Hindsight is good. At times it does feel good to say, “I wish I’d known it!” Though the market remains shell-shocked by Tesla CEO Elon Musk’s abrupt announcement that he plans to take the company private, a little bird called hindsight tells us that he has been throwing breadcrumbs all the way for us to follow. But it seems we missed following them.

June 7, 2013: The First Crumb

Elon Musk emails SpaceX employees. This gives a clear idea about What Musk’s real opinion about being a public company.

“Per my recent comments, I am increasingly concerned about SpaceX going public before the Mars transport system is in place. Creating the technology needed to establish life on Mars is and always has been the fundamental goal of SpaceX. If being a public company diminishes that likelihood, then we should not do so until Mars is secure. This is something that I am open to reconsidering, but, given my experiences with Tesla and SolarCity, I am hesitant to foist being public on SpaceX, especially given the long term nature of our mission.”

To paraphrase that, Elon Musk is making a case to stay private (to SpaceX employees) by telling them about his experience with two public companies, Tesla and SolarCity. The one sentence that we have to note here is this: If being a public company hurts our goal, then it’s not worth it.

Well, that kind of sums it up doesn’t it? If staying public is going to delay our progress, we stay private. The next two paragraphs are the best.

“Public companies are judged on quarterly performance. Just because some companies are doing well, doesn’t mean that all would. Both of those companies (Tesla in particular) had great first quarter results. SpaceX did not. In fact, financially speaking, we had an awful first quarter. If we were public, the short sellers would be hitting us over the head with a large stick.

We would also get beaten up every time there was an anomaly on the rocket or spacecraft, as occurred on flight 4 with the engine failure and flight 5 with the Dragon prevalves.”

This is what Elon Musk was thinking in 2013. Guess his opinion still hasn’t changed. Now read the email he sent to Tesla employees a few days ago. Just one paragraph:

“As a public company, we are subject to wild swings in our stock price that can be a major distraction for everyone working at Tesla, all of whom are shareholders. Being public also subjects us to the quarterly earnings cycle that puts enormous pressure on Tesla to make decisions that may be right for a given quarter, but not necessarily right for the long-term.”

It looks as if Elon Musk pulled out his 2013 SpaceX email and rewrote it for Tesla. In the SpaceX email, Elon says that Tesla and SolarCity are public because they had no choice.

So, to ask a rhetorical question, if there was a choice, then would he have kept them private? That time has come now, but more on that in the later part of the article. Now let’s keep following the breadcrumbs.

April 2017: The Second Crumb

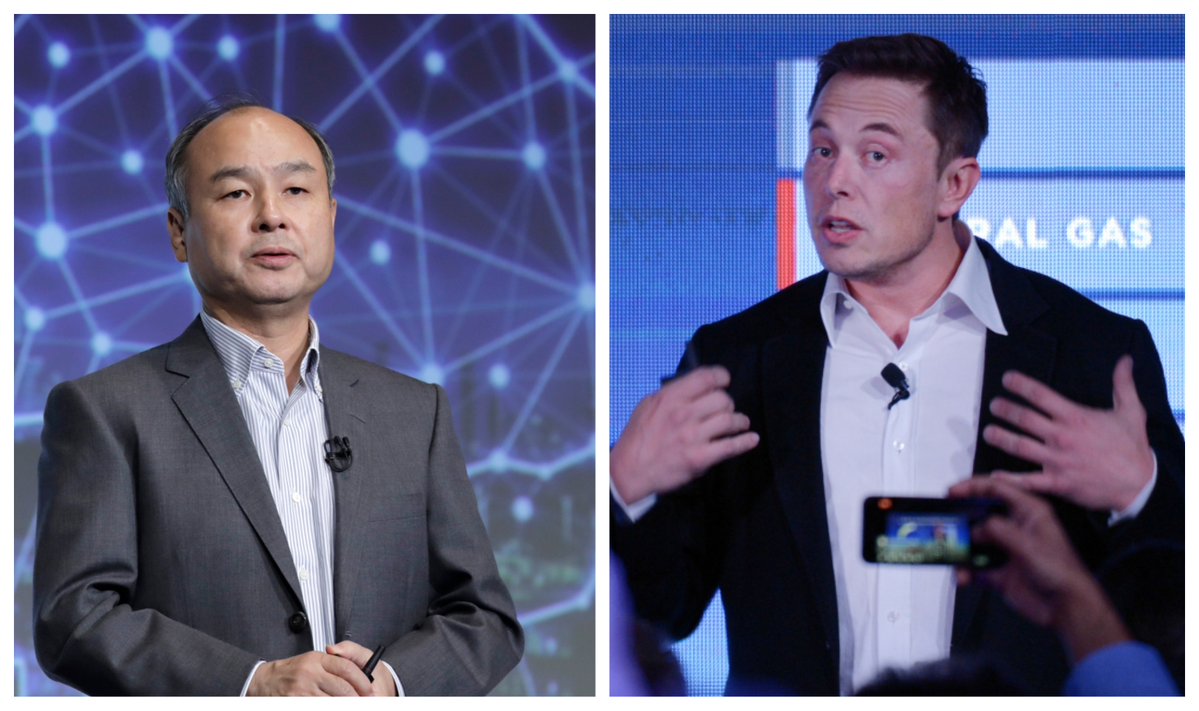

According to this Bloomberg article, Elon Musk met Masayoshi Son to talk about Softbank Group investing in Tesla. Sources told Bloomberg that the talks included a potential privatization plan. The talks didn’t yield results due to disagreements over ownership. We still cannot say for sure that Softbank is not in the picture, but at least we know that Elon has been knocking doors for more than a year now.

November 2017: The Third Crumb

Elon Musk tells Rolling Stone author Neil Strauss: “I wish we could be private with Tesla,” “It actually makes us less efficient to be a public company.”

Note the words “less efficient”. If the CEO of a company feels that something is making operations less efficient, then there is only one thing that he will do. Find the cause and kill it.

But at the time, Tesla was still struggling with Model 3 “production hell”. His conversation with Masayoshi Son must have hit home because, starting in Q1 2018, Tesla has been guiding for GAAP profits in Q3 and Q4 2018.

April 2018: The Fourth Crumb

Things started looking up in April 2018 after Tesla crossed the first major milestone of building more than 2000 Model 3s in a week. Elon Musk once again emails Tesla employees.

Just one paragraph needs a bit of careful reading:

“A fair criticism leveled at Tesla by outside critics is that you’re not a real company unless you generate a profit, meaning simply that revenue exceeds costs,” he wrote. “It didn’t make sense to do that until reaching economies of scale, but now we are there.”

Musk also said in the email that, “Going forward, we will be far more rigorous about expenditures.”. From the start of 2018, Tesla has been guiding for GAAP profits in Q3 and Q4 2018.

Aug 2, 2018: The Fifth Crumb

Elon Musk tells analysts during the second quarter earnings call:

“And from an operating plant standpoint, from Q3 onwards, I really want to emphasize our goal is to be profitable and cash-flow positive for every quarter, going forward”

Aug 7, 2018: The Final Crumb

“Am considering taking Tesla private at $420. Funding secured.: – Elon Musk”

Now let’s just speculate a bit here. So Musk talks to Masayoshi Son in April. The talks fail for whatever reason, and then he tells Neil Strauss a few months later that he wishes for Tesla to be private. Son must have given enough reasons for not investing in Tesla (assuming that he refused), and Elon had plenty of time to correct/update course. He then tells investors he wants Tesla to be “profitable and cash-flow positive for every quarter.”

Winding back the clock, Elon Musk had plenty of challenges in the second half of 2017. Model 3 production didn’t go as planned, Tesla had repeatedly pushed back its production targets, and the company was slammed by Wall Street to the extent that nobody expected Tesla to reach Model 3 Production rate of 5000 units per week.

If you are going to ask for investors to dole out cash in the tens of billions, will you be going with an income statement where the bottom line is in thick red, or will you wait for it to turn green and say, hey we are the number one EV maker in the world, we are already at an annual production rate of +360,000 units and we just got some favorable terms from the Chinese government to build a factory there, so we should double our current capacity in the next three years and we expect to stay profitable from here on out now that we have economies of scale? I think the answer is obvious.

My 2 Cents

Elon has always hated the idea of heading a public company. Given a choice, he would have kept Tesla private. But Tesla sorely needed the capital to expand aggressively. Now that the economies of scale have kicked in and Tesla expects to be profitable in the next two quarters, Elon Musk has a solid case to pitch for funding.

He could have done it earlier and someone might have funded it. But the red-inked income statement would have only made his negotiating position that much weaker. Now, he is in a position of strength. He just waited for the right time to get better terms.

So, for all those who are thinking Elon is bluffing, I am really sorry to say that it doesn’t look like it. The deal still has plenty of regulatory investor hoops to jump through, and it may not even be successful. But Elon has been working towards this point for a very long time, and we all know what happens when someone perseveres to this degree. For the man who built a company that can successfully land rockets, finding a buyer seems to be a comparatively easy challenge.

As Peter Thiel Once said, “You never Bet Against Elon”.

It’s no secret what Elon Musk thinks of Henry Ford and Model T that changed the global automotive industry and all our lives with it. If you got time, please do read Autoblog author Gary Vasilash’s article “Elon Musk’s plan to take Tesla private isn’t crazy. Just ask Henry Ford.” A similar drama played out 100 years ago.

Source: Tesla Email (August 2018), Tesla Email (April 2018)

The full text of SpaceX email:

From: Elon Musk

Date: June 7, 2013, 12:43:06 AM PDT

To: All <All@spacex.com>

Subject: Going PublicPer my recent comments, I am increasingly concerned about SpaceX going public before the Mars transport system is in place. Creating the technology needed to establish life on Mars is and always has been the fundamental goal of SpaceX. If being a public company diminishes that likelihood, then we should not do so until Mars is secure. This is something that I am open to reconsidering, but, given my experiences with Tesla and SolarCity, I am hesitant to foist being public on SpaceX, especially given the long term nature of our mission.

Some at SpaceX who have not been through a public company experience may think that being public is desirable. This is not so. Public company stocks, particularly if big step changes in technology are involved, go through extreme volatility, both for reasons of internal execution and for reasons that have nothing to do with anything except the economy. This causes people to be distracted by the manic-depressive nature of the stock instead of creating great products.

It is important to emphasize that Tesla and SolarCity are public because they didn’t have any choice. Their private capital structure was becoming unwieldy and they needed to raise a lot of equity capital. SolarCity also needed to raise a huge amount of debt at the lowest possible interest rate to fund solar leases. The banks who provide that debt wanted SolarCity to have the additional and painful scrutiny that comes with being public. Those rules, referred to as Sarbanes-Oxley, essentially result in a tax being levied on company execution by requiring detailed reporting right down to how your meal is expensed during travel and you can be penalized even for minor mistakes.

YES, BUT I COULD MAKE MORE MONEY IF WE WERE PUBLIC

For those who are under the impression that they are so clever that they can outsmart public market investors and would sell SpaceX stock at the “right time,” let me relieve you of any such notion. If you really are better than most hedge fund managers, then there is no need to worry about the value of your SpaceX stock, as you can just invest in other public company stocks and make billions of dollars in the market.If you think: “Ah, but I know what’s really going on at SpaceX and that will give me an edge,” you are also wrong. Selling public company stock with insider knowledge is illegal. As a result, selling public stock is restricted to narrow time windows a few times per year. Even then, you can be prosecuted for insider trading. At Tesla, we had both an employee and an investor go through a grand jury investigation for selling stock over a year ago, despite them doing everything right in both the letter and spirit of the law. Not fun.

Another thing that happens to public companies is that you become a target of the trial lawyers who create a class action lawsuit by getting someone to buy a few hundred shares and then pretending to sue the company on behalf of all investors for any drop in the stock price. Tesla is going through that right now even though the stock price is relatively high, because the drop in question occurred last year.

It is also not correct to think that because Tesla and SolarCity share prices are on the lofty side right now, that SpaceX would be too.

Public companies are judged on quarterly performance. Just because some companies are doing well, doesn’t mean that all would. Both of those companies (Tesla in particular) had great first quarter results. SpaceX did not. In fact, financially speaking, we had an awful first quarter. If we were public, the short sellers would be hitting us over the head with a large stick.

We would also get beaten up every time there was an anomaly on the rocket or spacecraft, as occurred on flight 4 with the engine failure and flight 5 with the Dragon prevalves. Delaying launch of V1.1, which is now over a year behind schedule, would result in particularly severe punishment, as that is our primary revenue driver. Even something as minor as pushing a launch back a few weeks from one quarter to the next gets you a spanking. Tesla vehicle production in Q4 last year was literally only three weeks behind and yet the market response was brutal.

BEST OF BOTH WORLDS

My goal at SpaceX is to give you the best aspects of a public and private company. When we do a financing round, the stock price is keyed off of approximately what we would be worth if publicly traded, excluding irrational exuberance or depression, but without the pressure and distraction of being under a hot public spotlight. Rather than have the stock be up during one liquidity window and down during another, the goal is a steady upward trend and never to let the share price go below the last round. The end result for you (or an investor in SpaceX) financially will be the same as if we were public and you sold a steady amount of stock every year.In case you are wondering about a specific number, I can say that I’m confident that our long term stock price will be over $100 if we execute well on Falcon 9 and Dragon. For this to be the case, we must have a steady and rapid cadence of launch that is far better than what we have achieved in the past. We have more work ahead of us than you probably realize. Let me give you a sense of where things stand financially: SpaceX expenses this year will be rougly $800 to $900 million (which blows my mind btw). Since we get revenue of $60M for every F9 flight or double that for a FH or F9-Dragon flight, we must have about twelve flights per year where four of those flights are either Dragon or Heavy merely in order to achieve 10% profitability!

For the next few years, we have NASA commercial crew funding that helps supplement those numbers, but, after that, we are on our own. That is not much time to finish F9, FH, Dragon V2 and achieve an average launch rate of at least one per month. And bear in mind that is an average, so if we take an extra three weeks to launch a rocket for any reason (could even be due to the satellite), we have only one week to do the follow-on flight.

MY RECOMMENDATION

Below is my advice about regarding selling SpaceX stock or options. No complicated analysis is required, as the rules of thumb are pretty simple. If you believe that SpaceX will execute better than the average public company, then our stock price will continue to appreciate at a rate greater than that of the stock market, which would be the next highest return place to invest money over the long term. Therefore, you should sell only the amount that you need to improve your standard of living in the short to medium term. I do actually recommend selling some amount of stock, even if you are certain it will appreciate, as life is short and a bit more cash can increase fun and reduce stress at home (so long as you don’t ratchet up your ongoing personal expenditures proportionately).To maximize your post tax return, you are probably best off exercising your options to convert them to stock (if you can afford to do this) and then holding the stock for a year before selling it at our roughly biannual liquidity events. This allows you to pay the capital gains tax rate, instead of the income tax rate.

On a final note, we are planning to do a liquidity event as soon as Falcon 9 qualification is complete in one to two months. I don’t know exactly what the share price will be yet, but, based on initial conversations with investors, I would estimate probably between $30 and $35. This places the value of SpaceX at $4 to $5 billion, which is about what it would be if we were public right now and, frankly, an excellent number considering that the new F9, FH and Dragon V2 have yet to launch.

Elon