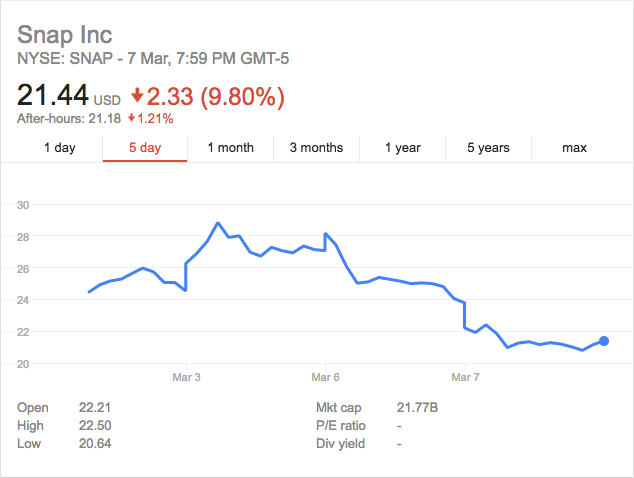

After early euphoria over the initial public offering on Thursday, March 2, 2017, Snap Inc. appears to be in trouble – and not just because the stock has already started moving sideways and trading volume has dramatically dropped within a week of the IPO.

First, the facts.

The original price of the stock was set at $17.00, but soon after it debuted on the market, SNAP moved up above the $28.00 level. As early as Monday – four days after the IPO – the price dropped to around $25.00, and over the past two days it dropped further down, almost touching $20.00.

What’s worse, five of seven analysts covering the IPO have recommended a “sell” for SNAP stock, according to a report by Fortune.

According to Benzinga, trading volume has been on the decline as well. It debuted at 217 million, then dropped to 148.2 million the next day, further declining to 72.9 million on Monday and then 52.7 million Tuesday with about two hours to go on the bell.

With the stock now trading well below its post-IPO price, analysts are now looking at any upside that the company may have – and it’s not encouraging.

Is Snap Inc. Viable for the Long-term?

One of the biggest challenges appears to be the fact that Snapchat is not typical of social media networks, where content is static once it is uploaded. One of Snapchat’s USPs is that uploaded content disappears after a period, and that’s what makes it attractive to youngsters that form the bulk of the platform’s user base. But it also makes it very difficult to monetize – more so than other platforms like Instagram.

In terms of advertising opportunity, the platform itself hasn’t been designed for optimal ad revenues. Besides, Snap Inc. knows much less about its own user base than Facebook or Google because it doesn’t capture elaborate profiles or as much demographic data about its users. That makes it a hard sell to advertisers, who need to know exactly who they’re targeting.

Although Fortune says that it will be “difficult for Snapchat to occupy the social media space for long,” much of that is speculation based on the fact that the platform is easy to imitate and has a high level of competition. A “one-trick pony” is what Fortune is calling it.

But Then, Snap Inc. Has All of This…

But if you’re talking about social media companies that are one-trick ponies, Twitter needs to be included, and so does Instagram. Neither of these is a dying platform. Both are growing, albeit one more slowly than the other, but neither is showing a dramatic drop in usage.

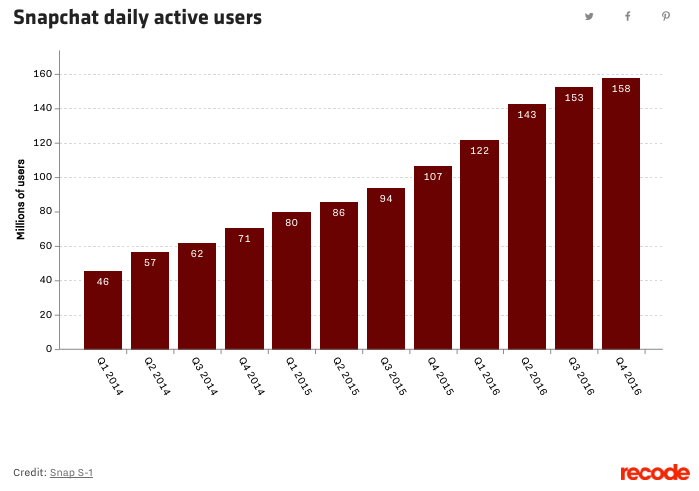

Take a look at this chart published by Recode:

That might look like a struggling social media platform whose growth has slowed over the past few quarters, but it does not necessarily represent a dying one.

While it’s true that Snapchat is more susceptible to disruption than, say, Facebook or even Twitter, the fact remains that Snapchat is still widely used among millennials, and that other companies are trying to emulate it with features such as disappearing “Status” updates on WhatsApp, and “Stories” on Instagram.

Facebook wouldn’t be bringing similar functionality into its own social media assets unless it felt that something was working well for Snapchat, and that it could use those functionalities to boost user engagement on its own platforms.

“According to the BI Intelligence social engagement index, which ranks top social platforms based on time spent per user across mobile and desktop, Snapchat is five times more effective than Twitter and 10 times more effective than LinkedIn at getting users to spend time on the platform on a per-user basis.” – Business Insider

There’s no denying that Snap Inc. is going to have its hands full now that it is answerable to its shareholders, but that might not mean that the company is going to disappear like one of its ephemeral photographs.

They’ve got new products in the pipeline, a still-growing user base and an enviable – if fickle – user base of nearly 160 million people that are using the platform every single day. But “is that enough?” is the question investors in SNAP need to be asking themselves.

Thanks for reading our work! Please bookmark 1redDrop.com to keep tabs on the hottest, most happening tech and business news from around the world. On Apple News, please favorite the 1redDrop channel to get us in your news feed.