Amazon Prime is a proven customer magnet for the e-commerce giant’s retail channels. By buttressing the core free two-day, same-day and two-hour delivery on the Prime membership with benefit after benefit, Amazon has almost guaranteed its growth for several quarters to come, if not years.

Prime Video is now becoming a heavy hitter in the Amazon Prime lineup of goodies and freebies, and Amazon’s success at the Oscars have boosted their confidence around original content more than ever before.

Even as early as July, 2016 Amazon CFO Brian Olsavsky wanted to triple its original programming over the following six months by doubling its content spend. This year JP Morgan says that original content for Prime Video will draw even more money muscle from the online retail king.

The estimate from JP Morgan shows that Amazon will spend around $4.5 billion dollars to beef up its original programming portfolio in 2017. That puts them far above what media masters like HBO intend to spend during the year – “could of billion dollars,” according to Time Warner CEO Jeff Bewkes.

While that’s impressive for a company like Amazon, it’s still short of what SVOD market leader Netflix intends to lay out for original content in 2017 – about $6 billion or so. But you have to remember that this is just one of the things Amazon is doing to boost its media portfolio, while for Netflix it is their bread and butter.

Keep that in mind and you’ll immediately see why Amazon spending $4.5 billion on video content creation is far more significant than Netflix spending nearly 50% more.

And while this is happening in the foreground, the cable TV market continues to struggle with cord-cutting. Surprisingly, however, it isn’t catching on like everyone expected it to. Here are just a few reasons why people aren’t cutting the cord fast enough:

- Service providers like Comcast often bundle their services, offering Internet, Cable, DVR Rental and Phone Service in one package, making it inconvenient for people to cut the cord

- Actually giving up your cable or satellite connection is harder than you think because it involves waiting in line to return the hardware, aggressive sales reps continually sweetening the deal and so on

- The learning curve for handling streaming TV – because of new antenna hardware, new remotes, navigating through the content – is quite steep for a lot of people

- It’s more convenient to just “turn on the TV” and record on a DVR than negotiating the often complex streaming interfaces.

- Costs for new antennas, roof installation make it an expensive upfront investment, even though it pays off within 8-24 months

- Certain programs like specific sporting events are not available on streaming services (although that’s rapidly changing)

With that many negatives going for them, streaming services like Netflix and Amazon continue to struggle against mainstream operators that are invariably larger than them and have entrenched themselves into people’s lives for decades.

Nevertheless, the future is certainly tilting towards streamed content, and as Gigabit LTE networks make their appearance later this year with T-Mobile, AT&T, Sprint and Verizon planning their rollouts, mobile viewing is going to rise as well.

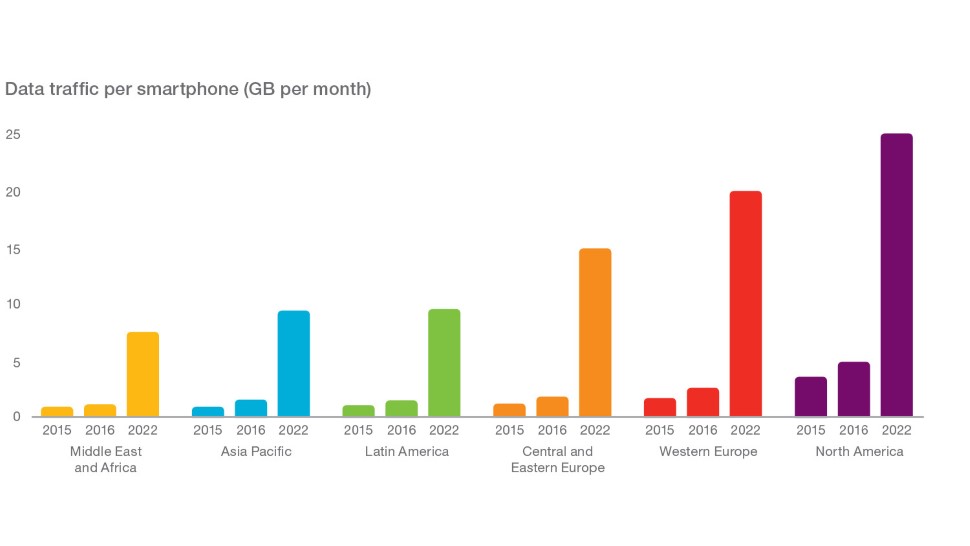

This is what Ericsson says in its recent mobility report (emphasis ours):

“In 2022, North America will still be the region with the highest monthly usage (25 GB), but other regions will be catching up. Factors that will drive usage include an increase in the number of LTE subscriptions, improved device capabilities and more attractive data plans, as well as an increase in data-intensive content.“

That data-intensive content is essentially high-quality streamed video content like 4K, which most streaming service providers are already investing in.

That’s the kind of growth we’re going to see over the next half-decade or so, and Amazon Prime wants to be right in the middle of that growth. True, it’s an additional line of expenditure for them since much of the content on Prime Video is free for US Prime members, but that expense is more than offset by the fact that Amazon Prime members are far more valuable to the company (in sheer dollar terms) than non-Prime shoppers.

If you’re not convinced, have a look:

- Prime members generated 57% of Amazon’s North American revenue, according to ITG analyst Steve Weinstein

- The value of Prime members only increases over time (about 12% a year)

- Customers who joined Prime in January 2014 spent on average $2,147 in 2015

- Customers who joined Prime in January 2012 spent on average $3,091 in 2015

It’s clear as crystal: any investment in Amazon Prime pays off year after year, more than offsetting that investment.

That’s why $4.5 billion is a paltry sum for what Amazon can gain from this investment. Assuming that one million additional Amazon Prime customers are acquired because of this investment in 2017, the gross returns in terms of retail sales will far exceed $5 billion over a three-year period. The longer these members stay on, the more Amazon will keep earning from them.

Don’t be surprised if Amazon suddenly decides to up the ante even further and spend even more than Netflix on creating original content this year and beyond. There are key markets like India that are just heating up for Amazon Prime, and a lot of money is required to nurture such markets.

Thanks for reading our work! If you enjoyed it or found value, please share it using the social media share buttons on this page. If you have something to tell us, there’s a comments section right below, or you can contact@1redDrop.com us.