.

-

Positive GAAP net income in Q4.

-

Total 2018 capex, is expected to be slightly below $2.5 billion. “Q4 capex projection includes the purchase of land in China and initial design and other expenditures for Gigafactory 3.”