The Story:

Even as the GOP’s first Senator voiced his disapproval of both chambers’ versions of the tax bill, other Republican Senators have expressed concerns about its effect on the middle class and its ability to address the deficit issue without harming taxpayers in the long run.

This Happened:

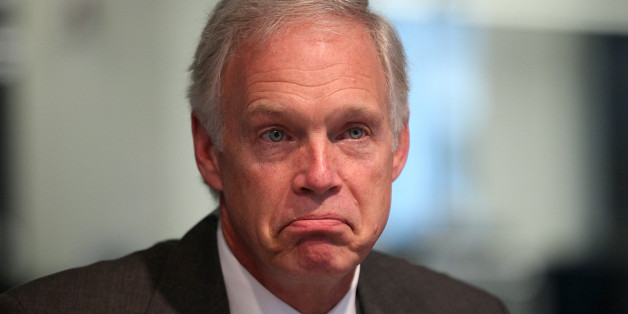

Senator Ron Johnson, Republican of Wisconsin, has cast a shadow of uncertainty on the $1.5 trillion tax cut proposal, saying he could not vote for the tax bill as written.

This Thursday the House is set to pass its own version, a proposed $1.4 trillion tax cut over a 10-year-period. On Wednesday, however, Sen. Johnson opposed both versions, stated that they favored corporations over other types of businesses such as pass-throughs and small businesses.

Referring to these other business types as “the engines of innovation and job creation,” Sen. Johnson said:

“Unfortunately, neither the House nor Senate bill provide fair treatment, so I do not support either in their current versions.”

Other Republican Senators, including Susan Collins (R-ME) and Bob Corker (R-TN), have made known their concerns regarding the tax bill. Sen. Corker said that he is “still working with folks to see if there’s some way to be assured as it relates to the deficit issue that we’re not going to create harm.”

His stand at the moment? “I’m not a yes, I’m not a no.”

With the House expected to pass its legislation, the onus of pushing the tax bill through now falls squarely on Republican shoulders, and some of them still seem to be weighing the pros and cons.

==========

Hey, thanks for visiting! We’re just a small team working extra-hard to help you cut to the chase on the most important news from around the world, so we’d appreciate your help spreading the word. Come join us on: Facebook and Twitter