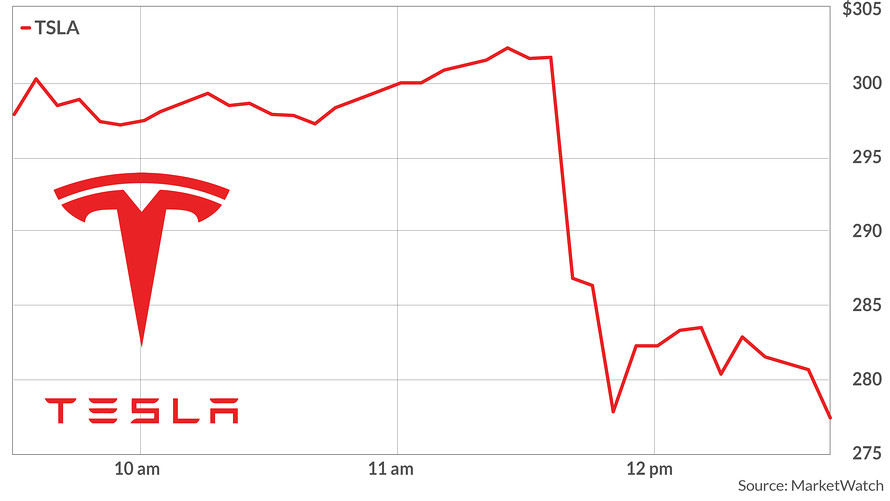

Colin Rusch, analyst at Oppenheimer, continues to remain positive on Tesla stock price despite the ongoing criminal probe by the U.S. Department of Justice into Musk’s announcement last month of intending to take Tesla private with “funding secured.” His target price of $385 represents a roughly 35% upside to where the stock is currently trading, against a consensus target price of $317.95.

Colin Rusch:“With numerous electric vehicle launches over the coming weeks and reports of a criminal probe by the SEC, we believe investor concerns on TSLA continue to be substantial. While we believe results of an SEC investigation are difficult to assess, we believe co-opetition is highly constructive for TSLA in terms of customer awareness and increased infrastructure capacity. But more important, we believe many of the new competing products look disappointing in terms of design and performance, highlighting a product advantage for TSLA. We believe the two critical drivers of TSLA shares are GM on Model 3, on which we believe TSLA is making progress, and secondarily, depth of demand for Model 3, which is likely enhanced by competitor advertising budgets and additional charging stations.”

Several things will affect Tesla’s stock price right after the Q3 earnings call.

First, their quarterly production and delivery numbers on Model 3 – as well as on-track performance for Model S and Model X 2018 sales to hit 100,000 units – will move the stock in a big way. That’s because these numbers highlight the scale of economies that Tesla must reach to hit their second goal…

Profitability: the second most impactful element of the Q3 call. Tesla is expecting to be cash flow positive in Q3, and that will make a huge difference to investor confident if they succeed.

Third is specifically their gross margin on the Model 3, and that depends on the first point – sales volume. If Tesla can show a gross margin of 15% on the Model 3, it will set the tone for a possible 18% margin in Q4. That’s quite possibly already in the bag because of the mix of sales with respect to Model 3 variants. The AWD Dual Motor and Performance P3D editions are far more popular than the current base model, the RWD Long-Range. That means their margins are better than if sales were skewed the other way. Additionally, the P3D’s Performance Upgrade Package (PUP) seems to be very popular with P3D buyers, if Tesla forum threads are anything to go by.

Considering these three factors and understanding how close Tesla is to achieving these goals is key to understanding how TSLA stock might move post the earnings call. Notwithstanding its day in the legal spotlight, Tesla is showing strong numbers on all fronts this quarter, and achieving those targets will go a long way in toning down all the other noise around the company and its CEO.