The Short:

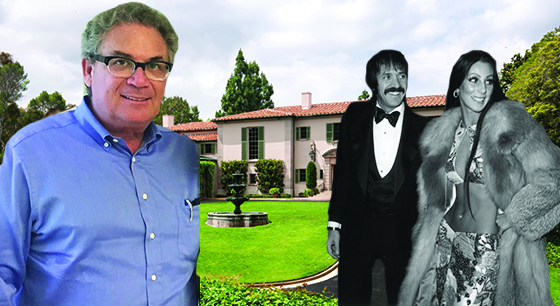

The Securities and Exchange Commission (SEC) has frozen all assets of Woodbridge Group and its owner, real estate mogul Robert Shapiro, calling his operation a Ponzi scheme.

In all, Woodbridge’s business model allowed the company to defraud 8,400 investors of nearly $1.2 billion.

The Long:

Woodbridge Group was promoted as a loan issuer of “hard money” loans to third-party owners of commercial properties, promising investors anywhere between 5% and 10% in what it called a “low risk” and “conservative” investment.

But the loans were going to Shapiro-held companies using a “a web of layered companies to conceal his ownership interest in the purported third-party borrowers,” according to the Director of the regulator’s Miami Regional Office, Eric I. Bustillo.

Co-director of the SEC’s Enforcement Division, Steven Peikin, said that “The only way Woodbridge was able to pay investors their dividends and interest payments was through the constant infusion of new investor money.”

That’s the essence of a Ponzi scheme. Here’s how Investopedia defines it:

A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors. The Ponzi scheme generates returns for older investors by acquiring new investors. This is similar to a pyramid scheme in that both are based on using new investors’ funds to pay the earlier backers. For both Ponzi schemes and pyramid schemes, eventually there isn’t enough money to go around, and the schemes unravel.

The SEC alleges that the entire operation was exactly that. Despite Woodbridge claiming that it had a 90% investor renewal rate, things started to unravel when existing investors started to withdraw their money.

+++ + +++