Although the House Ways and Means Committee has now made minor amendments in the tax reform bill to how the government would tax investment managers, corporate cross-border transactions and private university endowments, no changes were made either to the Affordable Care Act’s insurance mandate or to business taxation, which will have put additional pressure on the fiscal deficit.

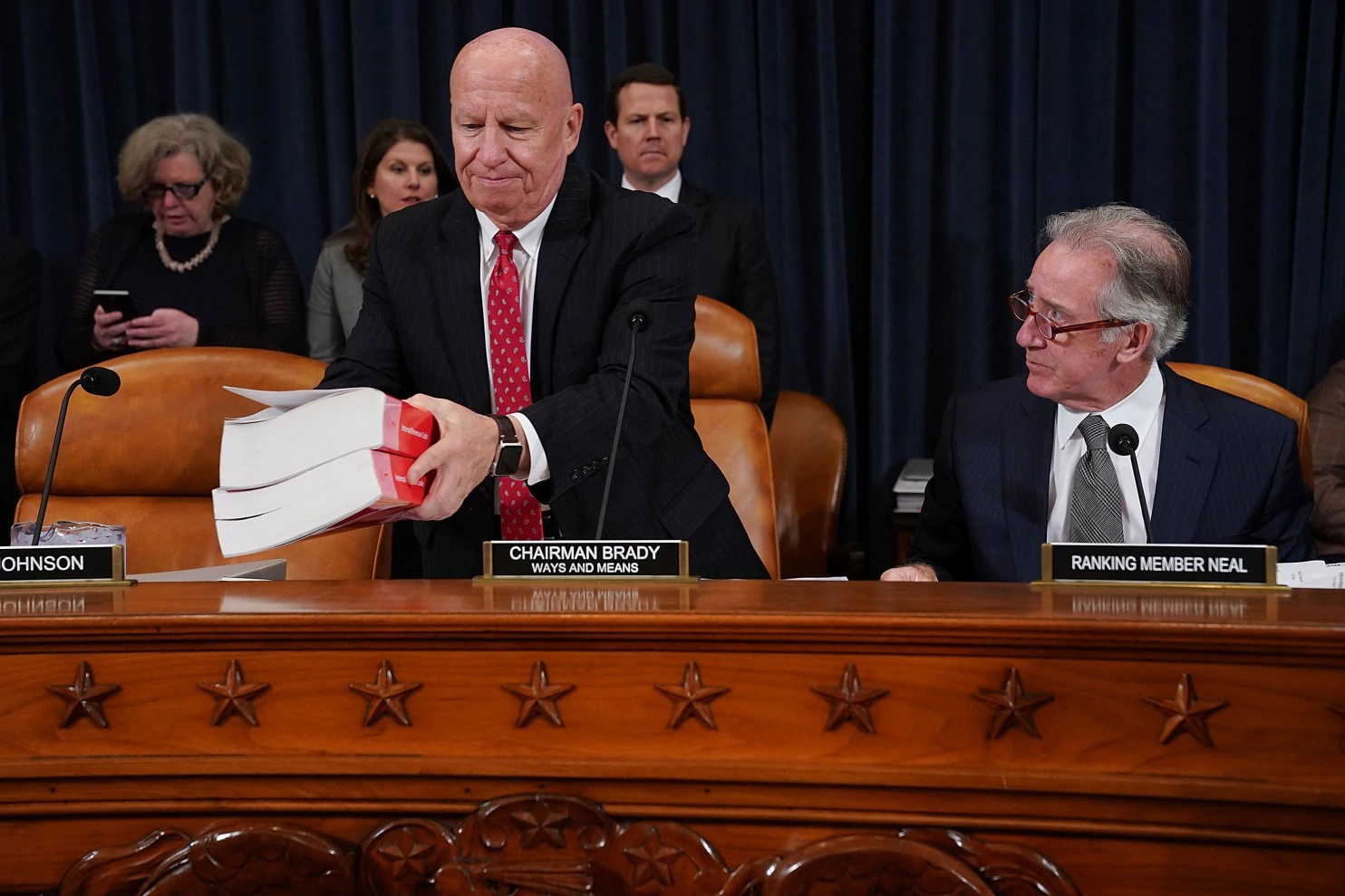

On Monday at the markup session, Committee Chairman Kevin Brady (R-Tex.) commented on not including several health-tax related measures, but did not rule out a repeal of the Affordable Care Act’s individual mandate, saying instead that “we will move to these important policies separately and immediately after conclusion of our tax reform efforts.” Among the issues referred to are taxation on health insurance premiums, OTC drugs and medical devices.

The move to keep those parts of the tax reform bill intact could help it ease its way to the House floor for a vote. At this point, any major changes in health-tax related parts of the bill could make it more difficult to pass through Senate. The mandate repeal would have saved the government $400 billion over a ten-year period, but would have left about 15 million more Americans without health insurance. That alone could further complicate the bill’s path through Senate.

The bill is already having to be defended against new evidence that the tax plan. The chief of staff of the bipartisan congressional Joint Committee on Taxation, Thomas A. Barthold, testified Monday that tax increases would start hitting about 38 million Americans in the $20,000 to $40,00 income bracket in 2023.

The proposed Tax Cuts and Jobs Act aims to help middle-class Americans, but the 2023 cliff has already been pointed to as a chink in the armor. Meanwhile, the Republicans argue that the tax increase in 2023 is because of a planned expiration of tax credit, further adding that Congress will “most likely” act to extend the credit.

The immediate effect of the Tax Cuts and Jobs Act, Barthold testified, is that, if passed, it will bring the number of taxpayers itemizing their deductions from 29 percent down to 6 percent by 2018. But that could have a fallout effect on the housing and non-profit sectors, which depend on these tax deductions as an incentive for people to buy homes and donate to charities.

The changes to the tax reform bill offered by Brady addresses a provision – criticized by many as a loophole – that allows investors to pay tax at the lower capital-gains rate rather than regular rates for earned income. Among those who frequently take advantage of this provision are hedge fund managers and private equity firms. It’s called “carried interest”, and the proposed change to the tax bill would make it mandatory for an asset to he held for at least three years before the carried interest provision could be claimed.

But the Democrats are already decrying the bill as a vehicle for the wealthy to enjoy a disproportionate share (about two-thirds) of the $1.5 trillion in proposed tax cuts over the next ten years. The discussions often became heated on Monday, with the Democrats largely accusing the Republicans of rushing the proposal.

The Senate Finance Committee is scheduled to unveil its version of a tax reform bill this Thursday, and will setup its own mark up sometime next week.

Thanks for visiting. Please support 1redDrop on social media: Facebook | Twitter