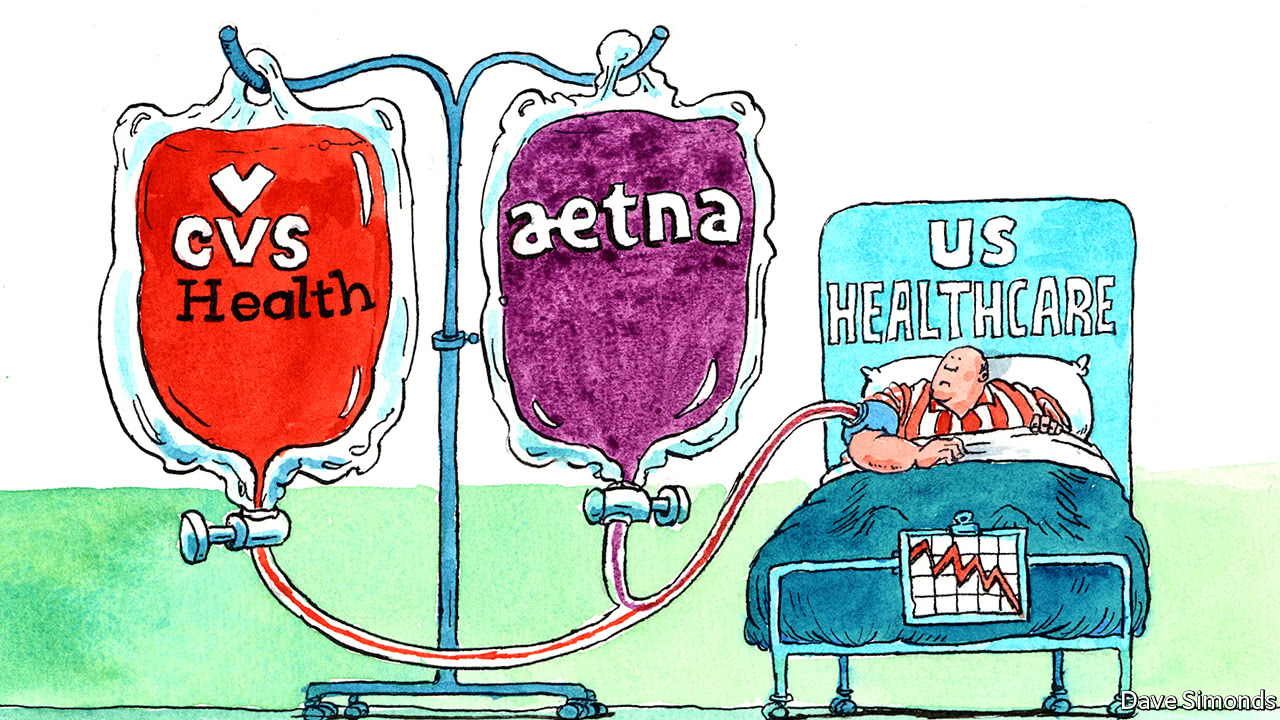

CVS Health has now agreed to buy Aetna for $69 billion in cash and stocks, but will regulators frown on such a marriage that would effectively change the landscape of the health care industry?

Several industries are currently in consolidation mode, and it’s happening fast. But regulators are increasingly scrutinizing the changing horizon in various industries.

Take, for example, the legal blockade by the Justice Department in the path of the AT&T-Time Warner merger. By virtue of these two businesses not being in direct competition with each other, the merger is considered a “vertical” one. But that’s not stopping the DOJ from putting hurdles in its path.

Could the same thing happen with the CVS Health – Aetna merger? Let’s take a look at what would happen within the health care space if the deal were to be approved by regulators.

First of all, Aetna’s massive database of 22 million customers would be leveraged by CVS to provide highly targeted health care solutions across its more than 10,000-strong store presence (9,700 pharmacies and 1,100 MinuteClinics.)

What CVS plans to do is create community health hubs where patients can deal with an integrated system of nurses and pharmacists to avoid going back to the hospital once released. Considering the fact that hospital readmissions cost patients an estimated $528 billion in 2016, that would contribute greatly to reducing the number of readmissions to hospitals.

The second way in which the consumer health care experience will be altered is that consumers will be able to directly interact with CVS pharmacists and nurses instead of having to jump an extra hoop and go through their doctor. Insurance companies typically have paperwork that needs to be submitted by a certified practitioner, and that hurdle would effectively be eliminated were CVS be allowed to purchase Aetna.

Both of those will be great for health care consumers. So, how is that going to make the deal a target for regulators?

In short, the fact that CVS will be able to provide almost end-to-end healthcare services (apart from what hospitals provide in terms of care) and will cover the breadth of the nation means that they could effectively kill any competition in this space.

Make no mistake. The competition won’t be killed, but it will disallow smaller players to operate in this integrated post hospitalization health care game. Big players like Amazon could still come in and disrupt the space, but smaller companies will find it increasingly hard to compete with an entity that provides practically everything outside the purvey of hospitals.

It might make CVS more resilient to competition from the likes of Amazon, but it might give the health care retail giant too much of an edge.

If regulators do see things from that angle, it could spell trouble for the merger.

+++ + +++