Tesla Customers who are waiting for the Standard Battery $35,000 Model 3 may have to keep waiting according to UBS, as the investment bank thinks Tesla will never make any profits at that price level.

UBS analyst Colin Langan told CNBC that “he thinks Tesla will never be able to make money at the $35,000 the company originally planned to charge for an entry-level model designed for the masses.”

“This car needs to sell in the low $40,000’s to break even, and I think they’re a long way from the 25 percent growth margin target, unless they can sell it well over $50,000,” Langan said Tuesday on CNBC’s “Power Lunch.”

Tesla analyst: The company needs to increase price of Model 3 just to break even from CNBC.

Earlier UBS Analyst Colin Langan said Tesla will lose about $6,000 if the company sells Model 3 for $35,000. There are several tools at Tesla’s disposal to increase the average selling price of its low cost sedan.

Autopilot

Not every $35,000 Model 3 buyer is going to pay for Autopilot. But there will be a good portion of customers who will opt for it.

Out of the more than 90,000 vehicles with Autopilot 2.0 hardware in Tesla’s global fleet, the owners of about 77% of them have purchased ‘Enhanced Autopilot’ and ~40% have purchased ‘Fully Self-Driving Capability’, sources familiar with the matter told Electrek.

If 77% and 40% of standard battery Model 3 buyers pay the standard $5000 for EAP and $3000 for FSD, it could help cover the overall $6,000 loss per car by quite a bit. Even more if enough customers opt for them later at an additional $1,000 per feature.

Other Extras

Tesla can also break up its option package that includes heated seating, premium audio system, LED fog lamps and premium connectivity just like other manufacturers, and charge a little bit additionally to increase the price of the car relative to the cost of materials.

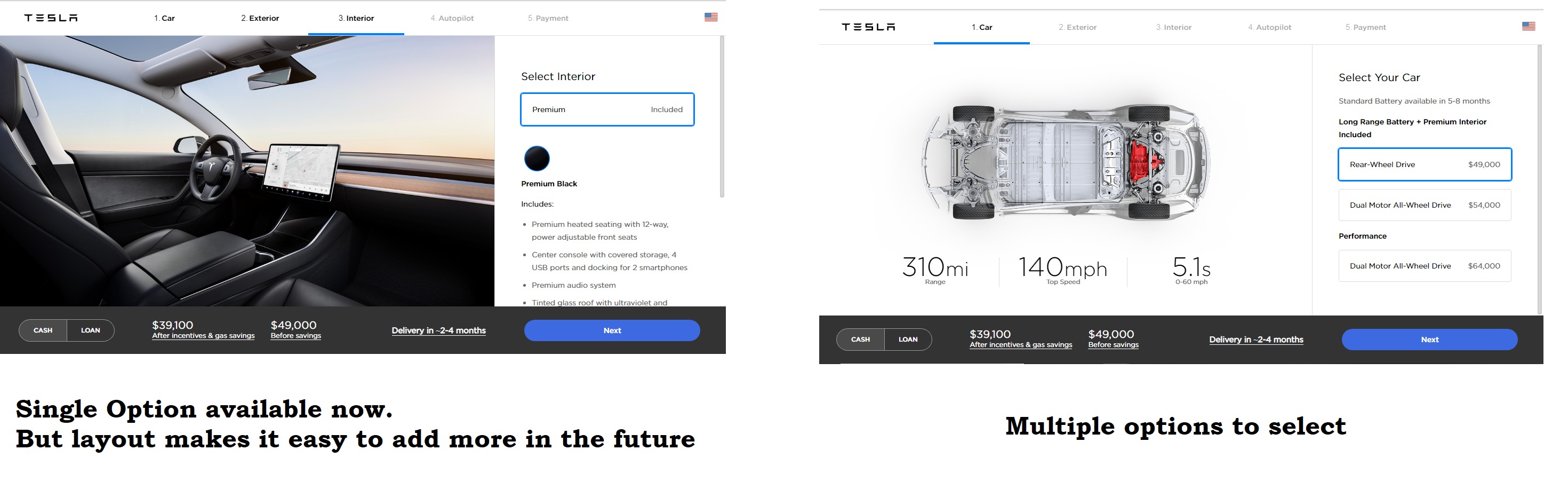

I think Tesla is already looking at both options to improve its cost vs profit equation for Model 3. Otherwise, why would Model 3 have a design layout that’s completely different from Model S and Model X?

The Interior Selection part of the Design Studio looks prepared to add more options in the future.

What about Scale?

Tesla wants the Model 3 price to drop to $35,000 because that’s the sweet spot of the US Small Size Luxury segment, which reported sales of over 450,000 vehicles in 2017. The top three in the segment, Mercedes Benz C-Class, BMW 3 Series and Infiniti Q-50 had combined sales of 177,635 units, accounting for a whopping 38.64% of segment sales.

Mercedes Benz C-Class starts at $40,250, BMW 3 Series starts at $34,900 and Infinity Q50 starts at $35,200. Tesla clearly planned the price point after taking a good hard look at the segment.

For a long time, the Model S and Model X have punched above their weight by competing with ultra-luxury competitors. Tesla wants to punch below its weight with Model 3, by targeting the entry point of the small size luxury segment. Because Tesla needs volume. And volume brings economies of scale.

Let’s agree for a moment that the $6,000 loss per unit is correct. But the segment offers the potential to sell lots and lots of units every week. Tesla captured nearly a quarter of the large luxury segment in the United States. If Tesla captures 20% of the US small size luxury segment with its $35,000 Model 3, then Tesla will be looking at nearly 90,000 unit sales per year in the United States alone.

It must also be noted that Tesla does not eat up market share within the segment, it also eats market share from other segments as well.

During the second quarter earnings call Tesla’s sales head Robin Ren surprised everyone by saying this:

“So, we looked at what people who are buying Model 3 cars in the United States, what cars they are trading in. What we found is through this year, from January to July, the top five non-Tesla cars people are trading in to get into a Model 3, they are Toyota Prius, BMW 3 Series, Honda Accord, Honda Civic and Nissan Leaf.”

Model 3 now stars at $49,000 and people are trading in Toyota Prius, BMW 3 Series, Honda Accord, Honda Civic and Nissan Leaf. Multiple segments.

So, a $35,000 Model 3 is certainly going to attract plenty of customers from many different segments.

If Tesla sells 100,000 Model 3s priced at $35,000, that’s an average of nearly 2,000 units per week. How much leverage will it get from its suppliers to reduce the cost of the products they supply?

According to Tesla CEO Elon Musk there are 10,000 unique parts in Model 3. 10 cents saved per part will reduce thousand dollars in cost.

Will you drop your price if your customer says that he will give you additional 8,000 orders every month – additional?

We covered this topic earlier in an article titled UBS Analyst says $35,000 Model 3 will Lose $6,000. But UBS repeated its thesis, we followed suit.