Riding on the back of the success of Model 3, Tesla turned a colossal corner, posting net profits in the third quarter of 2018. The fact that it was only the third time in its history the company was able to report profits speaks volumes about the achievement.

Take Model 3 out of the equation, Tesla wouldn’t be in a position to talk about being sustainably profitable.

The reason is relatively simple.

If there is no Model 3 —->Tesla will not have sufficient production volume —-> If there is not enough volume, there will be no economies of scale—–> If there is no scale, there won’t be any cost reduction to improve the bottom line.

Model 3 is indeed Tesla’s bet the company product. If it had failed, Tesla would have been toast. But if it’s success continues, it will dramatically change the future of the company. Let’s take a closer look at Model 3s impact on Tesla’s future and the automotive world.

How many Model 3s can Tesla sell globally: Market Size

Tesla sells Model S and Model X in nearly 30 countries.

Since Model 3 is a high volume product (Tesla standards), expanding geographical footprint beyond existing markets is impossible due to lack of charging infrastructure in the rest of the world. Most countries, including the United States and Germany, are only doing lip service in improving public charging infrastructure.

Tesla will stick to countries where it has supercharging infrastructure in place.

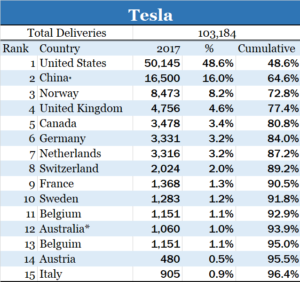

In 2017, the United States, China, and Norway accounted for more than 72% of the company’s sales. If you look at it from a continental perspective, North America and Europe accounted for nearly 80% sales, with China bringing in another 16%.

North America, Europe, and China accounted for nearly 96% of Tesla’s sales in 2017.

Tesla has higher odds of succeeding in its existing markets than in new markets. Model 3 will be sold exclusively in these regions for many more years to come.

Before we dig into potential market size for Model 3 in Tesla’s existing markets, let’s take a closer look at Model 3 price positioning and competition.

Model 3 now starts at $46,000 in the United States for the “mid-range” battery pack trim, going all the way to $70,000 for the fully loaded long-range battery Model 3 Performance version.

Tesla does not have any more room to go higher unless it wants to seriously cannibalize Model S that starts at $77,000. But Tesla has plenty of room to push Model 3s entry price lower. The company has insisted that it will launch the standard battery version at $35,000, though many in Wall Street still think it’s an impossible task.

Let us assume that Tesla positions Model 3 in the $35k to $80k price range worldwide. The German triumvirate, BMW, Merc, and Audi firmly control the global premium sedan market with multiple models competing in that price range.

BMW, Merc, and Audi are veterans in the premium sedan circuit. Tesla will not try and increase its production complication by adding more Models. It will be more trims, but certainly not more sedans to be slotted around Model 3. It may happen ten, twenty years down the road, but certainly not now.

It’s going to be a stretched out Model 3 trims versus entrenched BMW, Merc and Audi models fighting for buyers who are ready to spend $35k to $80K on their next car.

There are plenty of other car makers in the global premium sedan market, but the battle for Tesla is going to be against the top guns of the segment, not the smaller players in each region.

United States:

The second largest auto market in the world recorded sales of 17.237 million in 2017 and the entry-level premium sedan market is enormous with several players in the fray. The small luxury segment car sales touched 459,665 units, with Mercedes Benz C-Class, BMW 3 series, Infiniti Q50, BMW 4 series and Audi A4, five models, accounting for 55% of sales.

Things were nearly the same in the midsize luxury segment where Lexus ES, Mercedes E/CLS class, BMW 5 series, Lincoln MKZ and Audi A6, accounting for 63% of the 296,117 units sold in 2017.

The eleven models averaged sales of around 8,500 units per week in 2017, with the number one player averaging sales of 1000 to 1500 units per week in both the segments.

If Tesla can attract customers from other segments and repeat the success of Model S which accounts for more than a quarter of the US large luxury segment, selling 3,000 to 5,000 Model 3s per week in the United States is not out of the company’s reach.

Canada:

The tenth largest auto market recorded sales of a little over 2 million units in 2017. Though it may not be as big as its southern neighbor, Canada is one market that is geographically closer to Tesla’s factories, making it easier and faster for Tesla to sell its products.

The small luxury car segment posted sales of 51,395 units, while the mid-size luxury segment had sales of 13,234 units.

The top five models of the small luxury segment Mercedes-Benz C-Class, BMW 3-Series, Audi A4, Acura TLX, and Mercedes-Benz CLA-Class accounted for nearly 55% of 51,395 units sold in 2017.

The top six models of the midsize luxury segment Mercedes-Benz E-Class & CLS-Class, BMW 5-Series, Lexus ES, Lincoln MKZ, and Audi A6 accounted for nearly 65% of 13,254 units sold in 2017.

If Tesla can capture a quarter of small and midsize luxury car segment in Canada the company is looking at a market of around 300 units per week. Though 300 might look a bit low, it must be noted that Tesla sold less than 3,500 Models S and Model X in Canada last year, an average of around 66 units per week.

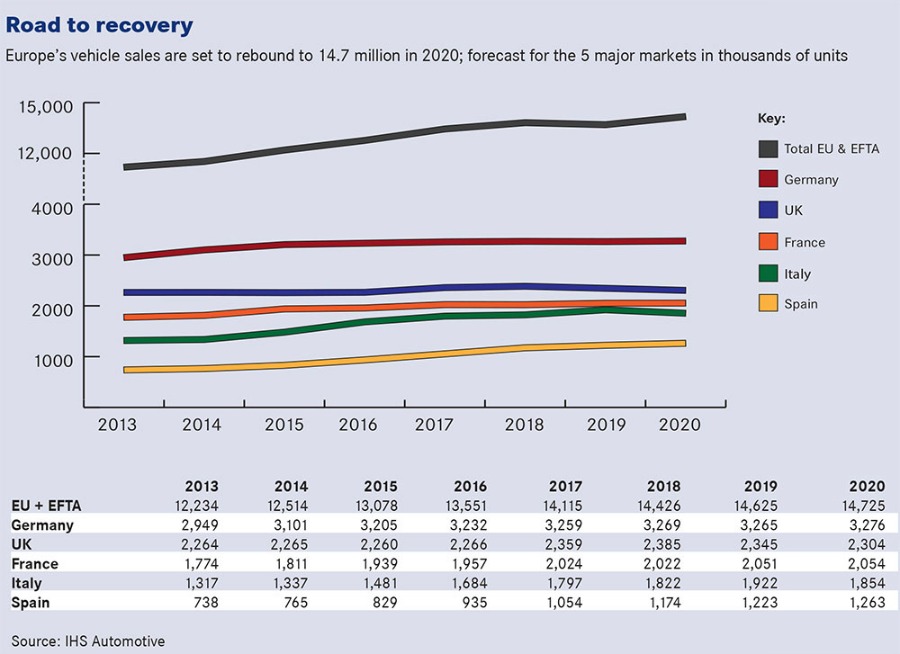

Europe:

Winning European premium sedan market in 2019 will be Tesla’s biggest challenge. No one knows how things will play out in China, but its safe to say that it’s certainly not going to get better any time soon.

Tesla is moving fast to build its factory in China, localize production, cut import fees and other tariffs.

But it’s a long-term play, not a short-term one, leaving Europe as the region that will be the difference between Tesla Model 3 becoming the best premium selling sedan in the world and the best selling premium sedan in North America.

The small and midsize luxury sedan segment in Europe is huge.

Data from Carsalesbase shows that the top players in the small luxury segment, Mercedes-Benz C-Class, Audi A4 / S4 / RS4, BMW 3-series, BMW 4-series, and Audi A5 / S5 / RS5 accounted for a whopping 83% of the 694,030 units sold in 2017. The top five players have an authoritative control over the market with Mercedes Benz C Class taking the crown selling 176,915 units last year, nearly 3,500 units per week.

The mid-size luxury segment in Europe reported sales of more than 400,000 units in 2017. Mercedes Benz E class, the number one player in the segment delivered 127,638 units, averaging nearly 2,500 units per week, followed by BMW 5 Series with 109,953 units, averaging nearly 2,100 units per week.

Tesla Model S didn’t set the charts on fire in Europe, but Tesla has tasted success in countries like Norway and the Netherlands.

Tesla has steadily expanded its supercharging stations in Europe and will continue expanding. Though the odds of Tesla walking away with one-fourth of the premium small and midsize segment in Europe looks a bit more difficult than it is in North America, Tesla does have a real shot at selling more than 5,000 Model 3s per week in the region.

If Model 3 can knock off Mercedes Benz from the number one place, the company is looking at sales of 6000 units per week in the region.

North America and Europe have enough size and space for Tesla to get between 5000 to 10,000 Model 3s per week. If Tesla can get China into the mix, the company can increase it by another 5,000.

Model 3 may not be a million unit per year model (yet), but it gives Tesla a clear path to selling 500,000 to 750,000 units globally. It will give Tesla the scale it so badly needs, reduces per unit production costs, paving a better path to profitability. For the automotive world, the success of Model 3 (a.k.a sales numbers)will certainly steer them towards a more electrified future.

World Best Selling Cars Ranking 2023. Tesla Model Y On Top Making A Step Into The Future

,