In this cloud industry review series, I’ve been talking about the biggest players in cloud, the edge they have over the competition, the pace at which they’ve been growing and where they are as at the end of 2016 – the Year of Cloud.

The first article covered cloud infrastructure industry leader Amazon Web Services, while the second talked about Microsoft’s cloud business. In this third article, I cover a company whose cloud strengths aren’t as widely known as the other two, but growing rapidly just the same – Big Blue.

IBM was a little late to the cloud party despite having the know-how for nearly as long as Amazon has, but once the company realized that this is the way forward they bulldozed their way into the industry, snapping up company after company in the last few years. The acquisition spree cost them billions of dollars in the process, but also provided them with enough expertise, personnel and clients in the cloud segment to stay close to the top players of the segment – Amazon and Microsoft.

As Amazon (completely) and Microsoft (mostly) focus relentlessly on shifting every possible company to a public cloud, IBM still believes that hybrid cloud – a mix of running your own infrastructure and using a public cloud to handle peak demand – is the way to go. This does make a lot of sense considering the kind of big-sized enterprise clients IBM already has – companies that cannot move that easily into a public cloud due to the sheer volume of data they have archived, issues with security, regulatory concerns and other big issues.

But Big Blue doesn’t get the respect it deserves in the cloud industy, and the company has no one else but itself to blame. I’ve said that before and I still think that’s true.

It’s not that they don’t talk about the growing parts of their business, but something about their messaging invariably causes them to be left out of cloud conversations. Wrongfully, I should add.

Microsoft and Amazon have mastered the art of staying in the limelight and making sure their solutions are a part of any discussion around cloud. IBM, despite having solutions that can match them, somehow never captures the imagination of the industry, the investors or the media.

That said, there is one area that has the potential to differentiate IBM’s cloud solutions from the crowd, and that is its Analytics division.

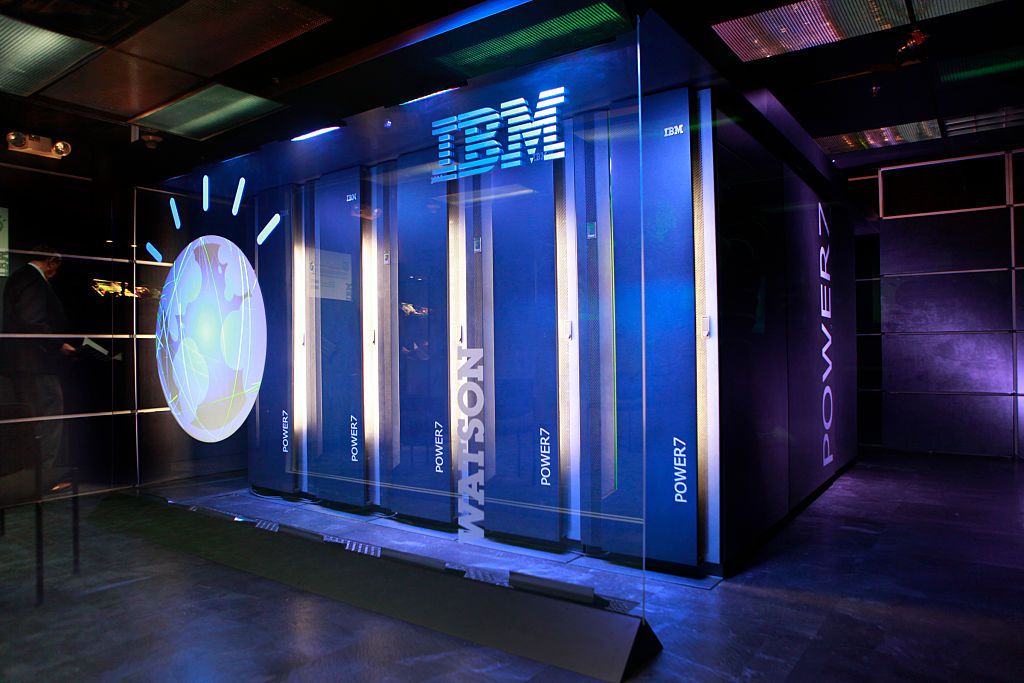

IBM’s strength in the Analytics segment is derived from Watson, a cognitive technology that IBM says can think like a human. IBM has been steadily building its offerings around Watson, and the results are already there to be seen. During the most recent quarter IBM’s Analytics division brought in $4.8 billion in revenues, registering a growth of 14% compared to last year. The division is possibly the biggest such unit in the world, with annual revenues very close to $20 billion, having registered year-over-year growth of 9%,4% and 14% in the first three quarters of the year.

Clearly, despite its current size IBM’s Analytics unit has been growing at a not-insignificant pace. Though Microsoft and Amazon are building their own AI platforms, IBM’s Watson is already there in the market with a huge list of clients. And let’s not forget the numbers that speak plainly of its success.

Amazon Web Services just crossed a milestone of over $3 billion in quarterly revenues during the recent quarter. Microsoft’s commercial cloud annualized run rate was $13 billion, showing a similar quarterly figure. IBM’s Analytics division is already well over those numbers, but for some reason nobody wants to talk about that. It’s a puzzler that I certainly can’t figure out, and neither can IBM, for that matter. They make all the right moves, and their CEO Ginni Rometty is a powerhouse in her own right, standing shoulder to shoulder with business icons like Jeff Bezos and, more recently, Satya Nadella.

Analytics is at the core of IBM’s strategic imperatives and easily the unit with the most potential, and it can carry their cloud solutions for a very long time because it gives their products an extra edge that others don’t have at the moment. IBM’s Cloud as-a-Service run rate reached $7.5 billion in the third quarter of the current fiscal, a growth of 65% compared to last year.

“Over the last 12 months, strategic imperatives delivered nearly $32 billion in revenue and now represent 40% of IBM. We had strong performance in our cloud offerings which were up over 40% led by our as-a-service offerings. We exited the third quarter with an as-a-service run rate of $7.5 billion. That’s up from $6.7 billion last quarter and the bulk of the increases organic. So we are building scale in these businesses.” Martin Schroeter, CFO IBM, 3Q-16 Earnings Call

In the first three quarters, as-a-service run rate has grown by 46%, 50% and 65% YoY, which means IBM has been able to keep the pace with segment leaders Amazon and Microsoft with respect their own cloud growth.

And yet…

Thanks for reading our work! We invite you to check out our Essentials of Cloud Computing page, which covers the basics of cloud computing, its components, various deployment models, historical, current and forecast data for the cloud computing industry, and even a glossary of cloud computing terms.