Customers standing in a queue to buy Model 3 does remind us of iPhone product launches, don’t they?

Queue at Tesla Martin Place to see Tesla Model 3 pic.twitter.com/UbEJ9KC1dc

— Heath Walker (@TexWalkerRanger) August 21, 2018

And the line got longer: Thanks to Heath Walker for uploading the video and images on Twitter.

Elon Musk’s goal of producing 500,000 Model 3s a year is a very realistic goal. But that’s not all. That goal presupposes that there will be strong long-term demand for Tesla’s most popular EV yet. Is that practical? The queue outside the Martin Place Tesla showroom in Sydney is certainly reminiscent of an iPhone launch, but what does it tell us about how well the Model 3 can do over several years?

First of all, we need to be clear that Tesla is still getting new Model 3 orders at an impressive rate. From Musk’s tweet last month, it looks like 20,000 new orders a month for the Model 3. Let’s take it with a pinch of salt and say 10,000 a month. Not an unreasonable figure to use for our purpose.

Dunno where this bs is coming from. Who knows about the future, but last week we had over 2000 S/X and 5000 Model 3 *new* net orders.

— Elon Musk (@elonmusk) July 20, 2018

Now, that’s just in the U.S. market and it translates to about 120,000 a year. Can they quadruple that globally when they start to expand in markets like Europe, China, Australia and about two dozen other countries? We think so.

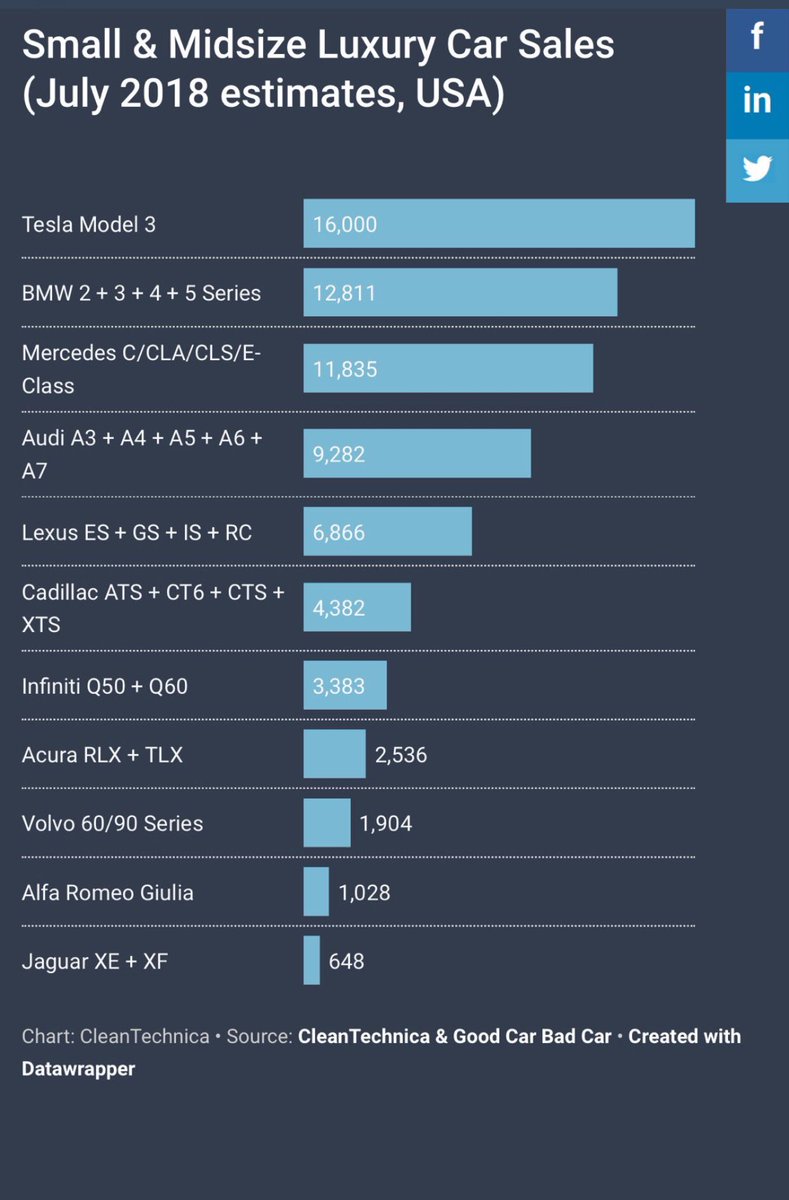

To get to that point, let’s see how its price-point-peers from Germany are doing.

The BMW 5 series sold 347,000 units worldwide, and it is priced upward of $50,000. That’s the lower end of the Model 3 right now, but in a few months that low end will drop to $35,000 with the rear-wheel drive standard battery Model 3. So the BMW 5 series is fair game for a comparison.

Its German peer, Mercedes-Benz, sold more than 415,000 for the C-Class Saloon and Estate models, both of which have a market maturity of about 4 years. Those are priced in the $40,000+ range as well. Again, fair game.

The Model 3 is already at the top of those segments in the United States, and that’s when you compare Tesla’s one model against combined lines for BMW, Mercedes-Benz and Audi.

This estimate was made in June by CleanTechnica. A more studied estimate for July published on August 1 by InsideEVs came in at 14,250. Let’s average that out to about 15,000 for July, and it still beats the German trio head-to-head.

That’s in the United States. Globally, the 5-Series and the Mercedes duo we talked about earlier are selling an average of nearly 29,000 units and 35,000 units a month, respectively.

The Model 3 hasn’t gone global yet and they’re already delivering around 15,000 units a month. When the standard battery version comes out at $35,000 for the RWD option, its potential market share is going to expand into the territory Toyota (Corolla/Camry) and Honda (Civic/Accord). The Model 3 is already doing that, even with variants that cost from $49,000 to $64,000. What can it do with a $35,000 variant?

The real question is, can the Model 3 generate that much demand year after year? I think it can. Model S paved the way for sustainable sales, and Model 3 is taking it to the next level. Does the Model 3 still have global appeal? You just have to look at the lines outside the Sydney showroom to figure that out. iPhone launch.

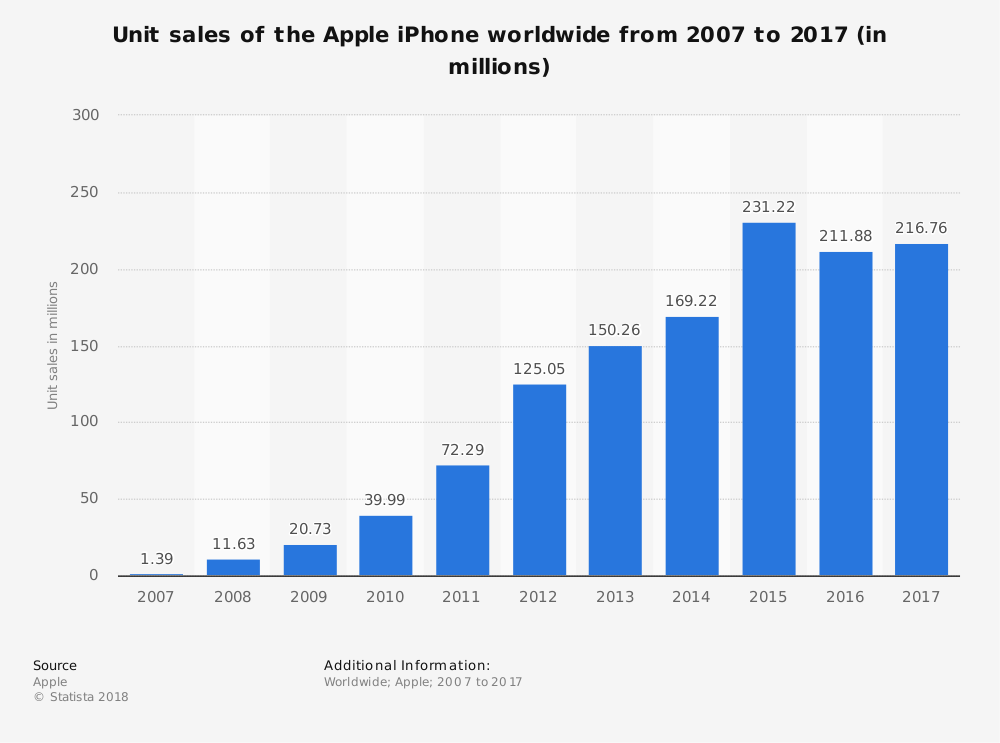

Apple has been severely criticized for hyping up its iPhone, but it continues to deliver on the sales front. Ten years on, iPhone sales may have hit a plateau, but they’re still selling them in the hundreds of millions.

Tesla has that same branding aura around it that makes it irresistible even to those who can’t afford it. But the difference is, Apple is climbing the price ladder with each iteration of the iPhone; Tesla is headed in the opposite direction to ultimately create a true mass-market product.

So, yes, global demand can definitely be sustained at high levels for the Model 3 in the foreseeable future. Their rivals in the ICE space have proved it, and Tesla is doing the same thing in the EV arena.

Think about it: China alone will generate far more sales than the U.S. once Gigafactory 3 in Shanghai is operational. The initial production capacity will serve a demand peak of 250,000 within the next three years, most of which will be consumed in the domestic market itself.

The current market in China is about 605,500 cars for the entire plug-in segment. Estimates for 2018 put plug-in sales at 50% higher – 920,000 cars a year, maybe more. Even that volume is only going to be 3.6% of the passenger car market, which represents a massive growth opportunity for EV companies.

With China aggressively pushing for electrification over the next few years, where do you think those figure will be in 2020, and where do you think Tesla will be when the dust settles? Tesla is already the largest non-Chinese EV player in China, so it makes a lot of sense for Tesla to push for full-capacity production of 500,000 cars from the Shanghai factory, doesn’t it?

Add another 500,000 a year from Fremont and Gigafactory 1 that will presumably serve the rest of the world, and a 1 million cars a year production capacity suddenly seems inadequate to address the future. GF 4 and 5, Mr. Musk?

What is the total market potential for Tesla, globally? Well, there were 93 million cars sold in 2017 across 189 countries. The bulk of that was passenger cars, and the total figure grew about 2-3% from 2016. Now remove SUVs, pickup trucks, small cars and mini cars and you still have about half the market open to the Model 3, especially when the base price goes down to $35,000 in a few months. That’s about 45 million cars across 189 markets, but Tesla can’t move that fast. Take just the top 30 global markets and you’re still looking at millions of potential sales for Tesla to target.

The Model 3 is almost ready to move to global markets, and even with just 30 countries under its belt, it’s very likely that it will push past BMW and Mercedes-Benz’s numbers in the next few years. Moreover, ICE sales will start declining significantly by that time, giving Tesla an even bigger advantage to dominate multiple segments.

So that’s what the queue outside the Tesla showroom in Sydney tells us. Nice.