According to this Bloomberg report published in January this year, nearly “80% of battery-powered vehicles in the United States are leased, not owned.” It’s clear that new electric vehicle buyers prefer the leasing route.

Leasing is cheaper than buying the car outright and early adopters know that technology is developing fast. Why own a product with outdated tech for ten years, when you can buy a new one in three years?

Leasing has its advantages. The down payment, as well as monthly payments, are low, then there are tax advantages for businesses to consider. There will be no need to hit the used car market when you are ready for the next upgrade.

But despite the obvious advantages, the number one electric car maker in the world, Tesla, has been swimming against the leasing tide.

In 2017, leasing accounted for 11.4% of Tesla’s automotive revenue before dropping to 3.6% in the third quarter of 2018. The sharp decline is because Tesla is yet to offer a lease on its high volume product, Model 3.

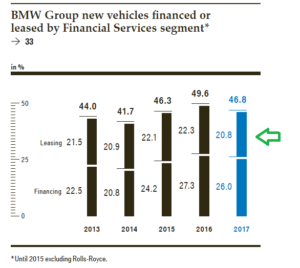

Leasing is a big part of luxury auto sales. In 2017, leasing accounted for nearly 21% of the BMW Group’s revenue. When you add third-party lease provider’s into the mix, leasing will account for a much larger share.

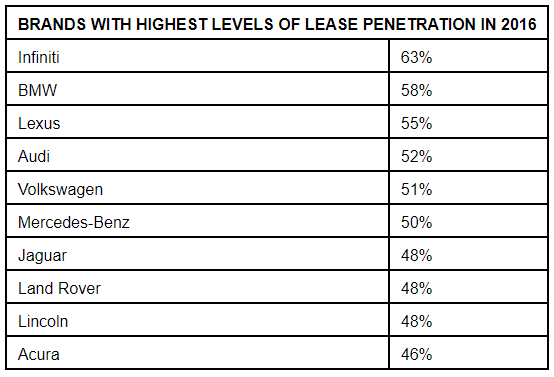

Several luxury badges have lease penetration rates over 50%. But not Tesla, and the company seems to be in no hurry to improve its lease penetration. Tesla customers prefer to own their cars instead of leasing them.

Are you ready to sell your Tesla in three years?

Some owners do, but most of them are not going to sell their Tesla in three years. There are several Tesla’s on the road today in reasonably good condition even after accumulating 400,000 miles. According to data collected by Tesla owners in Europe, the battery packs in Tesla held on to more than 91% of their capacity after crossing 170k miles. The study predicts Tesla batteries to hold 80% capacity after crossing 500k miles.

When the most expensive, most complicated part of the car retains its value, it removes any long-term running concerns of a potential buyer.

Leasing a Tesla is not yet financially attractive?

Data from Tesla (leasing calculator) shows that you can lease Model S75D with an annual mileage cap of 10,000 by paying $946 every month for three years. The downpayment is $7,000. The interest rate is 5.75%.

But you can buy the car outright on a 72-month loan carrying a 3.99% interest rate. The downpayment will be $10,000 and your EMI will be $1,067. Three years later you would have paid nearly $48,000 and own a car which is worth around $40K in the used car market.

If you had leased the car for three years, you would have paid nearly $41K by the time you are ready to return the car.

It’s not that hard to find a used Tesla Model S70D with a mileage of 40,000 selling for $40,000 to $45,000 and maybe even more, depending on the condition of the car.

Leasing does not offer a clear-cut financial advantage over buying a Tesla outright.

Tesla’s hold their value in the used car market?

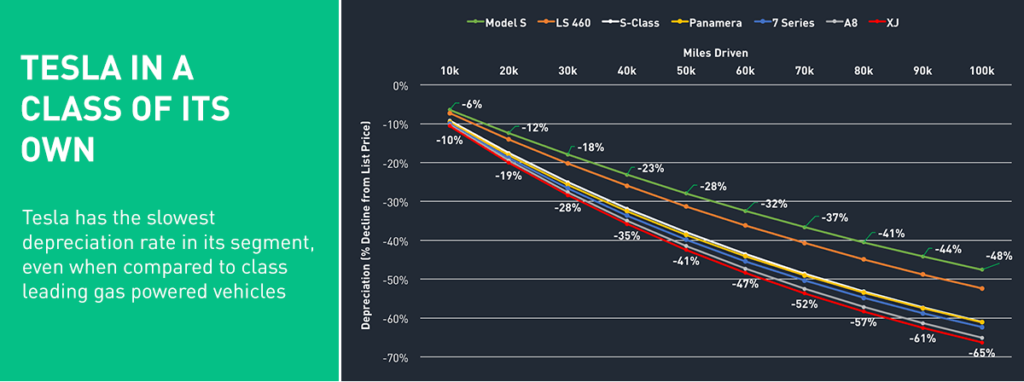

The high residual value is an important reason why Tesla owners are not going the leasing way like other electric car buyers. Since Tesla holds its value in the used car market, new car buyers don’t see any clear advantage in leasing a Tesla. They prefer to buy them outright.

Tesla has plenty of time:

Tesla will be more than happy to let the current status quo continue for some more time. Tesla currently offers vehicle leases in the United States for Model S and Model X directly from Tesla finance and through leasing partners.

When Tesla directly leases its vehicles, the company will have to forgo the charm of collecting full payment at the time of delivery and accept monthly payments over several years. Considering how tight the cash flow is and the number of analysts with a sell rating on Tesla stock, the company would prefer if its customers can buy the car outright and keep its quarterly numbers healthy.

As Tesla gets bigger and stabilizes it bottom-line, it can use the leasing program, make it more attractive and use it as a lever to adjust demand.

As of now, the company does not face a demand-side problem, couple that with the need for money today than tomorrow, it becomes easy to understand why Tesla’s lease penetration rate is so low and why the company would love to keep it as low as possible for some more time.

Captive leasing makes the automaker a lender at the time of new vehicle sales and a used car seller at the end of lease term.

Both the options are not palatable to Tesla at this stage, as the company needs to bring in as much money as it can today instead of accepting payments over a three or five year period.

From the customer point of view, Tesla’s depreciation rate has rendered leasing financially not as attractive as buying it outright.

It will be many more years before Tesla’s lease penetration rate catches up to other luxury badges. In my opinion, Tesla will never make it to that level. This is possibly one area where Tesla will be more than happy to languish at the bottom of the table.