“OMG, Tesla is going bankrupt!”

“Elon Musk is cheating everyone.”

“He is a hype machine.”

“Don’t invest in Tesla.”

Blah, Blah… and more Blah. I’ve read plenty of articles that go on and on about what’s wrong with Tesla. Just a simple Google search will give you dozens of fresh pieces on the topic.

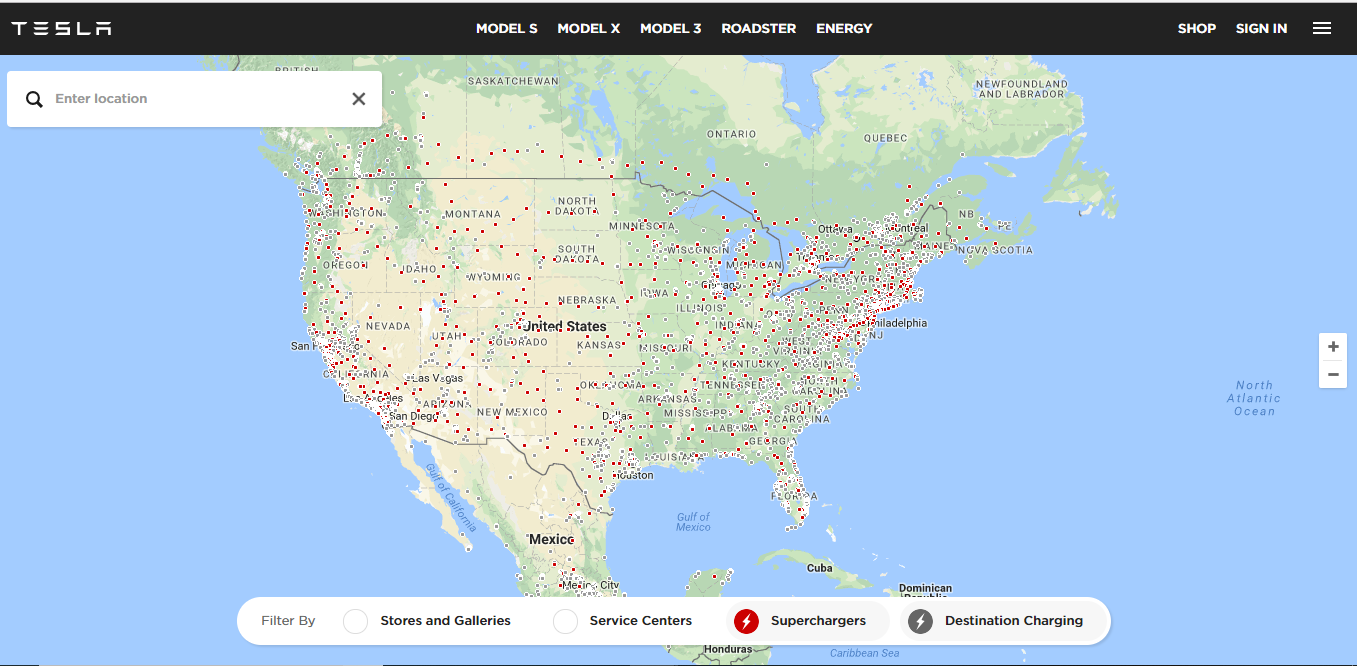

But here is one simple map that will show you how Tesla may have already won the EV game and built a huge head start over all the other automakers who are only now in the process of electrifying their fleets.

1,255 Supercharger Stations with 9,955 Superchargers (Global)

Take a good look at that, because that’s the map of Tesla’s Supercharging network in North America. The truth is, no one really wants to wait for a 100% charge, and not many people are going to run their battery dry before entering a supercharging station. A typical 20% to 80% charge takes around 20 minutes, so the time to charge is no more a barrier even for long distance drivers. And that’s a massive moat in and of itself if you think about it.

The other point is that Tesla’s charging system is proprietary, making it exclusive to Tesla EVs. Even if people find a way around it, nothing is going to stop Tesla from saying: “Sorry, this is private property for Tesla owners only.”

In such a scenario, how will other EV manufacturers like GM, BMW or Porsche make it possible for drivers to do a cross-country trip? The only option would be to spend an hour or so per charge at a public charging station, which will certainly make buyers think twice before dropping their money to buy their EV. As a fallout effect, it’s going to severely dent overall sales numbers for the “outsiders”, and thereby restricting non-Tesla EVs to urban markets.

It’s not that Big Auto doesn’t know about this gap, and they’ll figure out a way to address it. But how long will it take them to get their own networks to be as dense as Tesla’s? A few years? And how much denser will Tesla’s network be by then?

That’s a head start that will keep Tesla ahead of the curve – way ahead of the curve. Tesla already has the charging infrastructure to support thousands and thousands of cars, and it will only keep increasing and improving from here.

From a bird’s eye view, competing automakers are still busy building their first few EV models. They are still in the process of acquiring the expertise to build EVs. First, they need to do that, then they need to think about production capacity. And then they need to worry about where they are going to get the batteries made. With that steep a learning curve, they really don’t have the time to think about infrastructure.

And if they take two to three more years to address all those issues (and I believe it could take longer than that), Tesla will have already run away with the market. Or should I just say market-share, because a couple of years is all that Tesla needs to mass manufacture the Model 3.

Now, this is where it is very disappointing to frequently come across articles that keep blowing the death horn for Tesla. Think about this for a moment: Have you ever come across a company that has demand far outstripping supply, fold and die?

From its early days, Tesla has always had its demand way above what it could produce, right from the day it launched Tesla Roadster in 2008. Between 2008 and 2012, Tesla sold 2,450 roadsters in over 30 countries. Tesla stopped taking orders for Roadster after August 2011.

“The first “Signature One Hundred” set of fully equipped Roadsters sold out in less than three weeks, the second hundred sold out by October 2007 and general production began on March 17, 2008.” – Wikipedia

Yes, Tesla sold hundreds of Roadsters even before the company started building them.

Tesla Model S Sales

The Model S was no different either. Tesla stopped building roadsters because it wanted to get busy building the Model S, which was launched in 2012. And the Model S went through the same demand-supply phenomenon as its predecessor. By January 2011, a full year before the first Model S rolled out of its plant, Tesla had more than 3,000 buyers depositing $5000 or more towards their reservation, way more than their planned 2012 production capacity.

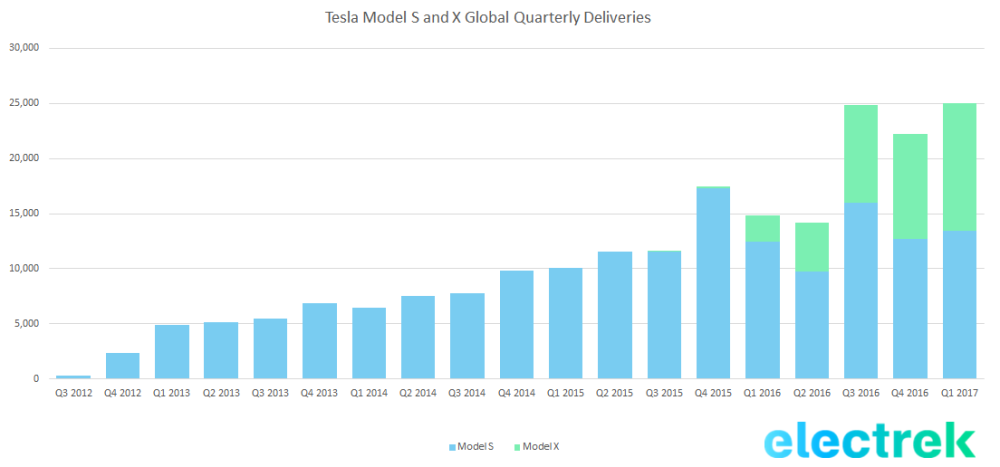

So what happened to Model S after that? This is what happened.

Annual global deliveries (including Model X, which started being delivered in Q1 2016) zoomed from 2,650 in 2012 to more than a hundred thousand by 2017. In the United States alone, Tesla has sold more than 25,000 Model S each year in the last three years.

2015 – 25,202

2016 – 29,421

2017 – 27,060

Total for 3 years: 81,000+

81,000 cars in three years doesn’t seem like much. But let’s take a look at what BMW sold in the U.S. during that time. From 2015 to 2017, BMW sold about 965,000 cars in the United States.

But wait. That’s an unfair comparison for a lot of reasons.

For one, that’s for “the BMW 1-series, 2-series, 3-series / 4-series, 5-series, 6-series, 7-series, i3, i8, Z4, X1, X2, X3, X4, X5, X6, Z8, Z3, 8-series.” That’s all BMW cars across all segments.

If you look at it from a price segment viewpoint, the Model S (starts at $72,000) would fall somewhere in the BMW 5-Series to 7-Series range. To put that in figures, the 7-Series, with a starting price of about $82,000 sold a little more than 31,000 units from 2015 to 2017. The 5-Series, starting at a more affordable $55,000, sold about 117,000 units during the same period.

Now, you’ll have to keep in mind that we’re comparing a 10-year-old company in a highly exclusive and practically non-existent segment – EVs – to a 100-year-old one operating in a 100-year-old segment – namely, internal combustion engines. From that perspective, you can see the huge strides Tesla has made in this space.

Selling 25,000+ units a year in the United States, where the price of a Model S is above 70K, is not a joke, and delivering 101,420 units of Model S and Model X in 2017 globally is absolutely not a joke either. So, Tesla’s annual Model S and Model X production capacity is already over 100k, and the global market for luxury and luxury mid-size EV sedans is quite large.

In a way, Tesla proved that the demand for EVs is definitely there, which is why it was no real surprise that Tesla ended up getting more than 400,000 buyers globally to deposit $1000 and reserve their Model 3 well before production started. Once again, demand far outstripped supply.

Tesla has already shown with the Model S that they have the ability to ramp up annual production to 100,000. The only problem with the Model 3 is that demand is so much higher, which means a serious ramp-up is a lot more urgent. And Tesla is actively addressing the issue. Experts from its German engineering wing are already tweaking the battery production line to solve bottlenecks, and the company recently flew in six planeloads of robots and equipment to speed up the automation phase.

But with production on the rise, the charging infrastructure now comes into clearer focus. Putting out hundreds of thousands of electric vehicles on the road without a proper infrastructure would have only made buyers look for other options. Tesla got the infrastructure first before moving in for the volume model. Smart.

Excerpts from HBR Interview with Carlos Ghosn, Chairman and CEO Renault-Nissan Alliance

Question: Let’s talk about your top electric model, the Nissan Leaf. What have you learned about the electric-car market so far?

Carlos Ghosn: In terms of the technology, the Leaf has been a big success. People worried that it wouldn’t be reliable, that the batteries wouldn’t work. But it’s a great car. In our customer surveys, Leaf owners report the highest levels of satisfaction. We’ve sold more than 200,000 units. The problem is that sales are below what we thought we could achieve. The reasons are becoming clear. People complain about the recharging infrastructure and the range. The Leaf can go 100 miles on battery power, but that’s not enough for many people. They want 200 or 400 miles. And this complaint is linked to the still small number of charging stations, which makes drivers anxious.

So, yes, Tesla is definitely going bankrupt. A company that has products that time and again created massive demand has to go bankrupt, right? Isn’t that what they teach at business school?

Let me know your thoughts on the comment section, and for those of you who want to point to “how the author conveniently sidestepped the dreaded profitability question”, I request you to wait for a little while before we address that topic in another article. Because that one deserves even more attention and explanation.

So, what title can you suggest for this article about Tesla Model 3?