Tesla sprung a massive surprise on Wall Street by beating topline and bottom-line expectations for the third quarter of 2018. This is not the first time the company turned in a profitable quarter. But every time it did so in the past, the company plunged neck-deep into the red in the following quarter.

But if you look closely, several indicators scream that things are going to be different this time. Tesla has already reached a stage from where the company can dictate its terms to the market instead of letting the market control its future.

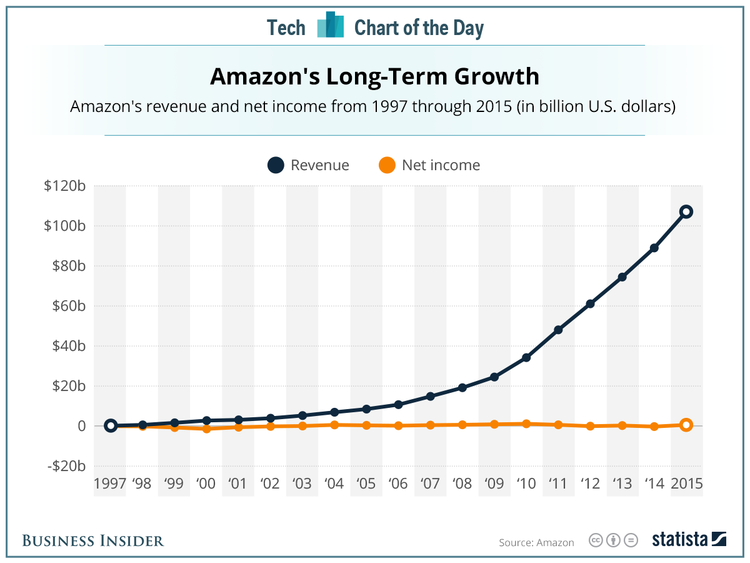

Amazon can take a boatload of debt without breaking a sweat and expand aggressively. But they never do. Jeff Bezos keeps his retail and technology empire in a barely profitable state re-investing as much as it’s possible to expand the business.

Tesla can do the same, but it will require a considerable amount of self-control to travel down that road. Elon Musk insists that he wants Tesla to stay sustainably profitable.

At a production rate of 7,000 cars a week, we believe we can be sustainably profitable from Q3 (2018) onwards – Elon Musk

But it’s easier said than done.

When you have a company that has outstripped supply since the day the first product was launched, it’s tough not to take as much money as possible to expand the business.

That theory – Invest as much as you can now, has gotten Tesla into deep trouble in the past. Now the time has come for Tesla to change course unless it wants to keep fighting twitter battles with short sellers.

Plunging Manufacturing Costs

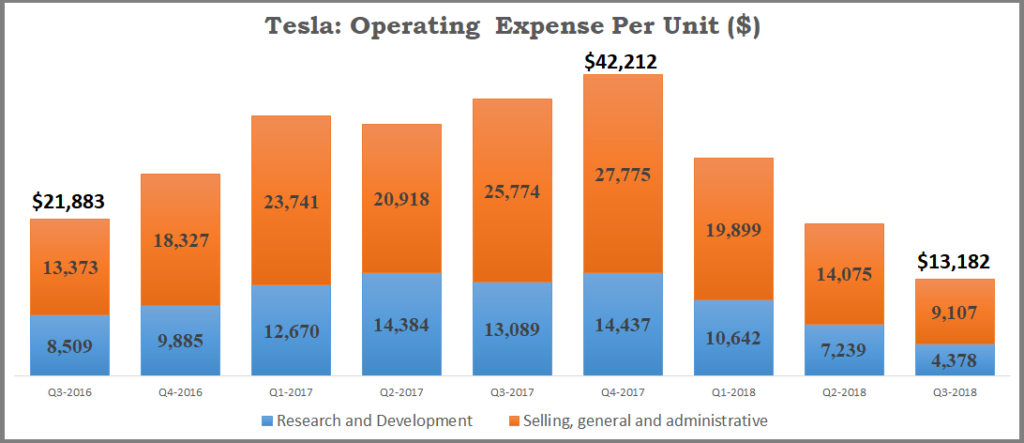

Tesla’s third quarter result is different from the company’s past profitable quarters because the electric car maker’s manufacturing cost per unit plunged to its lowest level.

Will manufacturing cost per unit keep plunging over the next several quarters?

Tesla manufactured 80,142 vehicles in the third quarter of 2018 while spending $350.84 million in Research and Development and $729.87 million in Selling, General and Administrative Expense.

R&D expenditure per unit = $4,378.

SG&A Expense per unit = $9,107.

Two years ago, during the third quarter of 2016, Tesla R&D expense per unit was $8,509 and SG&A expense per unit was $13,812. Between the third quarter of 2016 and 2018, Tesla’s operating expense per unit declined by 37%.

The immediate future for Manufacturing cost:

The average weekly production during the third quarter was 6,164 units. Tesla wants to increase weekly production to over 10,000 units in early 2019, a 66% increase.

Though a 66% increase in production may look like a daunting task, the reality is a little bit different.

Tesla is targeting weekly production of 5000 units each from its two assembly lines GA3 and GA4. Increasing weekly production from the current level of 6000+ units to more than 10,000+ units is more manageable than increasing production from 0 to 4000 units.

Capex: Will Tesla end up spending billions to increase its production capacity by more than 50%?

Elon Musk addressed Tesla’s near-term CapEx requirements during the second quarter earnings call. He said,

“By simplifying production lines, by speeding them up, by, in some cases, everything is being done manual instead of automatic, and in other cases, having be done automatic instead of manual, we’ve been able to achieve dramatic improvements to the output of existing lines, which means that our CapEx growing from 5,000 cars a week to 10,000 cars a week is a tiny fraction. CapEx growing from 5,000 to 10,000 is a tiny fraction of the CapEx needed to grow from 0 to 5,000 Model 3s. This is, I think, very good news for capital efficiency of the company.”

With core manufacturing structure already in place – factory, equipment, software, manpower, etc., increasing capacity is an incremental process for Tesla, not a new – from the scratch buildout.

Incremental capacity improvements are easier to achieve and cost a lot less than when you are starting from scratch.

Bottom line: Tesla can quickly increase its current weekly production rate without spending a ton of money. The more cars the company builds every week, the lower its R&D/SG&A cost per unit will get.

As operating expense firmly stays on a downward slope, it will get progressively easier for Tesla to be profitable. A profitable Q4-2018 and Q1-2019 will be easier to achieve than a profitable Q3-2018 and Q4-2018.

Between Research and Development, and SG&A, Tesla has a real shot at containing its R&D expense per unit. Tesla’s SG&A expense edged lower over the last couple of quarters but that has a lot to do with Tesla restructuring its workforce. Payroll related expenses will start increasing as Tesla adds more heads to improve global service capacity, open more stores and when it starts hiring for new manufacturing plants.

Tesla can still manage to keep a tight leash on SG&A expense per unit over the long term, but it’s a bit more difficult than doing the same with R&D.

Why?

Tesla has been spending a lot of money on Research. This helped the company in a big way. Tesla’s battery tech is unrivaled.

No other electric car in production can promise to take you over 300 miles in one charge and lets not even get into comparing Tesla’s battery degradation with other manufacturers. Model S, Model X, and Model 3 are proud owners of top-notch safety ratings. Tesla’s autopilot is undoubtedly better today than it was five years ago. Tesla’s supercharging tech remains a benchmark to this day.

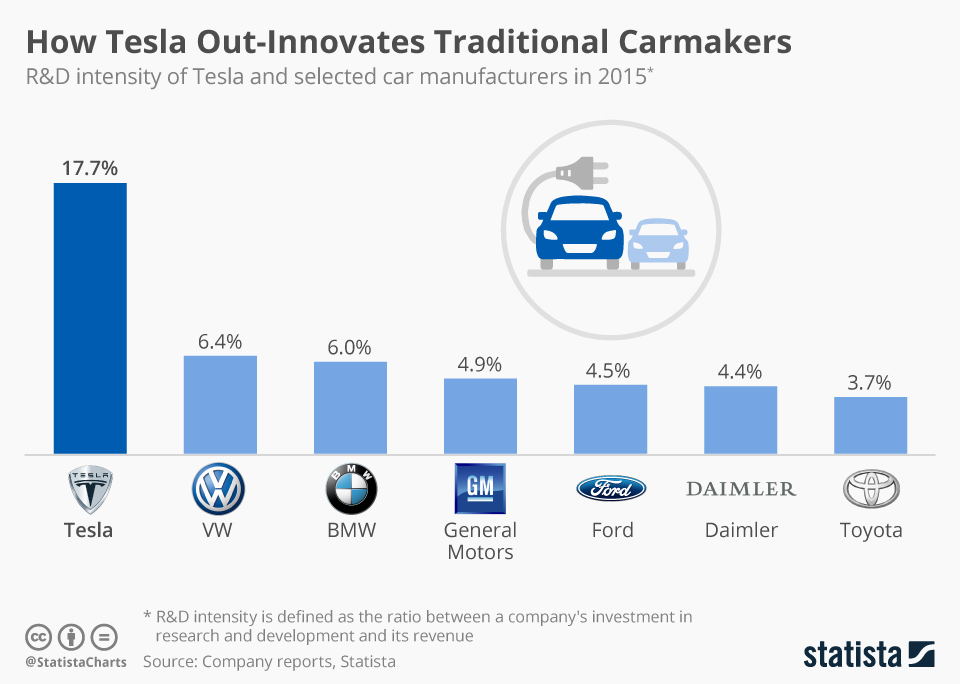

As a small company looking for an edge in the market, Tesla made a massive bet by often spending more than 10% of its revenue on R&D. The industry standard is around mid-single digits.

Tesla’s size worked against the company in the past, but it won’t anymore.

In Q3-2016, Tesla spent $214.302 million in R&D, 11.1% of the company’s automotive revenue for the quarter. Two years later (Q3-2018), Tesla’s R&D expense increased by 64% to $350.848 million. But it was just 5.9% of the company’s automotive revenue.

As volume increases, Tesla’s revenue will keep increasing. Even if Tesla keeps spending 6% of its revenue on Research and Development, the company will have plenty of money to spend on research projects.

In 2017, Tesla spent $1.378 billion in R&D, nearly 12% of the company’s total revenue ($11.758 billion).

During the most recent quarter, Tesla reported revenue of nearly $7 billion, a run rate of $28 billion (quarterly revenue multiplied by four).

If Tesla sets aside 6% of +$30 billion in revenue over the next four quarters, the company will have more than $1.8 billion to spend on R&D. A 50% cut – from spending 12% of total revenue on R&D to 6%, but still a fairly reasonable 28% growth in R&D expenditure – from $1.4 billion to $1.8 billion.

This would not have happened without Tesla’s Model 3 production surge. Tesla has already reached the scale it so badly wanted.

For possibly the first time in its history, Tesla’s financial position will incrementally get stronger over the next several quarters. Staying sustainably profitable is now in Tesla’s hands. Not with the competition. Not with its access to capital markets.

The only thing that Tesla needs to be careful about is not overplaying its current financial advantage.

With three new vehicles in the roadmap, the pickup, the semi, the roadster, and the standard battery Model3, Tesla can easily overload itself and stress its balance sheet further. But hopefully, the company will be aware of the perils that come with it and take a slow and steady approach to product lineup/global manufacturing capacity expansion.

It’s time to take things slow.