At the Apple Worldwide Developer Conference (WWDC) in San Francisco, Apple made a huge announcement that can shake things up for Paypal. The Cupertino-based tech behemoth announced that it will be taking Apple Pay to the web.

For some unknown reason, Apple has so far shied away from moving things to the web, touting apps as the best way for transactions to be processed. Unfortunately, however, despite the major shift from PCs to mobile devices, most people – including yours truly – prefer making online payments on a desktop or laptop using the Internet.

The truth is that I do make online payments using my phone, but if I have my laptop handy I much prefer that type of interaction. It somehow gives me a feeling of greater safety and security. It might be just me, but I don’t think that’s the case. A study done by Adyen, a global payment technology company, showed that mobile payments accounted for only about 30% of all global online transactions. Hmm, so it’s not just me after all.

Now that’s something to think about because, until now, Apple has been stubborn about going to the web with its mobile payment service. That means they’ve been missing out on 70% of the world’s online transactions, and are finally open to the idea.

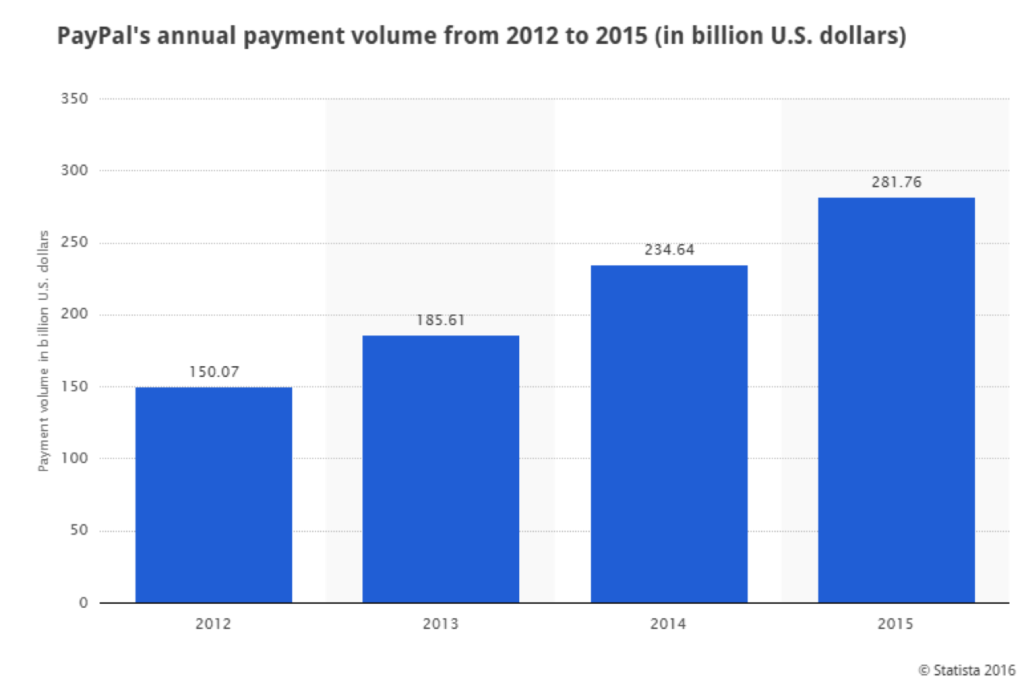

PayPal, is of course the de facto, international payment processor when it comes to web. With operations in 203 countries and a user base of 179 million active users doing nearly $300 billion worth of transactions in 26 currencies, PayPal pretty much controls that 70% I mentioned earlier.

To complicate the issue for Apple Pay and other mobile wallet services, PayPal also operates Venmo, a direct competitor to Apple Pay, Samsung Pay and other digital wallets.

Apple’s decision to move into the web payments space, therefore, could be one of the best decisions they’ve ever made. Although growth is exploding on the mobile front, they cannot afford to leave untapped a market as large as 70% of the world’s online payments.

In a way, it’s a logical step for Apple considering they already possess the technology backbone for the purpose. However, Apple Pay is much newer to the game, and expecting them to compete right away with PayPal is definitely a stretch by any standards. It was only launched last year and is only available in a handful of countries like the United States, the UK, Canada, Australia and Singapore.

Nevertheless, Apple wants to snatch a piece of that scrumptious pie from PayPal. If they can put their full weight behind the initiative and roll out the web version of Apple Pay in an aggressive manner, they may take a significant minority share of the market in the next five to ten years. To give PayPal a run for its money may take a decade or more, but any market share Apple can gain in that segment is a solid play for its future top line growth – and that’s something they urgently need to look into as their mobile devices show sales sluggishness.