Tesla’s rate of operating expense growth has been plunging since 2014. But will that be enough to turn the big spending Tesla into a profitable company this year or the next?

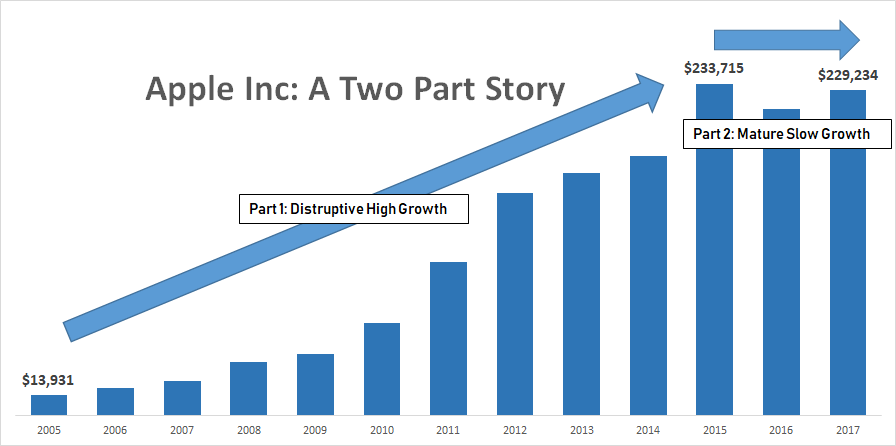

Size Is a Two Part Story

Doubling ten dollars to twenty is easy, but doubling ten billion dollars to twenty billion is not. If you look at any large company with billions of dollars in revenue you may have noticed a strong period of growth followed by a long period of slow growth. What works in favor of them during early days, their size, works against them as they get bigger and bigger.

Apple didn’t suddenly become an unwanted company in 2016. After a period of exponential growth, Apple’s revenue raced to $233 billion. Even to achieve one percent growth, Apple now needs $23 billion to be added to its top line. Apple grew its revenue ten fold between 2005 and 2012 – eight years. Now doubling their revenue may never be possible. Size was an advantage in 2005, it’s a huge disadvantage in 2017.

“It’s a huge advantage NOT to have a lot of money” -Warren Buffett

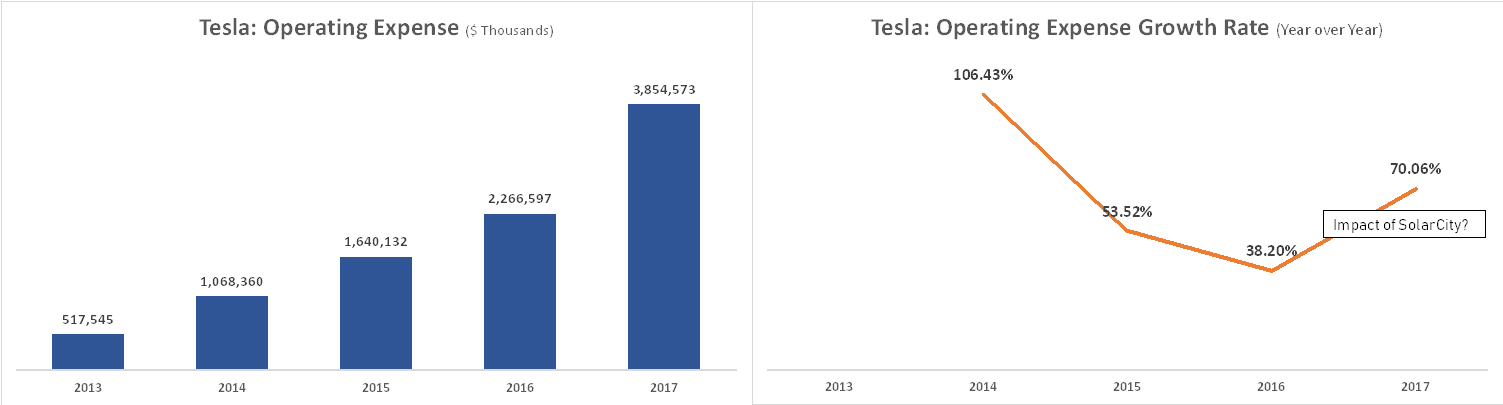

Tesla’s Operating Expense accounts for more than a third of the company’s Revenue

Tesla’s operating expense includes Research and Development expense and Selling, General and Administrative expenses.

In 2017, Tesla’s Research and Development expense accounted for 12% of Tesla’s revenue, while Selling, General and Administrative expense accounted for 21% of revenue. Operating expense for the year was 34% of Tesla’s revenue.

Will Tesla’s Operating Expense become a Two Part Story?

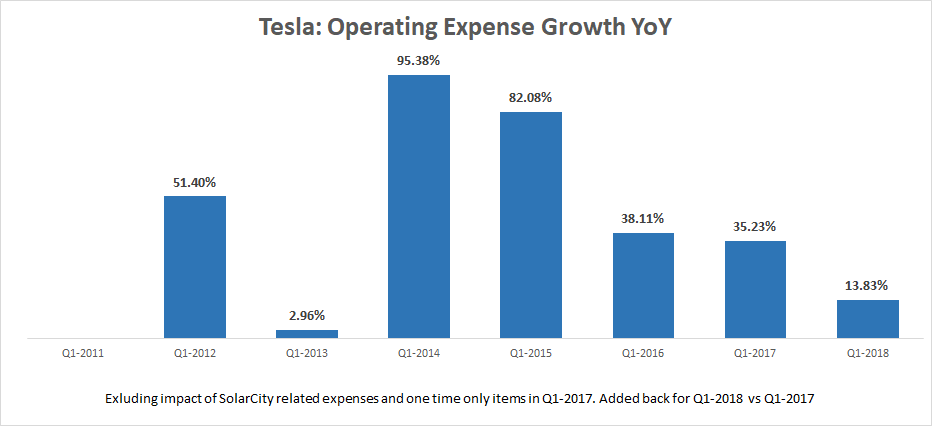

After declining from 106.43% growth in 2014 to 38.20% growth in 2016, Operating expense grew again by 70.16% between 2016 and 2017. Tesla’s decision to buy SolarCity in 2016 played a huge role in increasing the company’s operating expense in 2017.

In fiscal 2016, SolarCity reported operating expense of $901.76 million. If we assume $800 million in Operating Expense related to SolarCity in 2017 and exclude that, Tesla’s Operating Expense growth drops to 34%, less than Tesla’s Op.Ex growth rate in 2016.

Unfortunately, Tesla didn’t break out the impact of SolarCity’s acquisition on its operating expense for 2017. The company did give some details during its first quarter 2018 report and shareholder letter.

Tesla reported an increase of $44.8 million in R&D and $136.6 million in SG&A due to SolarCity acquisition and there was also a one time hit of $67 million related to SolarCity and Grohmann acquisition. If we exclude these items, operating expense grew only by 35% between Q1-2017 and Q1-2016.

The pace of Tesla’s operating expense growth declined steadily from 95% in the first quarter of 2014 to 14% in the first quarter of 2018.

Will it decline further?

Tesla is not the same car manufacturing company it was in 2014.

The number of employees working in Tesla has gone from 5,869 employees in December 2013 to the current more than 40,000 level. Production has increased from 22,477 vehicles for the full year of 2013 to 34,494 during the first quarter of 2018.

Tesla’s max production capacity is already near 73% of the company’s planned annual production capacity of 500,000 vehicles. As the pace of headcount growth slows down to a crawl, one of Tesla’s biggest expense item, monthly salaries to employees, will slow down as well.

Unless Tesla immediately starts pushing for capacity beyond 500,000 units, production related expenses will also slow down. Tesla CEO Elon Musk has subtly indicated that the company will remain extremely focused on controlling its expenses. In an email sent to employees in April Musk wrote

“A fair criticism leveled at Tesla by outside critics is that you’re not a real company unless you generate a profit, meaning simply that revenue exceeds costs. It didn’t make sense to do that until reaching economies of scale, but now we are there.

Going forward, we will be far more rigorous about expenditures. I have asked the Tesla finance team to comb through every expense worldwide, no matter how small, and cut everything that doesn’t have a strong value justification.

All capital or other expenditures above a million dollars, or where a set of related expenses may accumulate to a million dollars over the next 12 months, should be considered on hold until explicitly approved by me.”

Musk followed up his statements by announcing a company wide workforce restructuring in June this year. At the time of announcement Tesla noted that the 9% workforce reduction will apply only to salaried positions and not affect production associates.

With two of the company’s biggest expense items, monthly salary and production ramp up related expenses slowing down, Tesla has an extremely good chance to close 2018 and 2019 operating expense growth well below what the company reported in the last four years.

According to the company –

Research and development (“R&D”) expenses consist primarily of personnel costs for our teams in engineering and research, manufacturing engineering and manufacturing test organizations, prototyping expense, contract and professional services and amortized equipment expense.

Selling, general and administrative (“SG&A”) expenses consist primarily of personnel and facilities costs related to our stores, marketing, sales, executive, finance, human resources, information technology and legal organizations, as well as fees for professional and contract services and litigation settlements.

Q1-2018 vs Q1-2017 Impact of SolarCity Acquisition:

“Research and development expense increased by $139.6 million, or 76%, in the three months ended March 31, 2017 as compared to the three months ended March 31, 2016. This was primarily due to the inclusion of research and development expenses from SolarCity of $44.8 million”

“Selling, general and administrative expense increased by $285.3 million, or 90%, in the three months ended March 31, 2017 as compared to the three months ended March 31, 2016. This was primarily due to the inclusion of selling, general and administrative expenses from SolarCity of $136.6 million”

“Total Q1 operating expenses increased sequentially as the period now reflects a full quarter of SolarCity operating expenses, and due to $67 million of non-recurring charges related to the SolarCity and Grohmann acquisitions and the end of our work for Daimler”

From Tesla Q1-2017 Earnings and Shareholder Letter

Sources:

SolarCity Annual Report: 2016

Elon Musk Email to Employees: April 2018