Gone are the days when companies sold software licenses for an annual fee. Now, it’s all about hosting the software or the application in the cloud and selling it for a

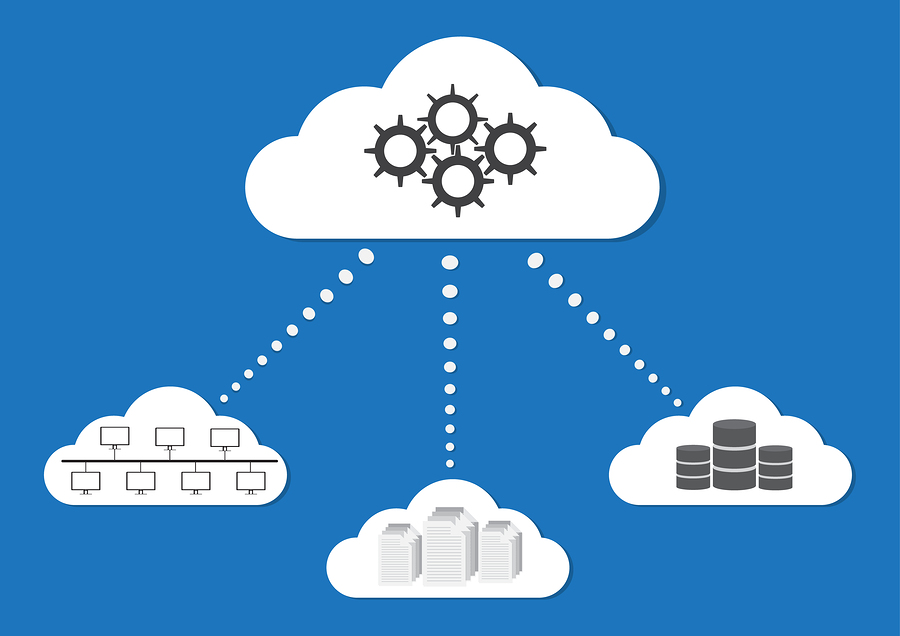

The global software industry is slowly transitioning from the on-premise annual licensing model, where the users manage their own infrastructure, to a cloud-based Software-as-a-Service (SaaS)

Worldwide Public Cloud Service Revenue Forecast (Billions of U.S. Dollars)

| 2017 | 2018 | 2019 | 2020 | 2021 | |

| Cloud Business Process Services (BPaaS) | 42.2 | 46.6 | 50.3 | 54.1 | 58.1 |

| Cloud Application Infrastructure Services (PaaS) | 11.9 | 15.2 | 18.8 | 23.0 | 27.7 |

| Cloud Application Services (SaaS) | 58.8 | 72.2 | 85.1 | 98.9 | 113.1 |

| Cloud Management and Security Services | 8.7 | 10.7 | 12.5 | 14.4 | 16.3 |

| Cloud System Infrastructure Services (IaaS) | 23.6 | 31.0 | 39.5 | 49.9 | 63.0 |

| Total Market | 145.3 | 175.8 | 206.2 | 240.3 | 278.3 |

According to research firm Gartner, the global software-as-a-service market grew from $58.8 in 2017 to $72.2 billion in 2018, a growth rate of 22.7%. The SaaS market is forecasted to grow at double-digit speeds over the next several years and cross $100 billion in 2021.

Why the Global SaaS Market will keep growing

“In many ways, the enterprise SaaS market is now mature. However, SaaS still accounts for less than 15% of total enterprise software spending and therefore remains small compared to on-premise software, meaning that SaaS growth will remain buoyant for many years to come.

While SaaS growth rate isn’t as high as IaaS and PaaS, the SaaS market is substantially bigger and it will remain so for the foreseeable future.” –

Here is a list of top Software-as-a-Service companies that keep tightening their grip on this fast-growing market. Do check our list of top ten cloud computing companies.

#1 Microsoft

Microsoft became the number one cloud service provider in 2018,

Don’t get me wrong: Microsoft Azure revenue grew 76% in the most recent quarter, but at $8.6 billion for the quarter, the Intelligent Cloud division that hosts Azure revenue still lags Microsoft’s Productivity and Business Processes division that hosts the company’s Software-as-a-Service products by nearly $1.2 billion.

Microsoft’s lead SaaS product, Office 365, raced past 155 million commercial monthly active users in the quarter ended September 30, 2018. There aren’t many, if any, software applications that’s subscribed to by more than 150 million paying users around the world.

If we add the 32.5 million Office 365 consumer subscribers to the list, Microsoft is closing in on 200 million subscribers for Office 365. It’s a huge number because the world’s second largest social media platform, Twitter has only 326 million users. If Microsoft makes $5 on average per user, the company may very well cross one billion dollars in monthly Office 365 revenue soon.

Office 365 user base doubled in less than two years.

| End of Period | Commercial Monthly Active Users |

| Nov-15 | 60 million |

| Apr-16 | 70 million |

| Oct-16 | 85 million |

| Apr-17 | 100 million |

| Oct-17 | 120 million |

| Apr-18 | 135 million |

| Oct-18 | 155 million |

Major SssS Products:

Office 365 and Dynamics 365.

#2 Salesforce

Salesforce is a pioneer in the Software-as-a-Service industry. In fact, it was Salesforce that showed the world that software can be sold using the centrally hosted, pay for what you consume business model.

Listen to what the company said in its IPO registration statement in 2004. ” By designing and developing our service to be a low-cost, easy-to-use application that is delivered through a standard Web browser, we substantially reduce many of the traditional expenses and complexities of enterprise software implementations. As a result, our customers incur less risk and lower upfront costs.”

Between February 2000 and October 2003, Salesforce “customer base had grown to approximately 8,000 subscribing customers.”

The market leader in the Customer Relationship Management Software market has already crossed 10 billion dollars in annual revenue and the company has forecast revenue of $15.9 Billion to $16.0 Billion in 2020. Subscription and support accounted for more than 93% of Salesforce revenue in the most recent quarter.

Major SAAS Products:

Sales Cloud, Service Cloud, Marketing Cloud, Commerce Cloud, Community Cloud and Quip

#3 Adobe

Adobe, well known around the world for its multimedia products and PDF (Portable Document Format) is a Software-as-a-service giant in it’s own right. In the third quarter of 2018, Adobe’s Cloud units, Creative Cloud and Document Cloud reached an annual revenue run rate of $5.66 billion and $744 million.

Major SAAS Products:

Adobe Creative Cloud – Subscription service for Adobe’s creative products including Photoshop, Illustrator, Premiere Pro, Lightroom, InDesign and Adobe XD

Adobe Document Cloud – Subscription service for Acrobat family of products, the Adobe Acrobat Reader and a set of integrated,

Adobe Experience Cloud – offers cloud-based products for marketing, analytics

#4 Oracle

When Oracle co-founder Larry Ellison told investors in December 2016 that Oracle has “a fighting chance to be the first SaaS company to make it to $10 billion in annual revenue,” not many expressed doubts about the statement. Oracle is a powerhouse in the Database market and it is extremely strong in the ERP software segment.

For a company with such a strong presence in the global on-premise infrastructure market, it shouldn’t be difficult to make more than 2.5 billion dollars from software subscriptions. Oracle strengthened it’s presence in the SAAS market with the acquisition of NetSuite, a leading Cloud ERP provider, for $9.3 billion in 2017.

We still don’t know if Oracle has met its co-founder’s target of 10 billion dollars in annual revenue from SaaS, as the company changed it’s financial reporting standards recently which lumped cloud and non-cloud revenues making it hard to identify their growth in Cloud.

But what we do know is that Microsoft and Salesforce now make more than ten billion dollars in annual revenue from SAAS.

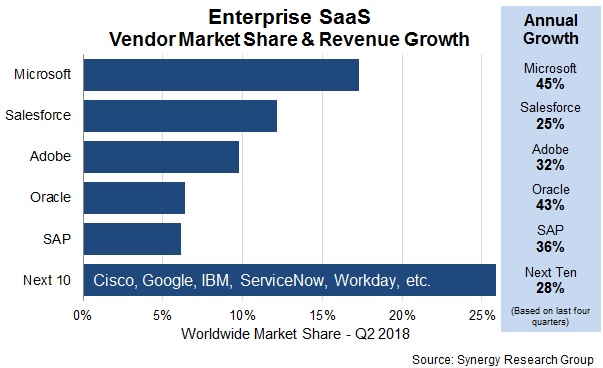

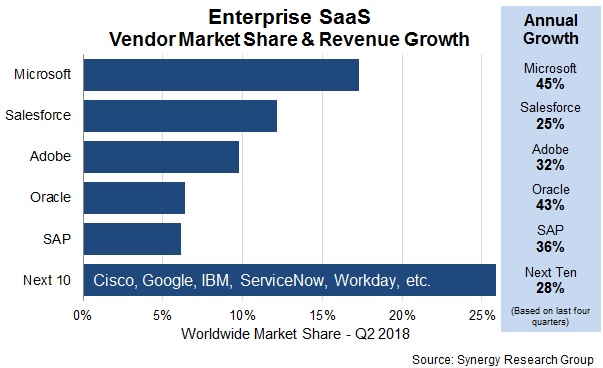

Q2-2018 SAAS market report from Synergy Research Group shows Oracle trailing Microsoft and Salesforce by a wide margin. But the good news is Oracle’s SAAS revenue grew 43% between Q2-2017 and Q2-2018.

Oracle was the second fastest growing cloud among the top five SaaS cloud providers.

Major SAAS Products:

Oracle ERP, EPM, SCM, HCM Cloud. Oracle Customer Experience Cloud and Oracle Analytics Cloud

#5 SAP

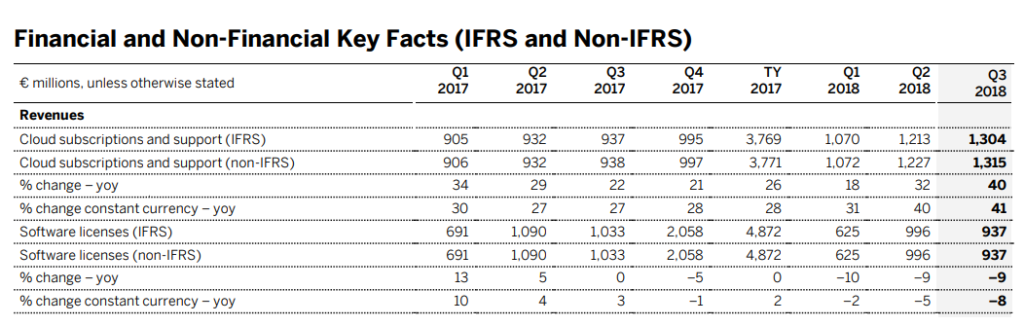

“Cloud revenue is expected to overtake license revenue for the for the first time,” SAP CEO McDermott said on Q4-2017 earnings call.”We expect cloud to grow at 30% compounded annual growth rate and more than double by 2020,” he added giving more color to SAP’s ambitions in the fast growing cloud market.

SAP delivered a lot more than it’s CEO end of 2017 prediction. Cloud subscription revenue became 40% larger than software license revenue in the third quarter of 2018. SAP’s cloud revenues continue to gain as revenue from Software licensing remains weak.

Cloud subscriptions and support revenue grew 40% in the third quarter that ended in September 2018, compared to last year. Software license revenue declined by 9% during the same period.

“SAP is the fastest growing cloud company at scale in the enterprise software applications industry. Our growth drivers are firing on all cylinders, especially SAP C/4HANA and SAP S/4HANA as foundations of the Intelligent Enterprise. With a stronger than ever Q4(2018) pipeline, we confidently raise our full year guidance.” – Bill McDermott, CEO

Major Cloud Products:

SAP S/4HANA and SAP Cloud Platform

#6 IBM

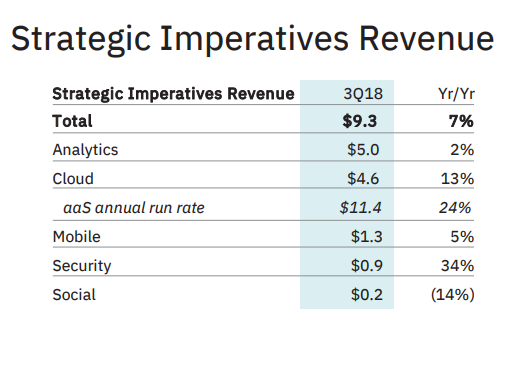

IBM made a bold bet early on that analytics will play a crucial role in the future of cloud computing. When everyone kept their focus on building infrastructure services and cloud applications, IBM doubled down on Watson, building a case for businesses to add and exploit Watson’s AI capabilities in their applications.

IBM is

Every major cloud provider including Microsoft, Amazon, Google,

IBM’s bold move in Analytics may not have given the company the earth shattering results it expected, but the $5 billion revenue in the third quarter of 2018 from its Analytics unit is not going to keep them unduly worried about it’s future either.

Major SAAS Products:

IBM lists a whopping a 46 products under Predictive Analytics and a lot more software-as-a-service products. Please check the full list of products by visiting IBM

#7 ServiceNow

When Forbes names you the most innovative company of 2018, you must be doing something right. According to Forbes ServiceNow is”

America’s hottest IT-services company.”

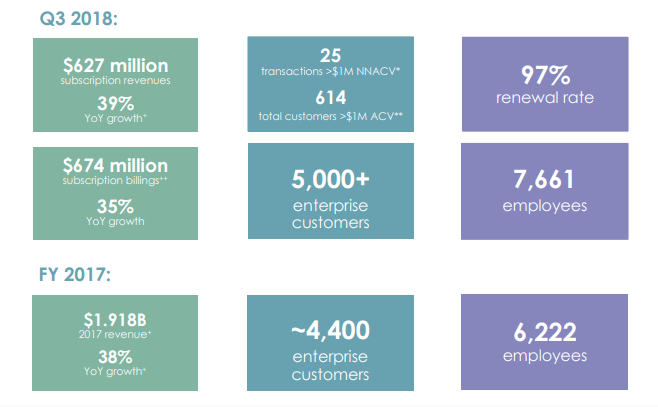

Founded by Fred Luddy, ServiceNow boasts more than 5,000 enterprise customers. The specialized technical management support provider addresses a crucial gap in the cloud computing world and business has been growing at a steady clip over the last few years.

In the third quarter of 2018, ServiceNow reported $627 million in subscription revenues, a growth of 37% compared to last year. The best part is nearly 97% of ServiceNow customers renewed their subscription.

Thanks for reading. Check back for more updates.

Surprised not to see Google Cloud and Amazon on the list? Tell us who should have made it to the top seven SAAS companies?