An investment bank analyst from Vertical Group, reiterated his sell rating on Tesla this week, writing that his estimated cancellation rates and share losses make him cautious on the stock “.

Johnson estimates that the Model 3 cancellation rate is as high as 66%. He notes that out of 582,000 early reservations for the vehicle, only 197,000 have resulted in sales. He writes that net orders for Model 3 cars increased by a “dismal” 5,000 units over the eight-month period from July 31, 2017, to May 2, 2018—or just 139 cars a week. – Barron’s

To be honest, no one really knows how many Tesla Model 3 reservations were cancelled. Tesla does not release official figures and it never will. So its left to mortals like us to keep guessing.

Johnson’s calculations collide head on with Second Measure‘s assessment that among customers who made a deposit, 23% received a refund. (Second measure has nailed its calculations in the past).

Second Measure’s numbers did match up last August, when Tesla CEO Elon Musk disclosed that there were 455,000 net reservations out of 518,000 gross reservations, suggesting 63,000 cancellations and a 12 percent cancellation rate. – Recode

Enough with other sources. Let’s dig into Tesla’s financials to see what’s happening with Model 3 reservations vs cancellations – a.k.a Customer deposits.

If cancellations are mounting and new reservations are not coming through then there is no better place to validate it – other than looking at Tesla’s customer deposits.

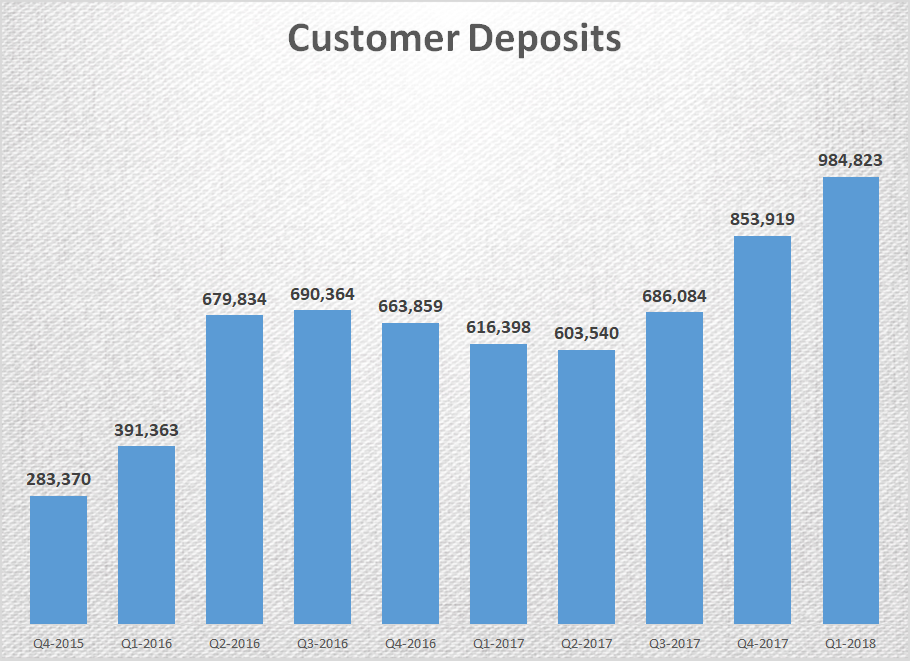

Tesla Customer Deposits (in $ thousands)

Source: Tesla Quarterly and Annual Reports

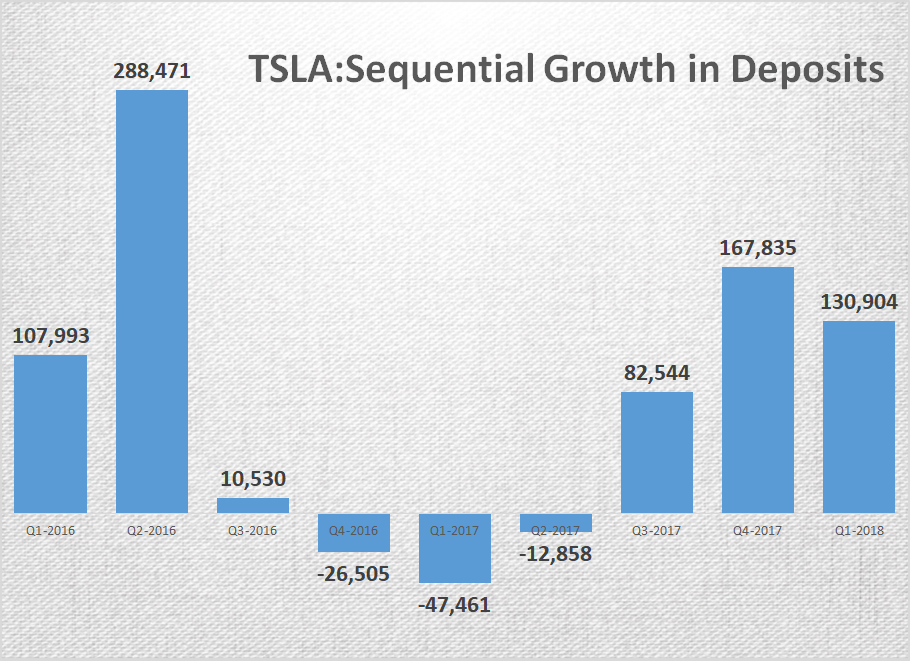

Source: Tesla Quarterly and Annual Reports

As you can see from the chart above, customer deposits surged immediately after Model 3 was launched in March 2016 (Q1-2016) , edged lower for some time, before starting to climb back up in the last three quarters.

Let me write this in a different way.

As you can see from the chart above, customer deposits surged as people got excited after Model 3s launch – got tired of waiting and kept cancelling their orders in the subsequent months, started reserving again as Tesla started Model 3 deliveries.

Tesla’s customer deposits increased by $167 million during the fourth quarter of 2017 and $130 million during the first quarter of 2018 – which means the amount of money Tesla received from new reservations were much higher than the amount of money Tesla returned due to cancellations.

Things may have accelerated in the other direction in April and May, but patterns don’t reverse that easily.

So how can Tesla’s cancellations be as high as 66%? Some one please explain to me as I am a little confused.

My 2 cents:

I do expect cancellations to accelerate over the next few quarters but reservations should pile up too. My reasoning

-

Tesla has made it clear that it will be building higher priced versions of Model 3

-

Tesla needs few more quarters of production to get Model 3 price down to $35,000

-

$35,000 is an extremely crucial price point to capture (US small luxury segment) volume.

-

With Tesla ramping up production, customers who are at the entry level of small luxury segment may cancel their orders now and book again at a later date.

-

As Tesla shortens time to delivery, it will attract new customers to the fold.