The human race is competitive by nature, and any rat race to the top spot at anything is always thick with competition. Number one in this, number one in that and so on. Things are not much different in the technology world, either. Contrary to popular belief, which is that the tech world is prone to disruption, our history is peppered with examples of tech companies, especially software companies, pitching a tent at the number one spot and staying put for decades. These companies have proved that reaching the top spot is never easy, but getting them out of that spot is even more difficult.

Microsoft Windows vs The Rest

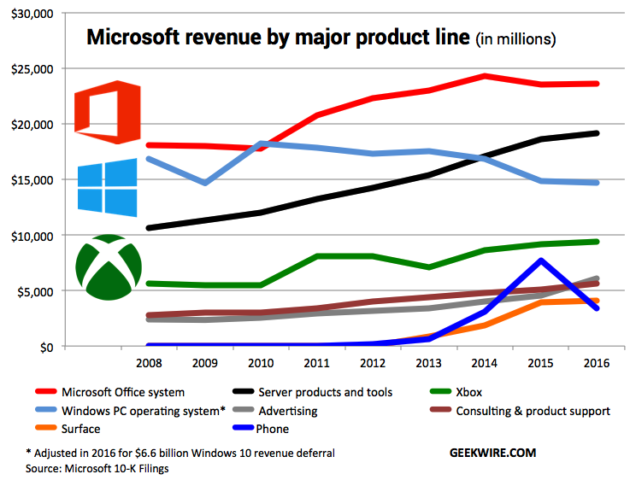

Bill Gates wanted to put a desktop in every home, and he did. It has been nearly 31 years since Windows was launched, and the rest is a lesson in history. The world’s number one desktop operating system has evolved so much over the years, moving from Windows 1 to Windows 10, and Microsoft has minted billions in the process. In 2016 alone, Microsoft made $14.7 billion from Windows.

Source: Onmsft

That’s the kind of money that should have attracted tech companies in droves to take a slice of that market. But not a single company other than Apple managed to make even a small dent in Microsoft’s stranglehold in the desktop world, and Windows still remains the dominant Desktop OS controlling nearly 83.53% of the market while Apples OS X holding 11.95%.

For that matter, even Apple enjoys that desktop OS market share on the strength of its hardware, and not the other way around, and this is evidenced by the sheer number of people who use BootCamp and other tools to run Windows on Mac machines.

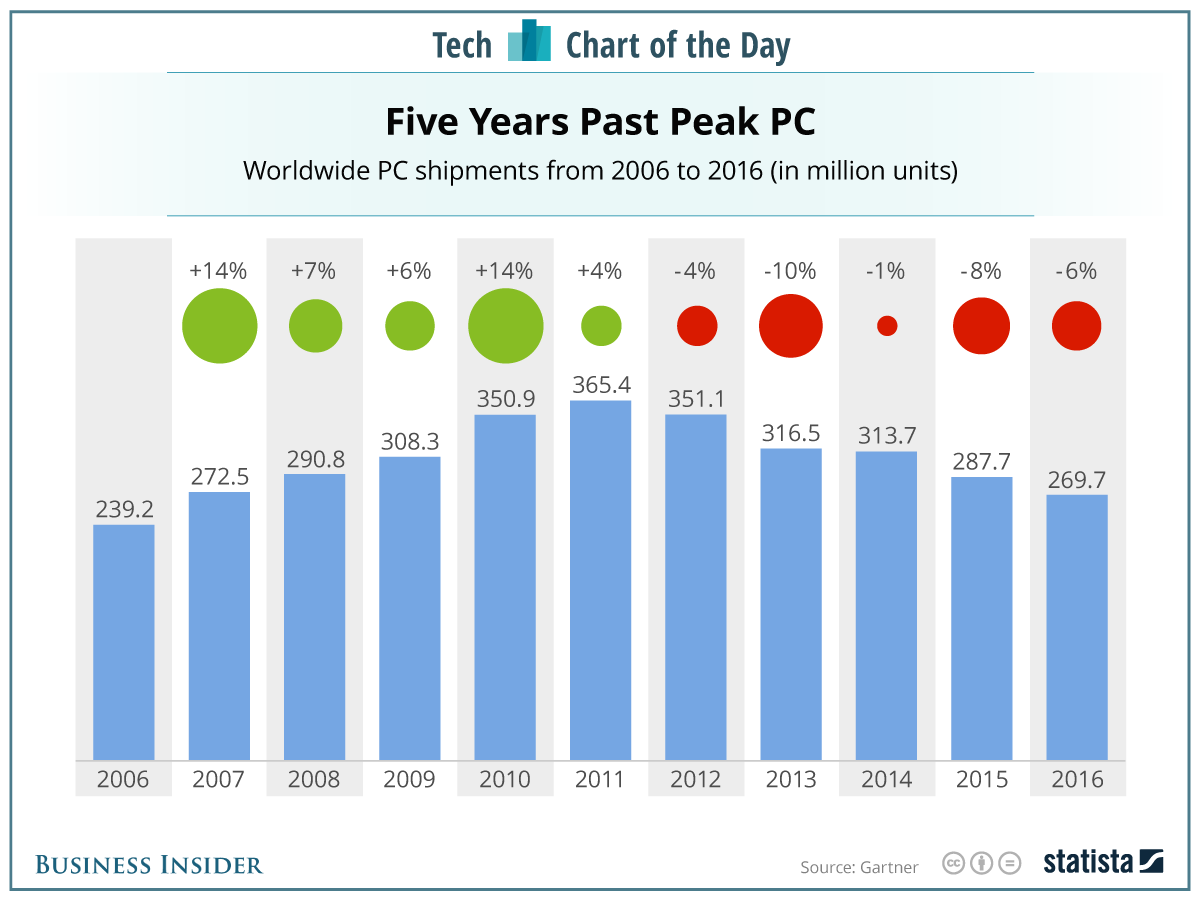

The odds of competition pushing Windows off its perch look even slimmer now, as the PC market has declined for the last five years and looks all set to make it a record-breaking six years of decline.

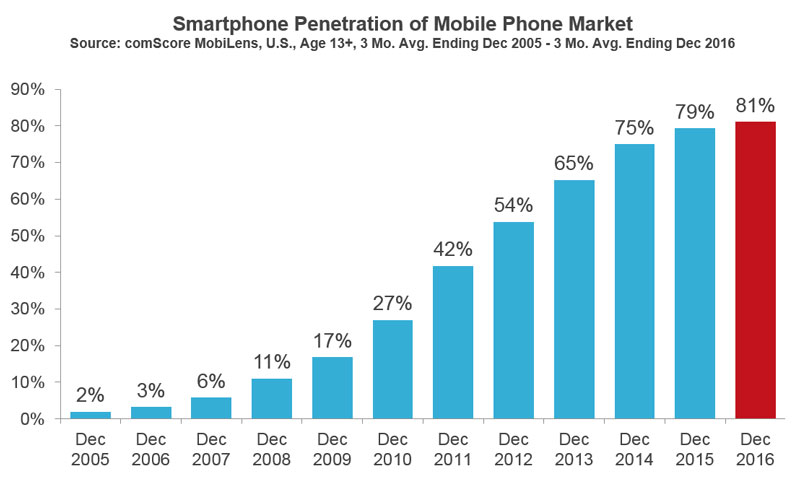

The growth of smartphones has tremendously reduced the need for PCs in our homes. Thanks to Steve Jobs revolutionizing the smartphone market ten years ago, consumers have already moved on to smaller screens, and they’re getting increasingly comfortable with them as resolutions move higher up the ladder to HD, 4K and beyond.

But the same cannot be said about the enterprise segment. There is no way that we would be able to carry on our work without PCs in our offices. So there is and there will continue to be a market for PCs in the future, albeit a much smaller one.

US smartphone sales hit an eye-popping 198.5 million units in 2016, with smartphone penetration pushing past the 80% mark. Despite the record-shattering numbers, 60.3 million PCs were sold in the United States.

Source: Comscore

Yes, the numbers are declining, and there are a lot of reasons why it the downtrend will continue for many more years. But there is a market for PCs, and a bottom will be found at some point. Consider this: If a developed country like the United States – where more than eight out of ten people own a smartphone – has a decent demand for PCs, then things won’t be too different in other parts of the world.

With markets shrinking, there isn’t a great incentive for the competition to look at the desktop OS market, which is going to make Microsoft Windows’ position at the top even more solid. They got there first, and nearly three decades later, their number one position has never looked as unbreakable as it does now.

Amazon AWS vs The Rest

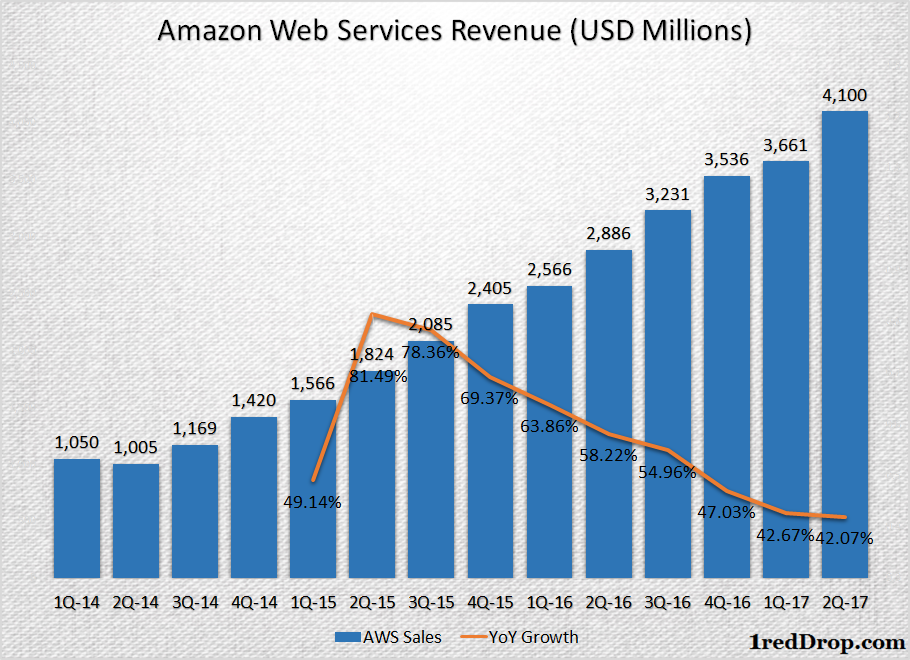

The Cloud Computing industry is one of the most competitive in the tech world. Amazon, Microsoft, Oracle, IBM, Google and so many other companies are working non-stop to capture the fast-growing market, but Amazon remains the king of the Infrastructure as a service (IaaS) jungle.

Amazon’s laser-like focus on managed IT infrastructure has helped a lot, but Microsoft, IBM, Google and Oracle are no slouches either, and they have all the money they need, an unmatched talent pool at their disposal, and they are actually far more experienced at building software than Amazon is.

Unfortunately, none of these advantages have helped any of these companies close the gap with Amazon Web Services and its IaaS offerings, which reported $4.1 billion in revenue during the recent quarter, giving them an annual run-rate of more than $16 billion.

Granted, Amazon had a huge head start over other tech majors, who kept sleeping while Amazon ran away with the IaaS market. Microsoft the first company to wake up from its sleep, launched Azure, it’s cloud infrastructure service, in February 2010, three years and eleven months after Amazon started offering IT infrastructure services to businesses around the world.

Seven years later, there is an Atlantic-Ocean-sized gap between Amazon Web Services and Microsoft Azure, and I am not even going to discuss other competitors. Microsoft’s overall cloud revenue run rate has gone past $18.9 billion during the recent quarter, a lot more than Amazon Web Service’s run rate in excess of $16 billion. But Microsoft makes most of its money through its Software as a Service SaaS products, not through IaaS like Amazon does.

Though we don’t exactly know how much money Microsoft Azure brings in, according to reports, Azure made $2.7 billion in 2016, which looks really small when compared to Amazon Web Services’ $12.21 billion revenue for the same year. We are not exactly sure how close that number is to Azure’s real earnings, but it looks like the analyst was mighty close.

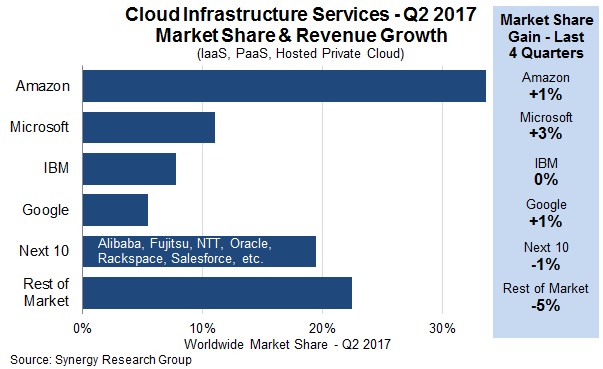

According to Synergy Research Group, Amazon Web Services controlled 34% of the Infrastructure as a Service market during the second quarter of 2017, while Microsoft held 11% of the market. That’s a three-fold difference in size. So after chasing Amazon for nearly seven years, there is clearly a yawning gap between Amazon and Microsoft in the infrastructure segment; and the fact that Amazon actually increased market share during the second quarter despite a multi-party race in the cloud segment is a clear indication that Amazon is going to stay put at the top for some more time. That’s eleven years at the top, and counting.

Microsoft Office 365 vs The Rest

And we’re back with Microsoft.

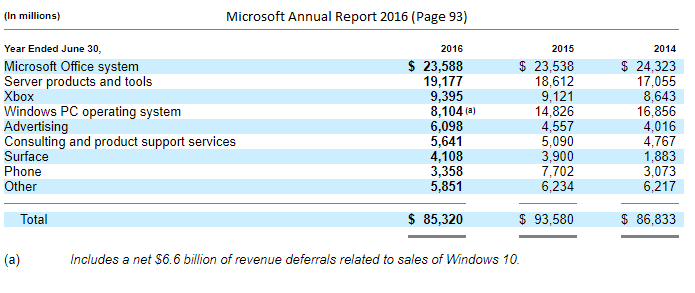

How many software products make more than $20 billion in annual revenue? I know of only one: Microsoft Office. With Microsoft’s Productivity and Business Processes segment – which holds Office-product-related revenues – growing at double digit rates, it’s going to be a matter of few more years before Microsoft adds another ten billion to its Office revenue. With no clear competition in sight, Microsoft has run away with the Office Productivity market, and its going to be daunting task for any company that wants to try and take on Microsoft Office at the productivity game.

Microsoft’s Office System revenue has declined from $24.3 billion to $23.5 billion, but the decline was not because some one else is gaining on them, but its because Microsoft is transitioning from an annual licensing model for Office products towards a cloud-delivered model, and it’s called Office 365.

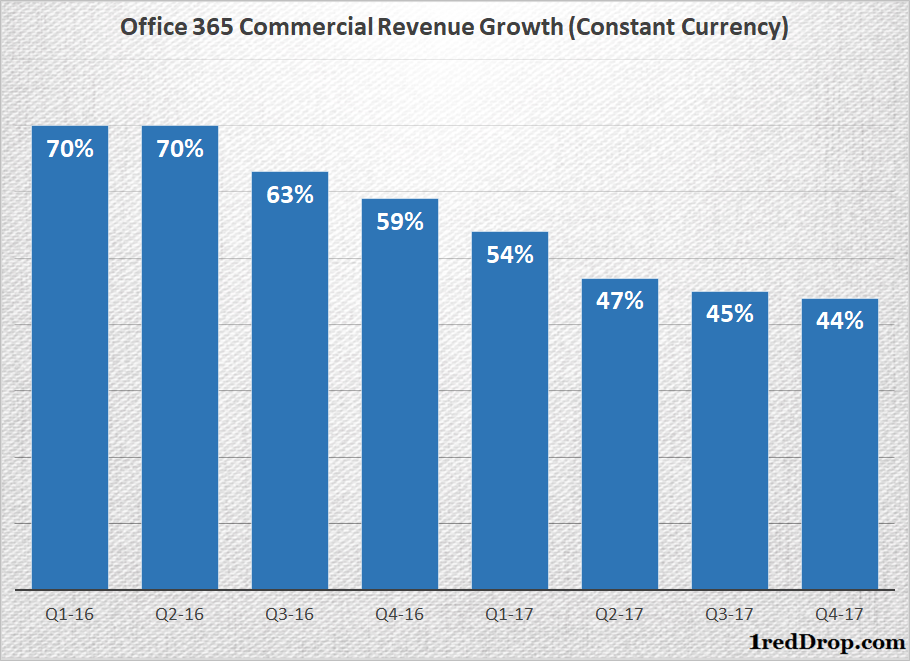

During the recently concluded fourth fiscal quarter 2017, which ended on June 30, 2017, Microsoft reported a 5% growth for regular Office Commercial Products, while Office 365 Commercial revenue grew 43%. Office 365 Commercial revenue has been growing strongly over the last eight quarters, which means Microsoft’s customers are moving away from buying Microsoft Office standalone licenses and opting for the cloud-accessible Office 365.

During the recent Build 2017 developer conference, Microsoft CEO Satya Nadella announced that Office 365 had crossed 100 million commercial subscribers. That’s a huge number for any subscription product.

And what reasons will competitors will be able to give these 100 million users to switch to their product? Not that many.

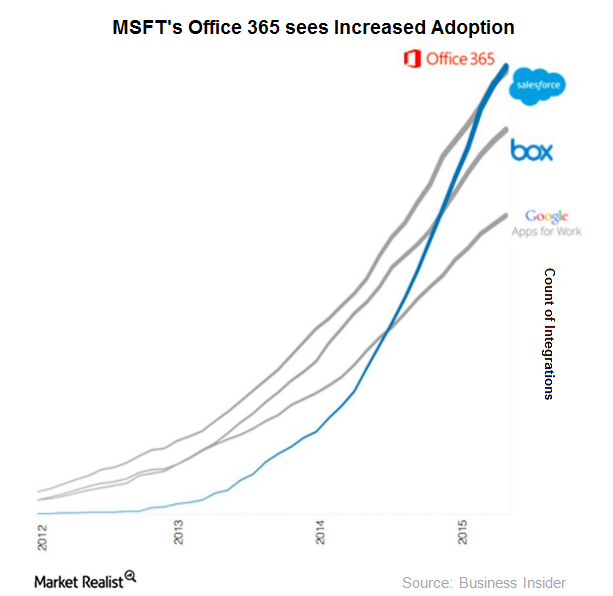

Microsoft Office is already the most sophisticated, feature-rich Office Productivity suite of software products in the world. Google has been doing its best to get its G Suite to compete in the productivity space, but numbers show that Office 365 has already run away with the market.

Microsoft reported $8.4 billion in quarterly revenue from the productivity segment during the recent quarter, the segment that holds Office 365, Dynamics 365 and LinkedIn revenues, while Google Other Revenues, which includes all of Google’s Cloud revenues along with hardware, apps, Play Store and other products, was just $3.09 billion.

“New Q2 data from Synergy Research Group shows that the enterprise SaaS market grew 31% year on year to reach almost $15 billion in quarterly revenues, with collaboration being the highest growth segment. Microsoft remains the clear leader in overall enterprise SaaS revenues, having overtaken long-time market leader Salesforce a year ago”

Despite the number one position, Office 365 is still growing, and it’s growing fast, at double-digit rates. The bigger the user base gets, the harder it will be for the competition to make any space for itself, because no one would be ready to take on the migration headache for a product that offers more or less the same that they already get.

Pricing could be one way to entice them, but Microsoft’s Software as a Service segment is already sitting on a fat +30% margin, so they will match any price move when necessary. And if the competition announces a solid feature, Microsoft will match that as well, and close the difference as soon as it appears. You can’t beat them on price and you can’t beat them on features and services.

As a result, once again, the number one player remains in firm control of the market, and will remain so in the future as well.

Google Search vs The Rest

The day we all started to use “search” and “Google” interchangeably, Google had cemented its position in our minds as the search engine to be on. Granted, the highly successful Google Chrome makes Google Search sit close to its user base, but that doesn’t mean that the competition, especially Microsoft, is going to be more than ready to cede everything to Google search and leave the market entirely.

Microsoft has been trying as hard as it can, through partnerships, deals and everything that it can, to improve its search market share, but unfortunately they are barely making a difference.

According to Netmarketshare, Google controls a mind numbing 97.07% of searches that happen on Mobile and Tablet. If you are thinking that Microsoft, with its Windows control over the desktop market, would be doing much better on the desktop search front, you will be in for a surprise. Google sits pretty with 81.62% of the desktop search market as well, leaving just 7.04% for Microsoft Bing to enjoy, the rest being spread out over multiple products.

Once again, it has been so many years since Google Search reached the top spot. They created the market, in a way, and now they are immovable. When it comes to search there is Google and then there is everyone else.

Is there a possibility for things to change in the future? Not so much. Android has virtually run amok with mobile OS market share, and Chrome is still the most used browser across the globe. That makes Google Search the default search engine for a major portion of the global population. If someone can shakeup the browser market, then there is a possibility of shaking up things in the search engine world, but Google is not going to give an inch on that front.

So, as long as we keep “googling” things, even a great browser may not be enough to topple Google Search from its number one position.

Salesforce CRM vs The Rest

This list would be incomplete without taking about the what Salesforce.com has done in the last eighteen years. They took a niche, the customer relationship management (CRM) software market, offered a unique pay-as-you-go option served on the cloud, and went against the Goliaths of enterprise software: Oracle, SAP and Microsoft. Though we all keep taking about how Amazon shook the world of Cloud Computing, it was actually Salesforce that mainstreamed the as-a-service model. To put it in simple terms, the on-demand subscription model for software delivery.

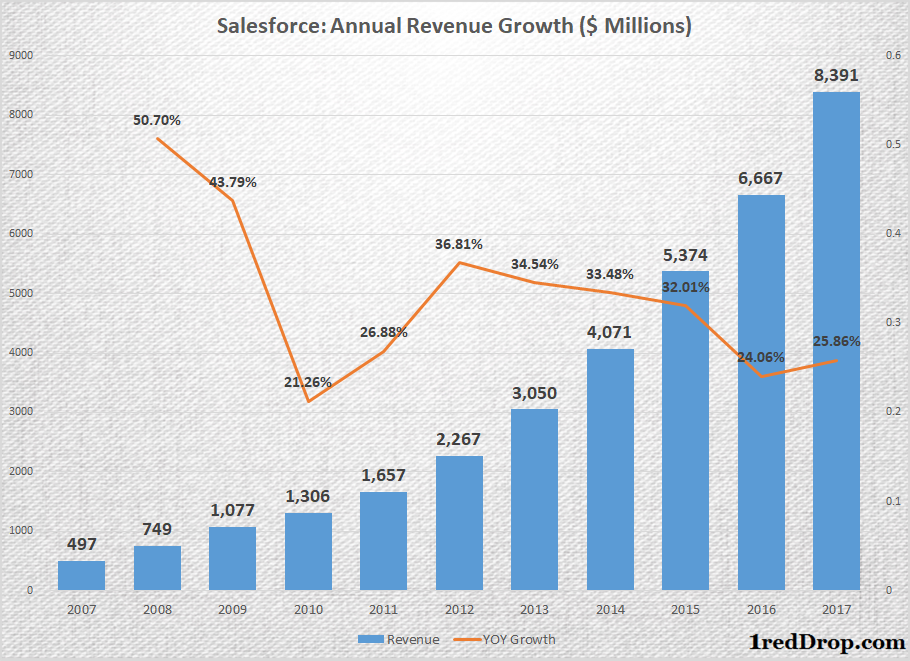

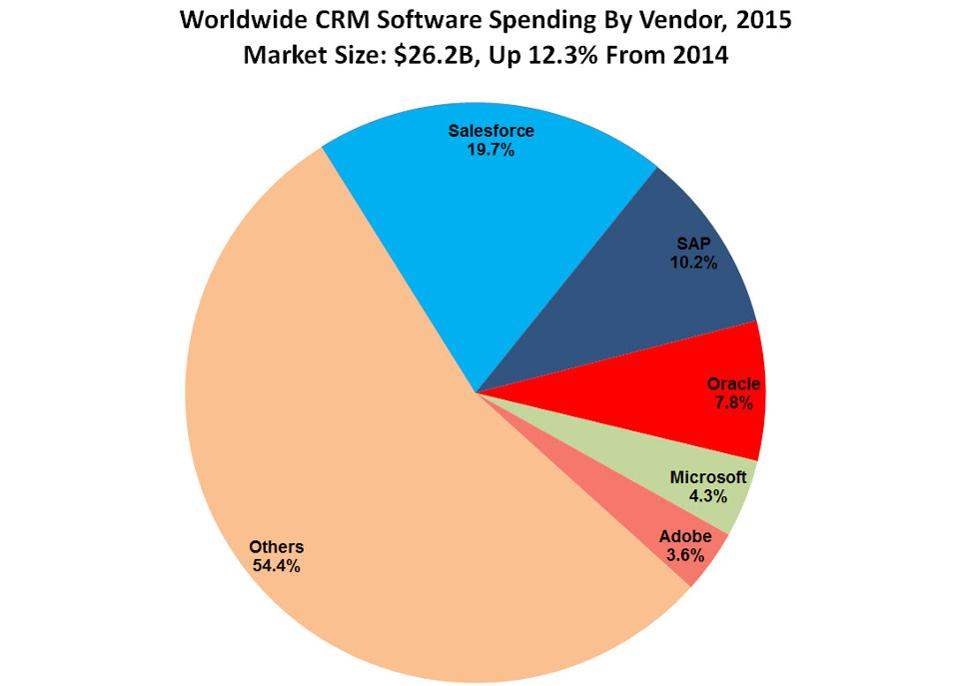

They did for the software segment what Amazon did for the infrastructure segment. 18 years after Salesforce was founded, the company sits pretty at the top of the CRM world, and controlled 19.7% of the CRM market in 2015.

Source: Forbes

Though we are yet to see the 2016 marketshare reports, don’t expect a lot to change, as Salesforce had roaring sales growth in the last eight quarters despite Microsoft and Oracle upping the ante, with the former dropping nearly $26 billion dollars to buy LinkedIn, while the latter spent more than $9 billion dollars to buy Netsuite, both acquisitions aimed squarely to improve their respective standings in the enterprise software segment, which includes Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP).

Salesforce increased its sales by more than 25% in 2017, and followed it up with a 25% and 23% growth in the first two quarters of the current fiscal, as if there were no competition to worry about. The amount of money Microsoft and Oracle have poured into this segment in the last one year is a clear indication of how serious the are about the enterprise software market; but, so far, the number one player in the segment is doing what we have seen all along, refusing to cede any ground.

Is It the First Mover Advantage?

There’s a phenomenon in marketing called the first mover advantage, or FMA, that accounts for some of the success that these companies have had. But that’s not entirely true, at least not in every case we’ve covered in this article.

Take Windows, for example. It’s not the world’s first operating system. The credit for that goes to the research division of General Motors, which created the GM-NAA I/O for its IBM 704 mainframe. Microsoft’s first OS came years later as MIDAS, or M-DOS. Windows only made its appearance in 1983 as a GUI for MS-DOS, and the first real competitor to Apple’s Macintosh operating system.

Another example is Amazon. It is not the world’s first online retailer, but it rapidly grew into a phenomenon that is now threatening the likes of Wal-Mart, which makes nearly half a trillion dollars in sales every year.

The story is very similar across the board. The first mover isn’t always the one that ends up on top for several decades. Then what’s the secret?

The real secret to getting to the top and staying there seems to be “filling a need”, and the faster that need is filled, the bigger the product tends to grow. We can clearly see how Facebook did that by offering people a way to connect online, and how Netflix is doing that in the world of streaming video on demand.

The company that filled the biggest need in the shortest amount of time has always come out on top. That’s why Google is always going to on top of search, Windows will always be on top of desktop OS, Amazon will always be on top of online retail and every company that filled that need in the fastest way possible will stay on top of whatever segment it dominates.

You could show me a dozen exceptions, but for every exception, I’ll prove that the exception actually validates the rule in a stronger way. And if that’s true in the world of technology, which is one of the most aggressively competitive market segments on the planet, then it’s equally true in other segments like logistics, pharmaceuticals, sportswear or any other industry you care to look into.

And that’s why the top spot is the best spot in the world of technology – and everywhere else.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter