Tesla may qualify for inclusion in the S&P 500 Index as early as the second quarter of next year if trailing profits hold up.

The Palo Alto, California based electric vehicle manufacturer currently ticks off on all the boxes to be included in the S&P 500 index, except for one – GAAP Profitability over the last four quarters.

There are stringent criteria for inclusion in the S&P 500 Index

Qualification for the index is not automatic.

Contrary to popular belief, the S&P 500 is not an index of 500 largest companies in the United States. The S&P Index committee has the final say in which company gets included or excluded. There are specific guidelines for qualification.

To qualify for the index, a company must have

-

A market capitalization of US$ 6.1 billion or more

-

Only common stocks of U.S. companies are eligible.

-

Must be listed on a major U.S Exchange

-

The ratio of annual dollar value traded (defined as average closing price over the period multiplied by historical volume) to float-adjusted market capitalization should be at least 1.0

-

The stock should trade a minimum of 250,000 shares in each of the six months leading up to the evaluation date.

Tesla ticks most of these boxes except the following one –

The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings (net income excluding discontinued operations) should be positive as should the most recent quarter.

Tesla reported positive GAAP earnings in the most recent quarter. If the company manages to keep things that way over the next three quarters, it will become eligible for inclusion. Tesla can still have few quarters go the other way and still make it, as long as the sum of GAAP earnings in the last four quarters stays positive.

The Twitter Escape:

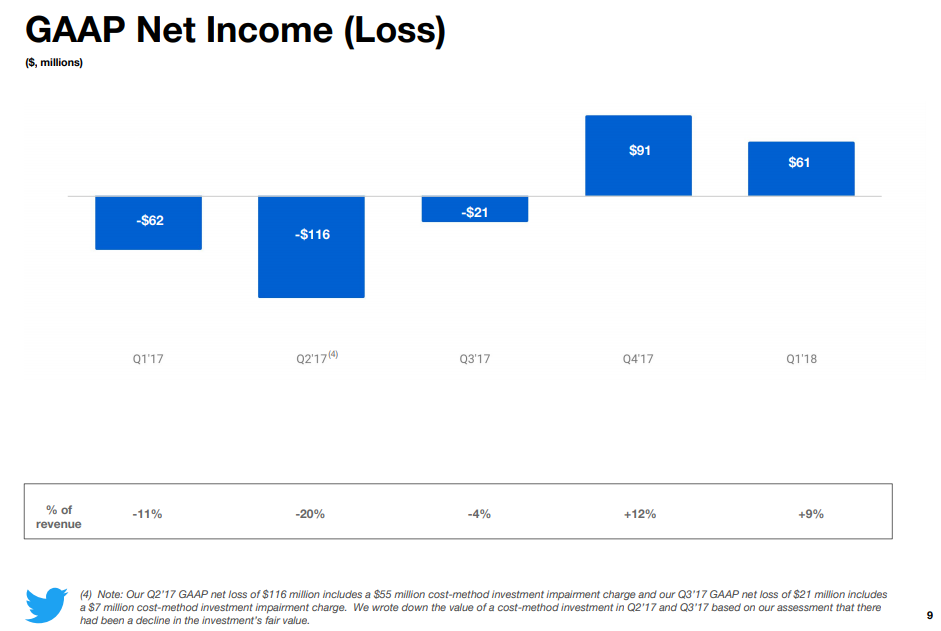

Twitter was included to the S&P 500 index in June this year. But the company barely made it past the selection hurdles. The sum of Twitter’s trailing four quarter earnings before inclusion was just $15 million.

The Advantage of S&P 500

The S&P 500 is widely known all over the world as a proxy to the U.S stock market and the economy. There is more than $9.9 trillion indexed or benchmarked to the index.

According to S&P Dow Jones Indices, the index includes 500 leading companies and captures approximately 80% coverage of available market capitalization.

A company’s inclusion in S&P 500 forces fund managers who manage large funds (that track the benchmark index – mutual funds, ETF’s.,) to add the stock and adjust the weight of their portfolio.Several pension funds only buy stocks of major companies like the ones included in the S&P 500.

From a trading standpoint, inclusion to S&P 500 index increases the demand for the stock, which in turn helps the stock price to rise. Twitter shot up by 5.1% after the news about Twitter’s inclusion to S&P 500 index become public.

How long will it take Tesla to Qualify?

Tesla’s trailing four-quarter earnings:

-

Q3-18 = $311.51 million

-

Q2-18 = ($717.53) million

-

Q1-18 = ($709.55) million

-

Q4-17 = ($675.35) millions

In the last four quarters, Tesla reported a net loss of $1,790.92 million. The earliest Tesla can make it to the S&P 500 will be the second quarter of 2019, unless they manage to surprise everyone by reporting $1.2 billion in quarterly profits in the fourth quarter.

Tesla has guided for positive GAAP income in the fourth quarter of 2018, but the company expects things to be a bit tight in the first quarter of 2019.

“We achieved GAAP net income of over $300 million, increased cash and equivalents by

$731 million and achieved a greater than 20% gross margin for Model 3. And moreover,we expect to again have positive net income and cash flow in Q4. And I believe our aspirations I think it will be for all quarters going forward,” said Elon Musk in Q3-18 earnings call.

“I think we can actually be positive cash flow and profitable for all quarters going forward, leaving aside quarters where we may need to do a significant repayment, for example in Q1 next year. But I think even in Q1, I think we can be approximately flat in cash flow by end of quarter.”