Late on Monday night, for just a few moments, the tax reform bill was nearly thwarted on its way to the conference committee later this week.

Key Republicans who are members of the conservative House Freedom Caucus threatened to vote against a standard step required to take the bill through to the conference committee.

The tied vote was because of a decision to keep funding the government beyond the Friday deadline, until December 22. House Freedom Caucus members wanted it to be extended until the end of the month to avoid voting right before Christmas.

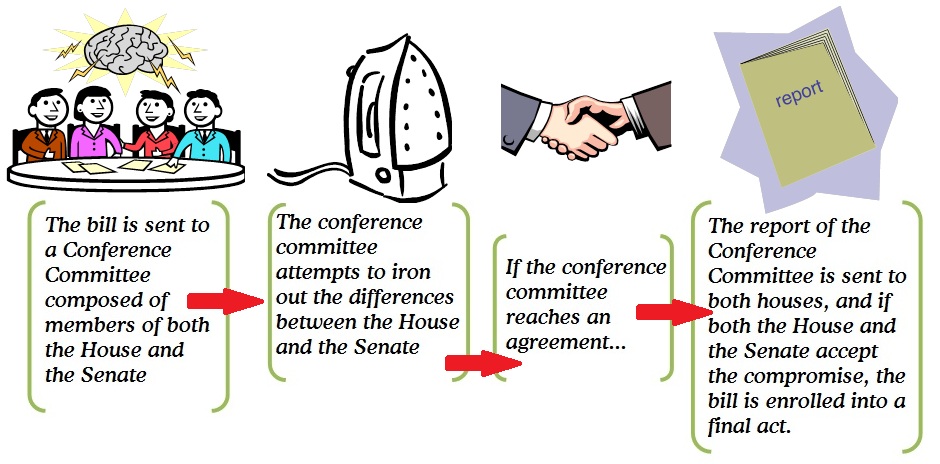

A short negotiation later, some of the nays became yays, and the bill passed safely on its way to conference committee, but not without a livid comment from Rep. Tom Rooney (R-FL 17th District) saying that he couldn’t understand how you could vote against going to conference committee on a bill you just supported.

House Speaker Paul Ryan (R-Wisconsin) has named as conferees GOP Reps. Kevin Brady of Texas, Devin Nunes of California, Peter Roskam of Illinois, Diane Black of Tennessee, Kristi Noem of South Dakota, Rob Bishop of Utah, Don Young of Alaska, Greg Walden of Oregon and John Shimkus of Illinois.

House Minority Leader Nancy Pelosi (D-California) has named Democratic Reps. Richard Neal of Massachusetts, Sander Levin of Michigan, Lloyd Doggett of Texas, Raúl Grijalva of Arizona and Kathy Castor of Florida.

Senate Majority Leader Mitch McConnell will also appoint conferees, and the Senate will vote to send the bill to Congress later this week.

The Republicans still have major challenges ahead of them. For instance, reconciliation will not allow Senate Republicans to pass a bill with just 51 votes if that bill adds to the federal deficit after the 10-year period is over.

Moreover, although the two versions of the bill are in broad agreement in several areas, certain key points could pose problems in conference. For example, the House bill repeals the alternative minimum tax, while the Senate’s version does not; and the Senate version repeals the individual insurance mandate, while the House’s does not.

In addition, there are regional demands like restoring more state and local tax deductions, especially from Republicans in California and Northeastern states, as well as calls for larger tax breaks for pass-through businesses by both House and Senate Republicans.

One thing is certain: the GOP must get this tax reform bill to the President’s desk as soon as possible if it wants to have strong talking points during next year’s mid-term elections. This win could potentially wipe out whatever legislative failures they have had so far since Trump took office.

+++ + +++