Tesla’s recent announcement to start production in China has raised a lot of eyebrows. Where are they going to get the money from?

A closer look reveals Tesla has no need to raise money in the billions to get going in China. They just need a partner and may be a billion to get going, because the market conditions in China will take care of the rest. Tesla must thank its stars and the German car makers for making this possible.

The Cost

The best way to find the possible cost of Tesla’s China plan would be to look for reference points. But unfortunately no one has built a factory that can manufacture 500,000 vehicles and battery packs every year. Not even Tesla.

So the best way to calculate costs is to track Tesla’s expenses related to Gigafactory 1 and Tesla Factory in Fremont.

Tesla opened its Fremont factory on October 27, 2010. Between 2010 and first quarter of 2018, Tesla’s total accumulated capital expenses stand at $8.749 billion. So, Tesla can repeat everything it has done from building couple of thousand cars every year to 7000 cars every week within 8 years and $8.5 billion dollars.

But Tesla didn’t just build two factories in the last ten years. Tesla spent a massive amount of money on building additional stores, service centers, mobile service stations and superchargers.

By the end of first quarter 2018, Tesla had 339 stores and service centers worldwide, 300 mobile service units and more than 1000 supercharging locations all of which could have costed the company more than a billion dollars.

That leaves $7.5 billion dollars in Capex spending to account for. But Tesla is not the new car manufacturer in the block. The company must have made lots of costly mistakes in the past and learned from it.

“Tesla has tried to hyper-automate final assembly,” the report states. “We believe Tesla has been too ambitious with automation on the Model 3 line. Few have seen it (the plant is off-limits at present), but we know this: Tesla has spent c.2x what a traditional OEM spends per unit on capacity.”

They shot themselves in the foot with over automation and it was a costly mistake. Tesla is not going to repeat those mistakes again. They have a set process which they need to rinse and repeat in China, leading to significant cost savings. Even a 10% savings due to experience will shave off nearly billion dollars in cost.

Tesla may spend anywhere between $4 to $7 billion dollars to reach annual production capacity of 500,000 units in China.

The Partners

But Tesla is not going to spend all the money, unless the company becomes wildly profitable in the next few quarters. Tesla will be looking for companies to partner with, especially to build its batteries.

It’s a mouth watering proposition for any large scale battery manufacturer to be associated with Tesla and build 500k battery packs every year. That’s why Panasonic agreed to pay half of Gigafactory 1 bills.

Tesla is not an unknown entity anymore and finding a battery maker to spend $3-4 billion dollars when Tesla promises to buy all the output is not going to be hard at all.

That leaves another $1 to 3 billion that Tesla needs to bring to the table.

The Timeline:

But Tesla is not going to build the factory overnight.

“A Tesla spokesman said it would take about two years until the factory begins producing vehicles, and another two to three years before the facility is hitting its annual capacity of 500,000 vehicles.”

Tesla is looking at four to five years to build the factory or may be even more. They can even use funding or debt/subsidy from local government to help build the factory.

What can Tesla do with just a billion dollars?

A billion dollars can get a lot of things done for auto companies.

According to Washington Post ” Toyota and Mazda corporations announced plans in 2017 to build a $1.6 billion assembly plant in the United States and work together to develop electric car and advanced safety technologies. The plant is expected to produce up to 300,000 cars a year and create jobs for 4,000 workers.”

The Chinese Market and German Trio

The biggest advantage Tesla has in China is margins. Tesla sold nearly 17,000 Model S and Model X in China, despite pricing them 50% more than what they cost in United States. Chinese love Tesla and they were willing to pay more for a good product. Given a choice between United States and China, Tesla has more odds of running a profitable business in China, thanks to customer demand and market size.

Tesla’s competition has done a huge favor by over pricing their cars in China.

BMW 530i which starts at $52,650 in United States, starts at ¥ 476,900 ($71,461) in China.

BMW 530i which starts at $52,650 in United States, starts at ¥ 476,900 ($71,461) in China.

Mercedes Benz E class starts at $52,950 in USA, while Standard E Class starts at ¥ 419,800 ($62,900) in China. Luxury manufacturers in China have priced their cars 20% to 30% above market price in United States.

Tesla does not have to follow their footsteps. All it has to do is – find the right price point to position its cars and allow operations in China to stay profitable. With competition giving so much room to move the price around, Tesla will have no difficulty in achieving solid profitability in China.

BMW, Mercedes Benz and Audi sold more than 500,000 vehicles each in China last year. Chinese luxury car market is huge and there is plenty of space for Tesla to capture.

BMW Group’s EBIT margin was nearly 9% in 2017. A feat that Tesla can easily achieve in China, just by pricing the car at the right place.

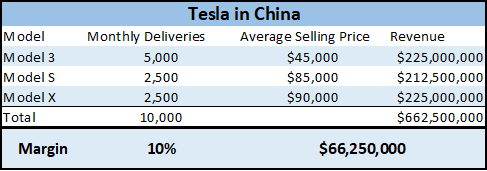

If Tesla sells 10,000 cars every month, a weekly production rate of around 2500 cars, Tesla’s operating profits in China will greatly reduce the company’s need for additional funding.

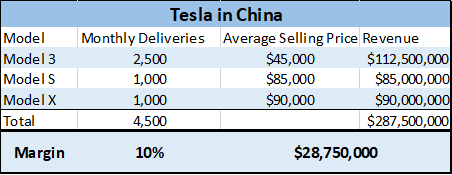

Even with 4,500 deliveries per month, a weekly production of more than 1000 units, Tesla can bring in nearly hundred million dollars in operating profits every quarter.  Tesla sold nearly 17,000 Model S and Model X in China last year when the cars were priced above $120,000. The average selling price I have used in the calculations are highly conservative estimates and even at that price point, Tesla will still be able to generate solid operating cash flow every month, which can be used to fund its expansion in the country.

Tesla sold nearly 17,000 Model S and Model X in China last year when the cars were priced above $120,000. The average selling price I have used in the calculations are highly conservative estimates and even at that price point, Tesla will still be able to generate solid operating cash flow every month, which can be used to fund its expansion in the country.

All Tesla needs to do is start off. The trade war forced Tesla to start production in China and it’s a huge blessing in disguise, because if Tesla had its Gigafactory 1 and Tesla Factory in China, the electric car maker could have easily become one of the highly profitable auto companies in the world.

Please comment and share the article on social media. Will be really cool if you can follow me on twitter @ShankarsTwits

Note: Elon Musk had repeatedly stated that Tesla will start building Model 3 and may be Model Y in China, while Model S and Model X manufacturing stayed in United States. The ongoing trade war certainly makes that decision a difficult one to execute and an unnecessary one as well.

Tesla’s flagship models, the S and X, offer the best margins and the company has years of experience building them. It makes sense for Tesla to build all models in China to maximize long run profits.

Important Links:

BMW China Spec sheet vs BMW USA pricing