Elon Musk’s announcement early this month that he is planning to take Tesla private shocked every one, and his decision to reverse course, announced through a late Friday night blog post this week, did bring some cheer back to the faces of long term shareholders.

The Forwards

Am considering taking Tesla private at $420. Funding secured. – Elon Musk, August 7, 2018

The Backwards

After considering all of these factors, I met with Tesla’s Board of Directors yesterday and let them know that I believe the better path is for Tesla to remain public. – Elon Musk, August 24, 2018

New York Times author David Gelles, who penned the now-famous details about Elon Musk’s ‘excruciating’ personal toll taken by the turmoil at Tesla, also gave us a sneak peek into why, when and how Elon Musk decided to backpedal on this plans to take Tesla private. If you haven’t read it, please do.

The reason that decision was made so late into this week could have been gleaned from the fact that Morgan Stanley dropped equity coverage of Tesla this Wednesday. According to various reports, Elon Musk hired Morgan Stanley to help him take Tesla private.

Though we at 1redDrop initially thought it could be Tesla’s board or the special board committee that hired Morgan Stanley as their advisor, according to Bloomberg, “Morgan Stanley is advising Musk, not the company, its board or a special board committee formed to evaluate a potential take-private proposal said the person, who asked not to be identified because the matter is private.”

Hiring Morgan Stanley makes it clear that Elon Musk was still mulling over taking Tesla private as late as Thursday, after Morgan Stanley dropped their coverage. David Gelles says that Elon Musk spoke to the directors on Thursday before announcing the reversal on Friday.

“Among his concerns were ceding too much control to private investors — including conventional car companies and Saudi Arabia, a symbol of big oil — and shutting out smaller investors who might be unable to retain a stake.” – NYT

Indeed, this conflict was a major talking point among Tesla investors. We do not know how many large institutional holders pointed out this conflict, but it’s interesting that a transformational electric car maker that wants the world to move away from fossil fuels is expecting to be backed by a country whose primary revenues come from fossil fuels.

A few days after the announcement, a page titled Say No to Saudi Arabia went up on the Tesla Motors Club forum. A quick look at the discussion will tell you that people had mixed reactions about Saudi Arabia helping Elon Musk take Tesla private.

The bigger their stake, the bigger the confusion would have been. Though from a financial perspective it may not have mattered much to large institutional holders who the next round of funding is coming from, from a brand perspective, having Saudi Arabia would have certainly taken a toll on the clean image Tesla has built all over the world.

People are hopeful for a change, and Tesla was offering that. That message for change would never have been as effective as it is today when sustainable transportation is powered by money that came from selling fossil fuels.

The second point that we need to take note of from David’s article is the amount of money that was required to take Tesla private. He writes:

“After a Silver Lake representative made a presentation expressing confidence in their ability to manage the process of taking Tesla private — a transaction that could have required $24 billion or more.”

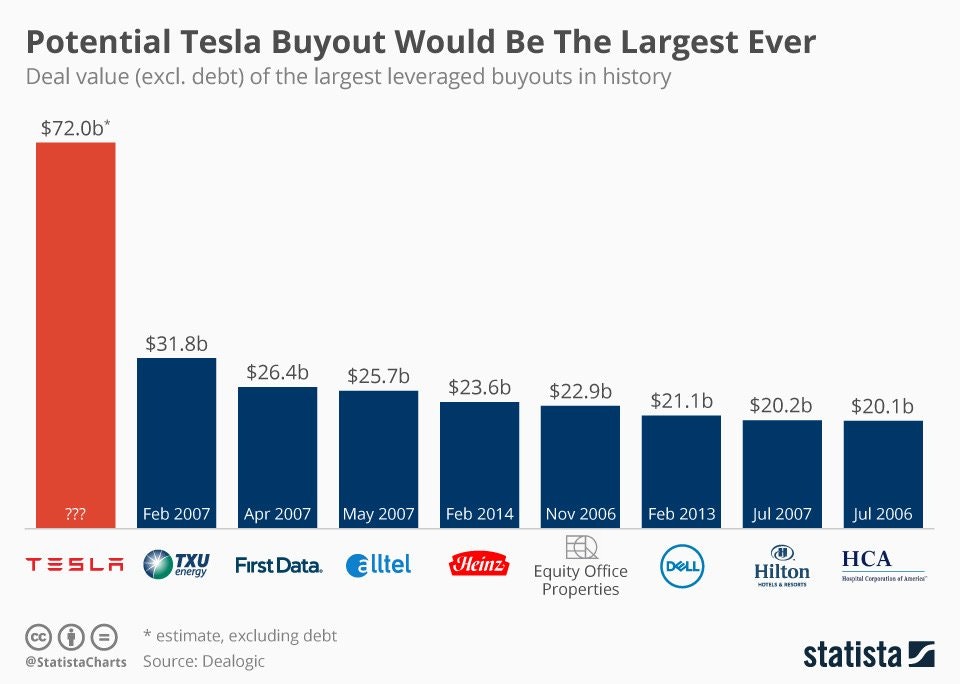

The media was skeptical about the take-private transaction going through because the deal size was estimated as being way too big – some said in the order of $50 billion while many kept stressing that its a $74 billion deal. But we thought those numbers were a bit inflated. We expected the transaction to cost around $26 billion. Not far from the “$24 billion or more” that Silver Lake eventually came up with.

There are plenty of individual investors, large ones like Ron Baron and thousands of small investors who would like to stay. Elon Musk has smartly made it clear that the company may get back to public markets at a later date. So there is an incentive to follow the company into the private world. Even if ten percent of individual investors choose to convert into the special purpose investment vehicle, then the price of the buyout will further drop to $26 billion. A deal far below the TXU one. – Shudeep Chandrasekhar, 1redDrop, August 10th, 2018

The point we are trying to make here is, the deal didn’t get derailed because there wasn’t enough money in the private world to help take Tesla private. That’s what we wrote on August 10th and that’s what we are writing today on August 25th.

Media – Deal value more than $72 Billion. We – Elon Musk needs less than $30 billion to take Tesla Private

Elon has been nurturing his thoughts of taking Tesla private for a very long time and, as usual, he just jumped at a task that many would have thought impossible to achieve. He set his target and then went after it. Not a great thing to do from the rules and regulations point of view, admittedly.

“I kind of say when I think can occur, but then I am typically optimistic about these things. But, maybe, hopefully less optimistic over time. It pretty much always happens but not exactly within the time frame. This is something I’m trying to get better at.” – Elon Musk

But to keep arguing that there was no money to take Tesla private is not as true as it is made to sound.

Carrying over all the retail investors into a private Tesla is a problem, having oil money support a clean energy company is a problem, sacrificing the straightforward fund-raising options offered by capital markets to escape the short seller narrative is a problem, even convincing long-term shareholders who think Tesla could be worth in the hundreds of billions to cash out at $74 billion is a problem, but finding less than $30 billion to take Tesla private was never a problem.

Even though these arguments are all moot points now that Tesla is staying public, it highlights how various sources can interpret something in completely different ways. There’s really very little unbiased reporting because information from different sources can lead to very different conclusions. What was thought to be a $70+ billion dollar deal was actually a $25 billion dollar deal. What was thought to be Musk breaking down in public is actually a fresh start for an entrepreneur on a very long journey that’s only just beginning.

The short seller narrative will live on, growing weaker with every Tesla success yet continuing to put pressure on Tesla to perform at its best at all times. We believe that’s a good thing, one of the best things about taking a company public in the first place. Greater transparency might not be great for Musk, but it’s what’s best for the company at a time when the world is divided between being skeptical of its achievements and having to acknowledge those achievements slowly emerging from the darkness of doubt.