There are at least two big reasons why we’re great fans of AWS and Microsoft Azure cloud services. The first is the fact that both units keep improving their services and keep adding layer after layer of new functionality, thereby keeping the entire industry in “disruptive mode.” The second is their habit of slashing prices. We’ve already shown you how Amazon did this with its S3 storage service pricing over the past several years.

SEE: The AWS Secret Formula for Success: High Profitability Despite Price Cuts

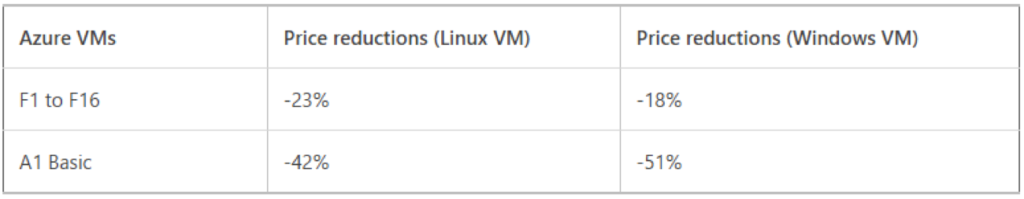

Microsoft has now announced that they have slashed Microsoft Azure Virtual Machine (VM) pricing by 24% to 61% across their Cloud Optimized F Series instances and General Purpose A1 instances. Microsoft also revealed that it will soon announce price cuts for their D-series General Purpose instances as well.

Here’s an example (UK South) of Microsoft Azure price cuts across VM solutions:

Source: Microsoft

Apart from the price reduction for on-demand instances, Microsoft has also cut its storage pricing in the 31% to 38% range. Venkat Gattamneni Director, Product Marketing, Microsoft Azure, said:

“We are happy to announce significant price reductions on several Azure Virtual Machine families and Storage types. We hope this will further lower the barrier to entry for our customers and accelerate cloud transformation.”

It’s a definite possibility that, as prices come down, Microsoft will be able to add more customers to its Azure VM and storage businesses. As CSPs (Cloud Service Providers) build scale, their operational costs are lower and they can pass on those savings to new customers.

Thankfully, instead of keeping these service out of reach by maintaining their prices at current levels, the top guns of cloud have chosen to keep driving prices further and further downward. That’s one of the factors impacting cloud adoption rates, and it helps both Amazon and Microsoft keep growing their respective top lines as well.

Despite all the talk about cloud taking over the world, the Infrastructure as a Service industry was worth only $22 billion in 2016. Yes, the segment posted a solid growth of 38% during the year, but a $22 billion market size for the IaaS segment when world wide data center spending alone is near $170 billion shows that cloud adoption is moving fast but there is still a lot of ground to cover.

If the cloud industry scales to a level where the cost of running your own infrastructure vs the cost+benefit of signing up to a cloud service becomes a no-brainer, then enterprises will have no option but to embrace the cloud in the big way.

Sure, there will be some extra-large-scale companies that would rather build their own private cloud environments, but if cloud services become cheaper to run and offer higher value, then it will become that much harder for even the largest of companies to write off as something that’s not for them.

As such, Microsoft Azure and AWS are drivers of that growth, which is why they’re at the top of the cloud computing industry.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.