If there is one thing that I never really wrapped my head around, then it is this: the end of

But that’s how automakers work. For their defense, it allows them to hold on to their margins through the year, see where they are before the onset of the last 30 days, decide how much sales they need, and figure out how much discounts and effort

December tends to deliver the deepest discounts of the year, with buyers receiving an average 7.7% off MSRP, TrueCar.com finds—vs. 6.8% in January.

Even if their plans fail, automakers still have 11-month sales in their bag. It’s worth the risk. That’s why automakers around the world, including Tesla, do the little bit extra in December.

For Tesla, the challenge is not beating its competition, but beating its own records from the past.

The Statistics

Tesla has already delivered 154,220 vehicles in the first three quarters of 2018, 49.69% more than what they delivered in the four quarters of 2017. Once we add Model 3 into the mix, Tesla’s fourth quarter could be the biggest ever by revenue and unit sales.

Tesla’s challenge comes in the form of Model S and Model X sales. Tesla delivered 28,320 Model S and X in the fourth quarter of 2017.

Though the company

With its second largest market appearing weak, Tesla needs a solid performance in North America and Europe to reach its guidance of 100,000 Model S and Model X unit sales for 2018.

Model 3: On the Rise

Tesla delivered 55,840 Model 3s in the third quarter of 2018 and the company said it expects deliveries to increase in the fourth quarter.

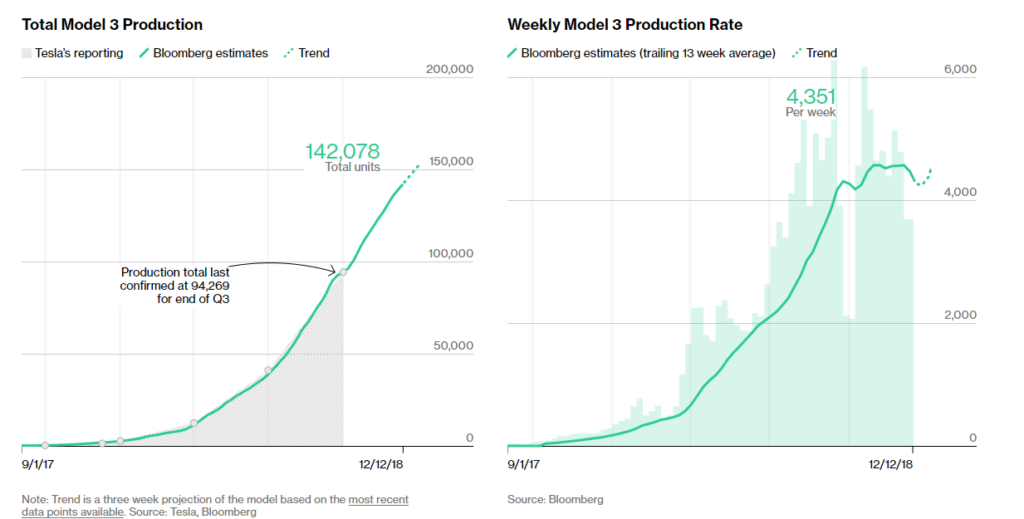

As of today, data from Bloomberg tracker shows the company has built 47,809 Model 3s in the fourth quarter. If Tesla manages to build more than 4,351 units every week from here, Tesla will easily cross

Weekly Production rate: 4,351 units

Tesla CEO Elon Musk said yesterday that customers can join a cancellation wait list for delivery this year. He also promised a full refund if Tesla didn’t deliver the car before January 1.

Tesla wants as many customers to place their order and take delivery this month. The electric car maker has already bought some trucking capacity and secured contracts to help support the company’s end of the year delivery push.

Where is the GAAP?

To make fourth quarter the best ever, Tesla has to deliver on its most important promise, GAAP Profits. If achieved, this will the first time in its history, the company posted profits two quarters in a row.

Tesla is not expecting a massive production ramp in the fourth quarter. They need to deliver ~28K Model S and X, the same as last year, to hit their 2018 guidance, and Bloomberg tracker shows Tesla is all set to slightly improve its Model 3 production in Q4-18, compared to Q3-18.

Q4-18 Challenge is not a challenge: Repeat last year’s Model S and X sales performance and slight increase in Model 3 production.

David Einhorn, the founder of New York-based hedge fund Greenlight Capital, and a well known Tesla short, was correct. For Tesla to have a really bad fourth quarter, the demand for its vehicles must flatline.

In his recent shareholder letter , Einhorn writes, “TSLA is expected to make and deliver more than 65,000 Model 3s in December quarter. It might be able to make them, but without an order

But so far, we haven’t seen any evidence of a demand slowdown, except for China.