The cloud computing industry grew strongly in 2016, continuing its double-digit growth spree into the first quarter of 2017 as well. But so much has changed in the last 24 months, and the competition has intensified. Moreover, Amazon, Microsoft, IBM, Google and Oracle are spoiling their customers with choices, and most of the top cloud service providers are now looking to beef up their software portfolios as well, instead of just concentrating on infrastructure services. Here is a quick look at all the five companies that are going to control the cloud segment for many more years to come.

Amazon

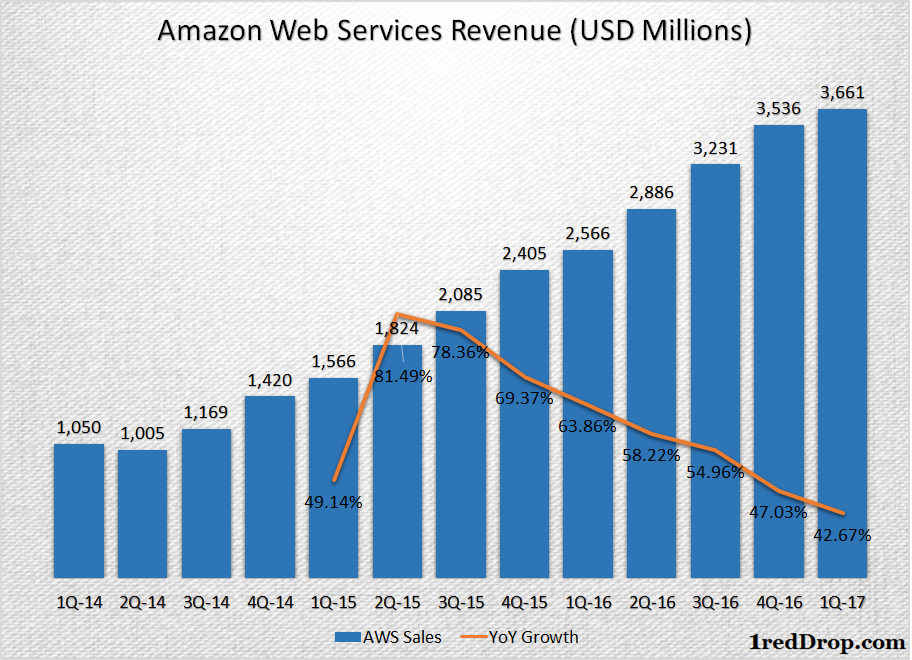

Amazon Web Services continued its double-digit growth during the first quarter of 2017, posting $3.661 billion in revenues, growing 42.67% compared to last year. The slope of its growth curve might raise concerns but, in reality, Amazon Web Services is still growing its revenue numbers sequentially as well as year-over-year. Their growth is massive when you consider the fact that Amazon Web Services is all about infrastructure and related services.

According to data from Synergy Research Group, Amazon Web Services’ market share in the cloud computing segment remained at 33%, and was largely immune to the intensifying competition. This clearly shows the kind of strength Amazon Web Services has in the crucial infrastructure services segment, which will help Amazon stay close to the top of the cloud infrastructure game for a very long time

Microsoft

Microsoft’s cloud revenues have been growing at a furious pace, but the share of software services is much higher than the contribution from their infrastructure services unit, Microsoft Azure. During the most recent quarter, Microsoft announced that its commercial cloud annualized run rate had exceeded $15.2 billion. It looks like the company may have already nosed ahead of Amazon in terms of overall cloud revenues.

The credit for that goes to Microsoft’s highly successful office collaboration and productivity software suite, Office 365. During the recently concluded Microsoft Build 2017 developer conference, Microsoft CEO Satya Nadella announced that Office 365 has 100 million monthly active users. That’s a massive user base for a subscription software, and it’s quite possible that Office 365 is now the world’s number one earning SaaS application.

Microsoft Azure continued its near-triple-digit growth, posting 93% growth for the last two consecutive quarters. The growth of its SaaS user base will undoubtedly help Azure to keep its sales numbers moving, and Microsoft seems to be on a firm path to keep increasing its overall cloud sales numbers over the next several years. At the current rate of growth, Microsoft’s target to hit 20 billion from cloud by 2018 is well within reach.

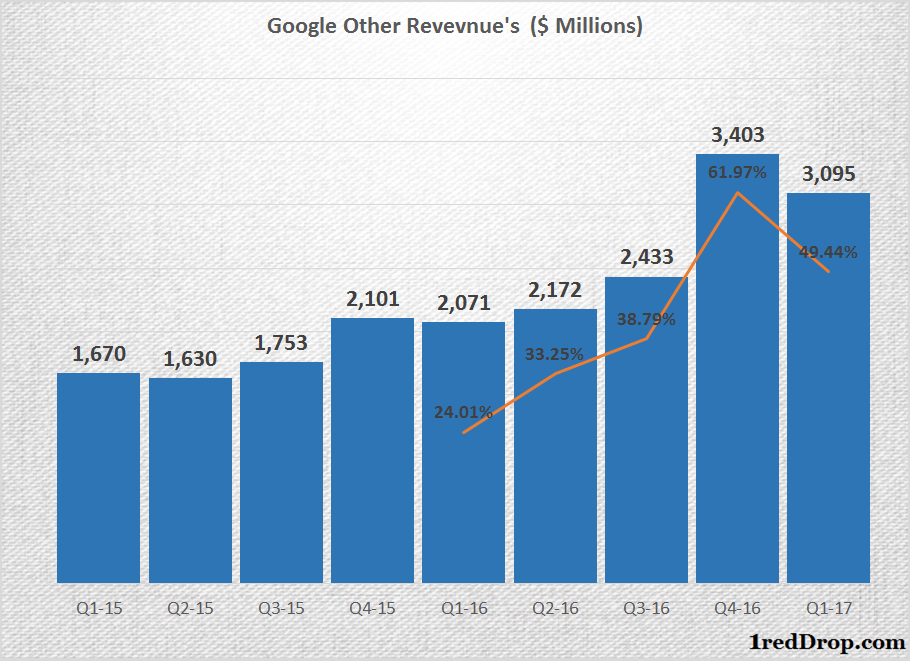

No one outside Google knows how much money the Google Cloud platform is bringing in every quarter, but Google Other Revenues, the segment under which GCP revenues are reported, has been growing at what can be termed a “cloud-worthy” growth rate.

Since the time Diane Greene took over as chief of Google Cloud, Alphabet, Google’s parent company, has been serious about its cloud growth. Apart from ploughing money into building datacenters and rolling out one cloud service after another over the past several months, Google has also stepped up its efforts to bolster its office collaboration product, G Suite, as it digs in for a long-drawn-out battle against Microsoft and Amazon.

IBM

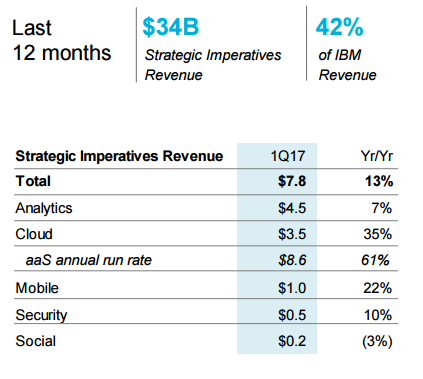

Despite taking a different approach to cloud, IBM has, so far, managed to keep its cloud sales growing strongly right until the most recent quarter. This despite their preference for large enterprise clients, and the hybrid model of cloud computing deployment that most of these clients are more comfortable with.

IBM’s cloud revenues reached $3.5 billion during the first quarter, a growth rate of 35% compared to the prior period. That’s not too far away from the numbers reported by Microsoft and Amazon. IBM’s as a service annual run rate reached $8.6 billion during the quarter, representing growth of 61% compared to last year.

Cloud and Analytics are proving to be IBM’s lifesavers as its legacy business revenues continue to decline at a rapid rate.

That said, by keeping the pace with newer players, IBM has proved that it has what it takes to compete in a new-age industry against more agile companies like Amazon.

Oracle

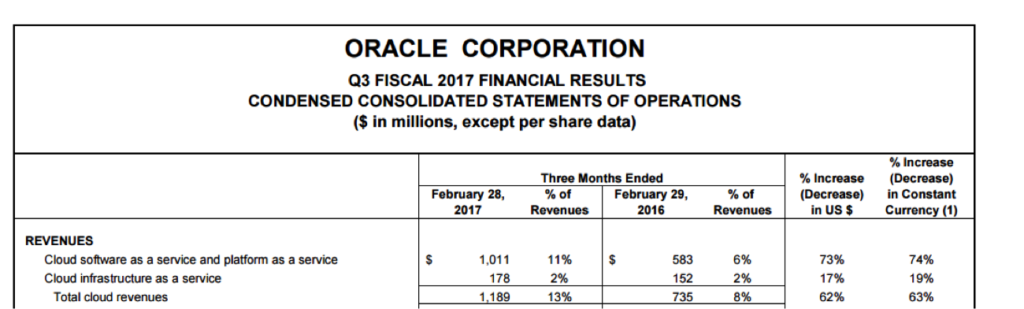

Oracle continues to remain a fringe player in the Infrastructure as a Service industry, posting a mere $178 million in quarterly revenues. Oracle’s cloud software services, however, continue to grow rapidly. The company crossed the crucial one billion dollar mark during the recent quarter, posting growth of 73% compared to the prior period.

Considering the size of their infrastructure services, it will be many more years before Oracle will be able to get into a position to challenge the current leaders. But by then, they might well have run away crucial market share. SaaS strength may help soften the blow for Oracle, but it remains to be seen if SaaS alone can lift Oracle to sustainable revenue growth levels in the future.

Of note is the fact that Microsoft’s success in SaaS is inexorably pulling the others to focus more on this particular segment. Their new focus on IoT and Edge Computing is an area that Amazon has been getting deep into in the past months. The move to SaaS could well be followed by a massive shift towards edge computing and related services – hardware, software, security and more.

This is our initial review of the top cloud computing service providers for the January to March 2017 quarter. Detailed analysis – and, of course, opinion – will follow.

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.