The European Union just created a new world record of its own by slapping a €13 billion (abotu $14.5 billion) tax bill on Apple, the biggest the Union has ever served on any single company in its history. The ruling is definitely going to spark off discussions about the money big corporate companies stash in safe havens around the world.

According to a Bloomberg News review published last year Microsoft, Apple Inc., Google Inc., and five other tech companies accounted for more than a fifth of the massive $2.10 TRILLION stockpile in profits that U.S. companies are holding overseas.

The U.S. government taxes repatriated cash at 35%. If you are business owner with $1 billion in profits from your overseas operations and decide to bring the money back into the United States, you will suddenly become $350 million poorer. So there’s actually a strong case to leave the money where it is, untouched. That is, at least until the local authorities decides to suddenly use you to make the headlines.

What’s the Real Issue Here?

Now what happens if a country that is not a tax haven – such as the Cayman Islands, British Virgin Islands and Bermuda, where hedge funds hide their cash – but a well-respected country and a proud member of the European Union only allows you to pay less than 35% tax on your profits? Then you have one more reason to operate out of there, correct? Now stretch that to its extreme and imagine if that country were Ireland, but only asked you to pay 1% tax. There’s no reason to say no, wouldn’t you agree?

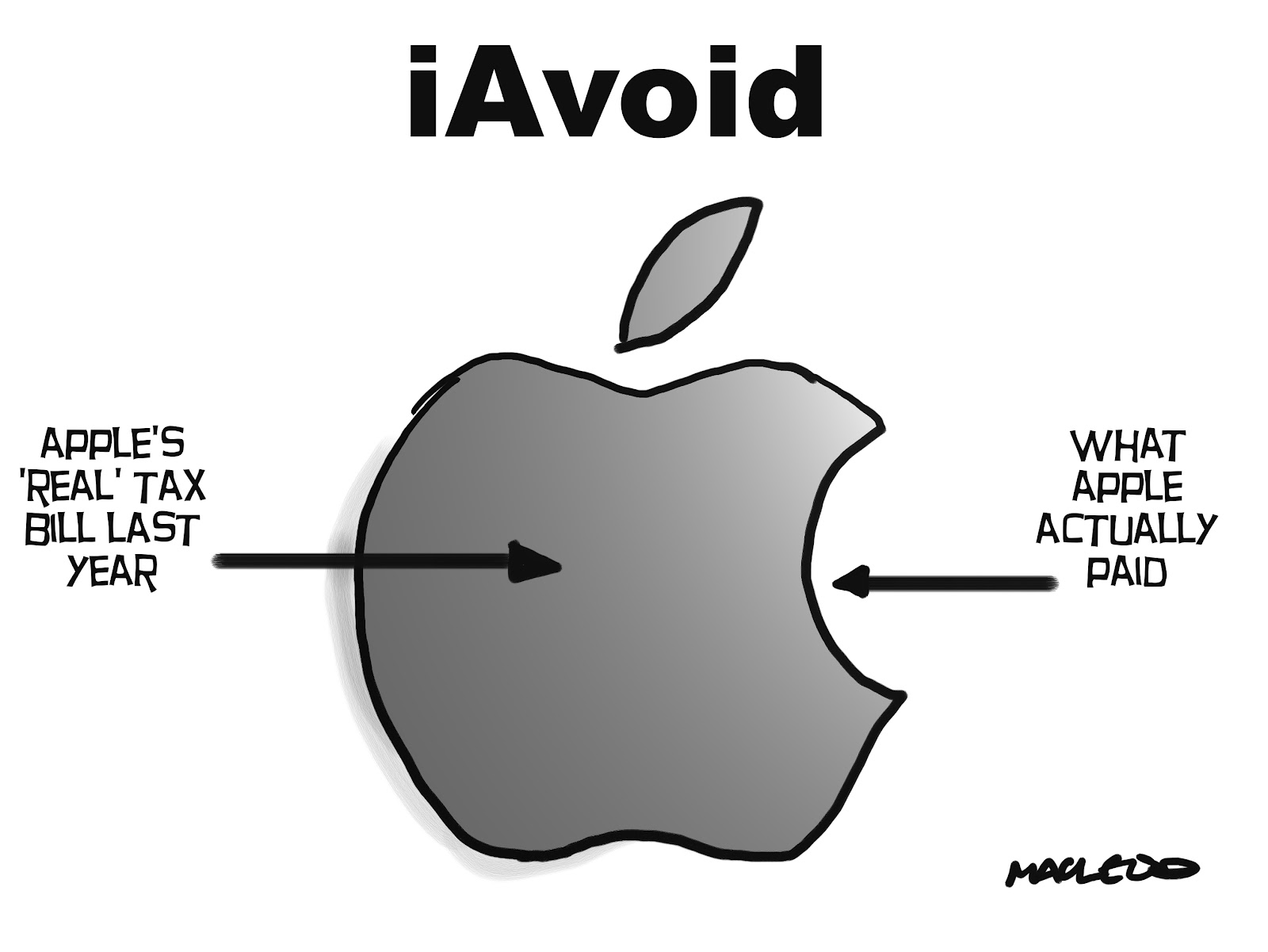

And that’s exactly what Apple did in Ireland. Unfortunately, the European Union didn’t think it was such a great thing. The ridiculously low tax rate of 1% is what they’ve raised their objections around.

The European Commission has concluded that Ireland granted undue tax benefits of up to €13 billion to Apple. This is illegal under EU state aid rules, because it allowed Apple to pay substantially less tax than other businesses. Ireland must now recover the illegal aid from the company. It has no choice in the matter.

“Commissioner Margrethe Vestager, in charge of competition policy, said: “Member States cannot give tax benefits to selected companies – this is illegal under EU state aid rules. The Commission’s investigation concluded that Ireland granted illegal tax benefits to Apple, which enabled it to pay substantially less tax than other businesses over many years. In fact, this selective treatment allowed Apple to pay an effective corporate tax rate of 1 per cent on its European profits in 2003 down to 0.005 per cent in 2014.“” – Europa.EU

There you go, so it wasn’t even 1 percent – it was far less than that. The upshot of the problem is that the EU alleges that Ireland didn’t offer the same treatment to all companies, thereby giving undue advantage to a single company over other businesses.

I think it’s a valid argument, but it leads me to believe that there is more to the story than Ireland merely doing a good deed for the biggest company in the world.

Thanks for reading our work! If you’re reading this on Apple News, please favorite the 1RedDrop channel (next to our logo) to add us to your news feed, or Like our page on Facebook. Please bookmark our site for more insightful articles on current and future technologies that are changing our lives.