Amazon’s grocery push has always been a stop-start game for the company. It piloted AmazonFresh, its grocery delivery service, in Seattle way back in 2006, and it hardly expanded its footprint since then. And, according to media reports, Amazon is now suspending AmazonFresh in many states around the country.

“The company emailed customers in at least five states on Thursday to inform them that the Amazon Fresh grocery delivery service was closing in certain neighborhoods later this month,” reported Recode.

Though there is no official press release from Amazon with respect to AmazonFresh, an Amazon spokeswoman confirmed to Recode that the company is ending AmazonFresh in parts of several states, but would continue serving in certain areas of big cities such as New York City, Boston and Chicago, as well as Philadelphia and Los Angeles among other metropolises – or metropoles (ends with an “eez”) if you’re a Latin geek.

“We have made changes to our service area and discontinued delivery to select zip codes,” Amazon said in an emailed statement to Bloomberg on Friday. “AmazonFresh continues to serve customers across the U.S. (Seattle, New York, Boston, Baltimore, Philadelphia, Washington D.C., Chicago, Atlanta, Dallas, Miami, Denver, Los Angeles, San Francisco, and more) and internationally (London, Tokyo, and Berlin).”

It’s an interesting development from Amazon, especially now that Amazon owns Whole Foods and its 400+ stores across the country. The fact that Amazon bought Whole Foods itself is a huge signal that the company accepted that its decade-long struggle to deliver groceries was a failure. The reason for that is that AmazonFresh didn’t take off because the company needed a significant physical footprint to be effective in the grocery game.

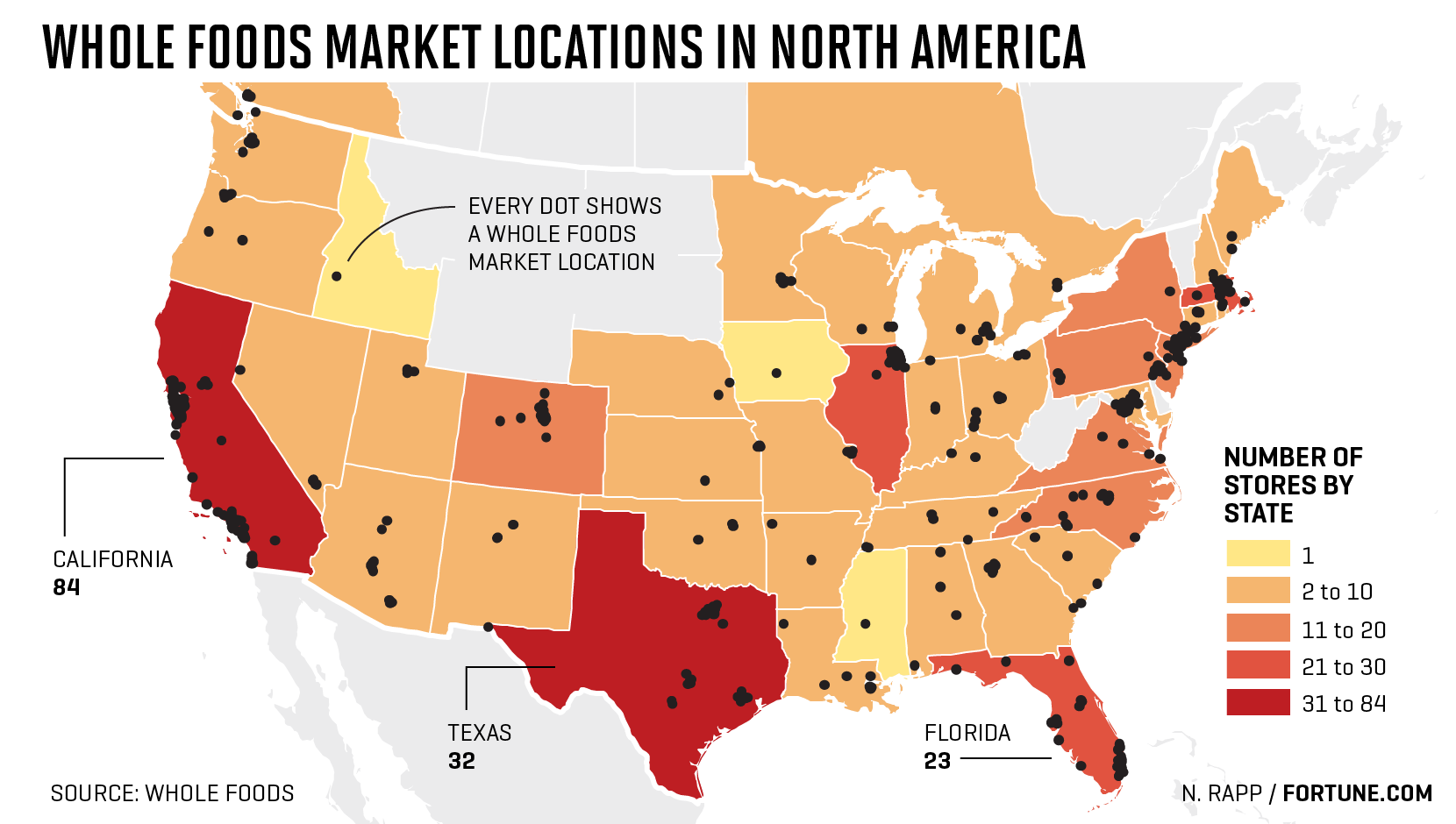

The Whole Foods acquisition has clearly reset Amazon’s direction for the grocery market. Because WFM is more concentrated in California, Texas and Florida, it makes sense for Amazon to push harder in these states, and even leverage the AmazonFresh brand wherever they have Whole Foods stores.

The strategy appears to be very clear when you look at Whole Foods’ physical footprint and match that to the cities where Amazon is scaling back on AmazonFresh – where Whole Foods isn’t, AmazonFresh won’t be. That makes sense when you consider how they can leverage WFM’s existing logistics and supply chain networks across the country. It saves time, money and effort that would have otherwise gone into expanding AmazonFresh to more physical locations. And that’s time that Walmart isn’t going to give Amazon.

Amazon didn’t spend $13.7 billion to buy Whole Foods and not do anything with it. The price tag is a clear indication that Whole Foods will remain at the crux of Amazon’s push to capture market share in the $800 billion grocery market.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter