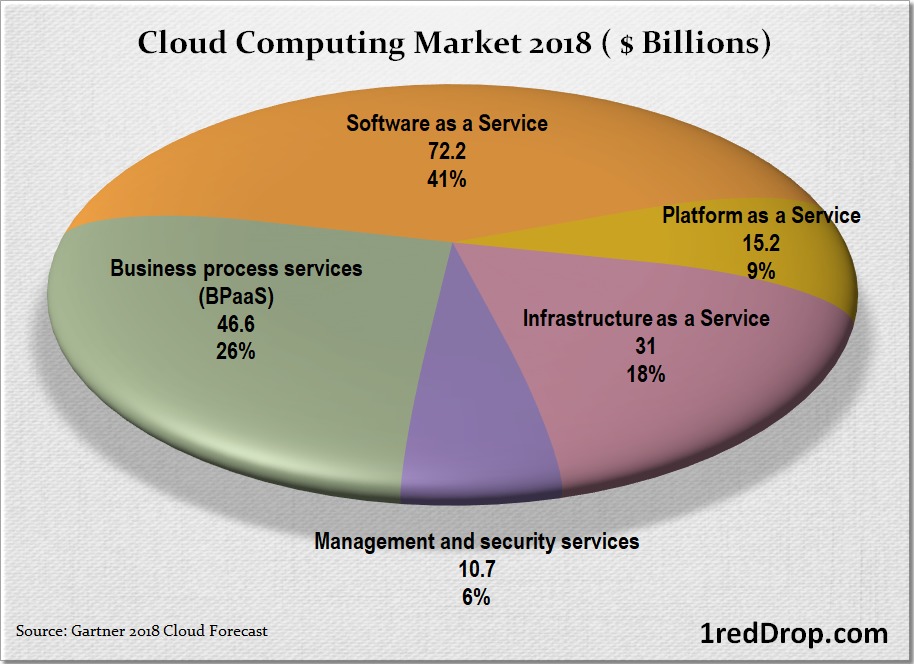

In 2019, Worldwide Public Cloud spending is forecast to hit $206.2 billion, up from $175.8 billion in 2018, a

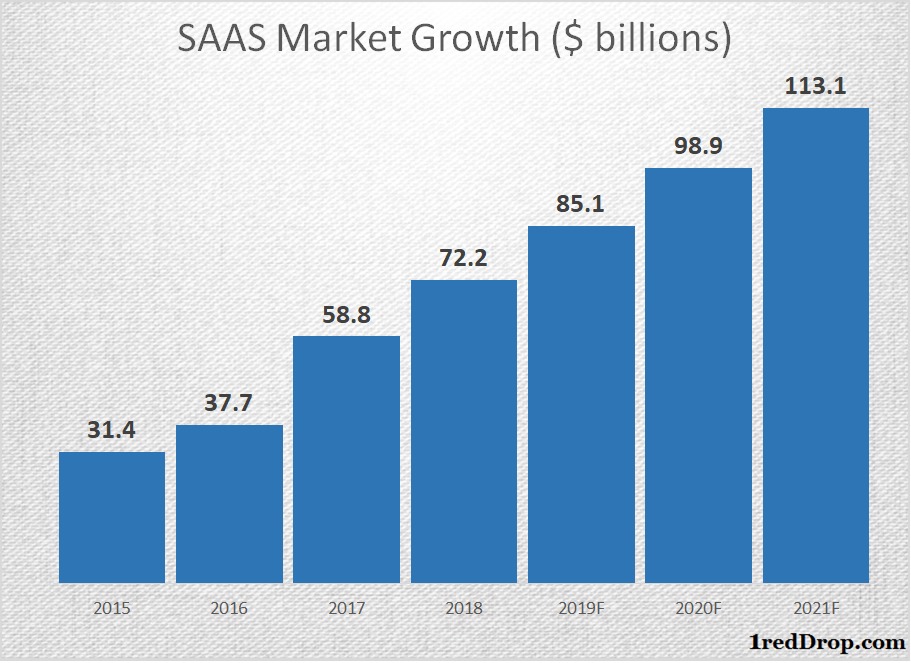

Software-as-a-Service, the largest component of Cloud Computing continues to outperform other segments. In 2018, SAAS accounted for 41% of the Cloud Computing market.

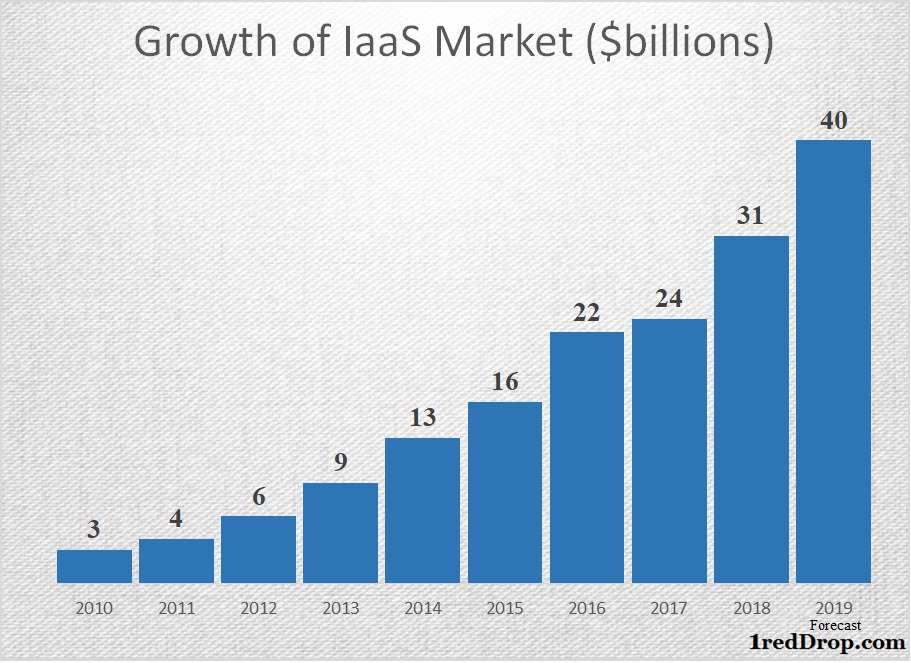

Infrastructure -as-a-Service

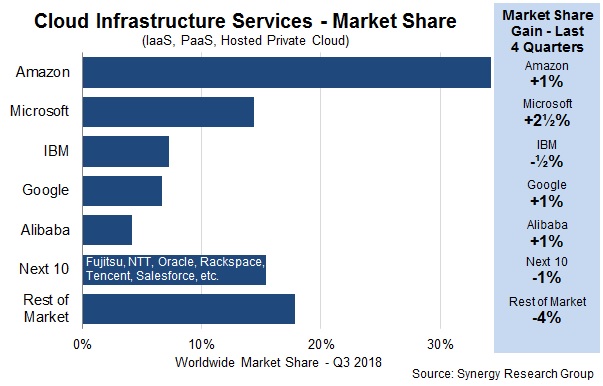

The Infrastructure-as-a-service segment continues to remain extremely competitive, as the market base consolidates around large scale players like Amazon Web Services, Microsoft, Google,

Data collected by Synergy Group in Q3-2018 show that Amazon Web Services accounted for a lions share of the IaaS segment with 34% market share.

“Market leader Amazon maintained its dominance and remains bigger than its next four competitors combined. Its sheer scale prevents it from growing as fast as the chasing pack, but it still managed to nudge up its market share a percentage point to a little over 34%.” – SRG

In 2018, Google Cloud broke into the leadership category for Gartner’s magic quadrant for Cloud Infrastructure as a Service.

Gartner’s Magic Quadrant for Cloud Infrastructure as a Service, in which the research firm groups competing players based on their vision (X-axis) and ability to execute (Y-Axis), shows Amazon, Microsoft

Key Development: Cloud IT Infrastructure Revenue Overtakes Traditional IT Infrastructure Revenue

Research and Consulting firm IDC reported that “in 3Q18, for the first time, quarterly vendor revenues from IT infrastructure product sales into cloud environments surpassed revenues from sales into traditional IT environments, accounting for 50.9% of the total worldwide IT infrastructure vendor revenues, up from 43.6% a year ago.”

Software-as-a-Service

The Cloud Software market reached $72.2 billion revenue in 2018, representing a 22.7% year over year growth rate. Gartner expects cloud software market to surpass $113.1 billion by 2021 at a compound annual growth rate of 12.6%.

Data Source – Gartner, 2019, 2020 and 2021 revenue are forecasts

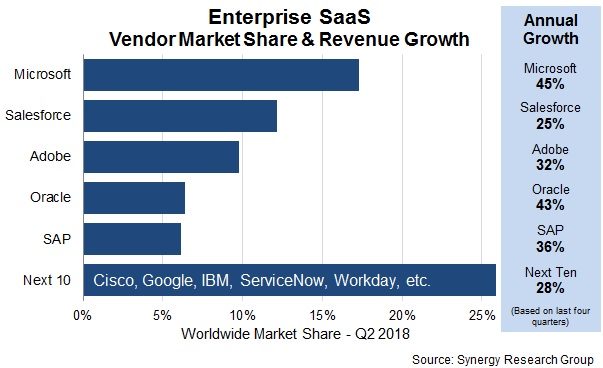

Microsoft is the leading SaaS provider, accounting for 17% of the market in Q2-2018. Despite being the largest player in the segment, Microsoft’s SAAS revenue grew by 45% between the second quarter of 2017 and 2018.

Cloud Computing Forecasts:

Cisco Global Cloud Index: 2016 to 2021

-

Hyperscale data centers will grow from 338 in number at the end of 2016 to 628 by 2021.

-

73 percent of the cloud workloads and compute instances will be in public cloud data centers, up from 58 percent in 2016 (CAGR of 27.5 percent from 2016 to 2021).

-

75 percent of the total cloud workloads and compute instances will be Software-as-a-Service (SaaS), up from 71 percent in 2016.

-

16 percent of the total cloud workloads and compute instances will be Infrastructure-as-a-Service(IaaS), down from 21 percent in 2016.

Gartner:

-

By 2022, Gartner expects that 90 percent of organizations purchasing public cloud IaaS will do so from an integrated IaaS and platform as a service (PaaS) provider, and will use both the IaaS and PaaS capabilities from that provider.

1reddrop’s Cloud Point of View 2019

Amazon Web Services and Microsoft have grown much larger in size compared to rest of the field. Microsoft’s cloud division brought in revenues of $26.7 billion in the last four quarters, edging past longtime leader Amazon Web Services’ revenues of $23.4 billion.

IBM’s Cloud as a service runrate reached $12.2 billion in the fourth quarter of 2018. Big blue’s acquisition of Redhat, one of the world’s leading provider of open source cloud software for $34 billion in 2018, will help the company close the widening revenue gap with Microsoft and Amazon.

In 2019, IT spending on Cloud products and services is forecast to be $206.2 billion. It is highly likely that the combined cloud revenue of Amazon Web Services, Microsoft and IBM surpass $75 billion in 2019. Add Google, Oracle, and Salesforce to the mix, the top five or six players will easily account for more than 50% of global cloud spending.

The cloud infrastructure market as well as the cloud software market is slowly inching towards maturity.

Transitioning from a segment with several large and small players to one with a few extremely large players and several niche players. The userbase has already started consolidating under the top five or six companies. Here is our list of Top 10 cloud computing companies of 2018.

Amazon remains firmly in control of the Infrastructure as a service market. With 34% of the market under their control, which is more than the combined market share of the next four players, Amazon will exit 2019 as the world’s number one IaaS provider.

Microsoft has already run away with the SAAS market with 17% marketshare, thanks to its strength in the Office Collaboration Market. Office 365 userbase has steadily grown in the last several years, without showing any signs of a slowdown. The more Office 365 userbase expands, the easier will be for Microsoft to sell it’s SAAS products.

As the cloud war rages on, a fascinating fight is emerging in the Data Warehousing segment between Amazon Web Services (Amazon Redshift) and Oracle’s Autonomous Data Warehouse.

“With more than 6,500 deployments, Amazon Redshift has the largest CDW deployments, and its momentum remains strong”, according to a recent Forrester report. Snowflake, a 7-year-old cloud-based data warehousing specialist has turned the cloud warehousing segment into a multi-player contest.

Global public cloud services market will continue to grow at double-digit speed through the next decade, because, despite its furious growth in the last five years Cloud still accounts for less than 5% of global IT spending.

2018 Global Cloud Spending = $175.8 billion

2018 Global IT Spending = $ 3.7 Trillion