Oil prices have remained extremely volatile in the last ten years. The price of oil shot up to $140 during the great recession, then fell below $30 in 2016 before recovering to the current above-$50 levels. But so high and so low for one of the most traded and most sought-after commodities, you may ask. And that’s a fair question because the world knows how much supply there is, but there is huge question mark that keeps hanging over the demand side of the equation.

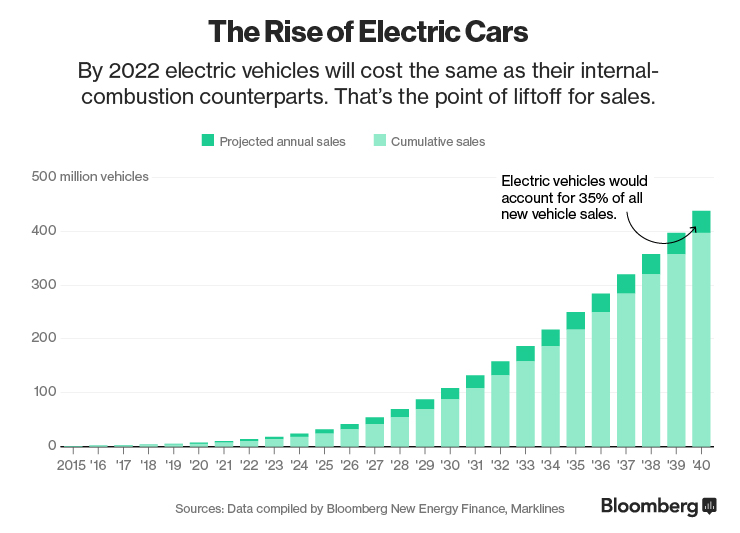

Though the short-term trouble has a lot to do with increasing oil production, especially U.S. Shale production, the long-term demand is only going to go lower. And one of the reasons for future demands being muted is EVs, or electric vehicles.

Country after country is now pushing hard towards electric vehicles in their pursuit to reduce oil consumption and cut down their oil bills.

Approximately 45% of global oil consumption is attributed to the road transportation sector, and that segment is already ready to say goodbye to oil. Though most of the current developments in battery technology are focused on passenger vehicles, its only a matter of time before it moves into commercial transportation, and at scale.

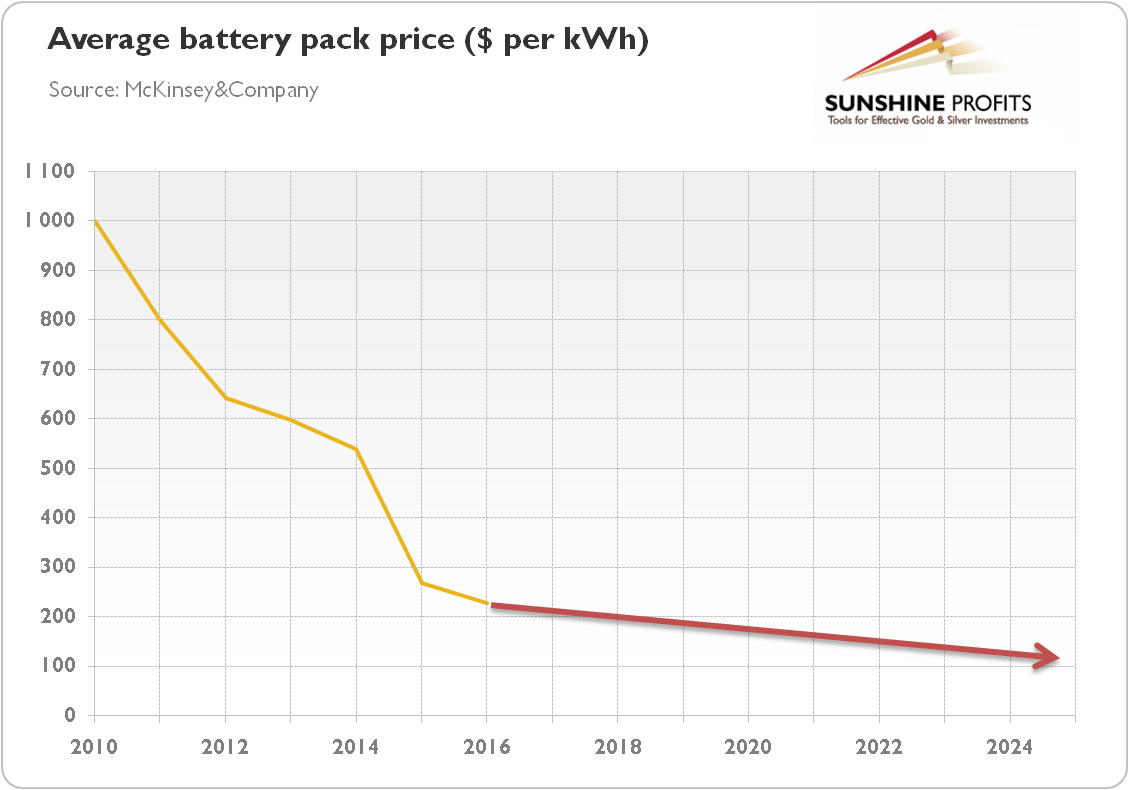

As battery production costs keep moving lower, the cost of building electric vehicles will become lower as well. The average price of battery packs has been falling for some time now, dropping by more than 80% in the last six years, in fact. As production keeps scaling up, the costs will further reduce.

Add to that the fact that EVs need a lot less money to maintain and the amount of money governments will save by not buying oil, and what you have is a very bleak long-term outlook for the industry as a whole.

China, for example, is racing towards electrifying its road transport because rapid industrialization has increased pollution, and EVs seem to be best bet to counter those effects.

India and Germany have announced their plans to go all electric by 2030 and Norway is well on its way to phase out fossil-fuel-powered cars as early as 2025, while the UK says that it will ban all sales of petrol and diesel cars by 2040. The United States is the only country that seems in two minds about using policy to stem the flow of oil into the transportation segment, but if most countries around the world decide to electrify their road fleet, U.S. auto makers will adjust to that need and drag U.S. policy along with them.

Where does all this leave the oil and gas industry? In a sorry place to be, unfortunately. It’s clear that future demand is going to be dented by the growth of electric vehicles, while short-term demand is handicapped due to increasing production. So, it’s not really a surprise that oil prices have been volatile in the last ten years. The oil and gas industry is going through a sea of disruption which, as we can see, is not going to end well.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter