In what could be one of the biggest tech IPOs of this year, messaging app company Line Corp. has taken the leap towards being listed, with stocks already jumping 23% on its first trading day.

The Japanese company raised approximately $1 billion dollars at the IPO after issuing 22 million common shares of common stock as ADR (American Depository Receipt) on the NYSE and 13 million on the Tokyo Stock Exchange (called Tōshō or TSE for short).

Line is essentially a messaging app, but comes with a load of features such as television, games, music, stickers and even a taxi-hailing service and online grocery ordering. The app is extremely popular in four countries – Japan, Taiwan, Indonesia and Thailand.

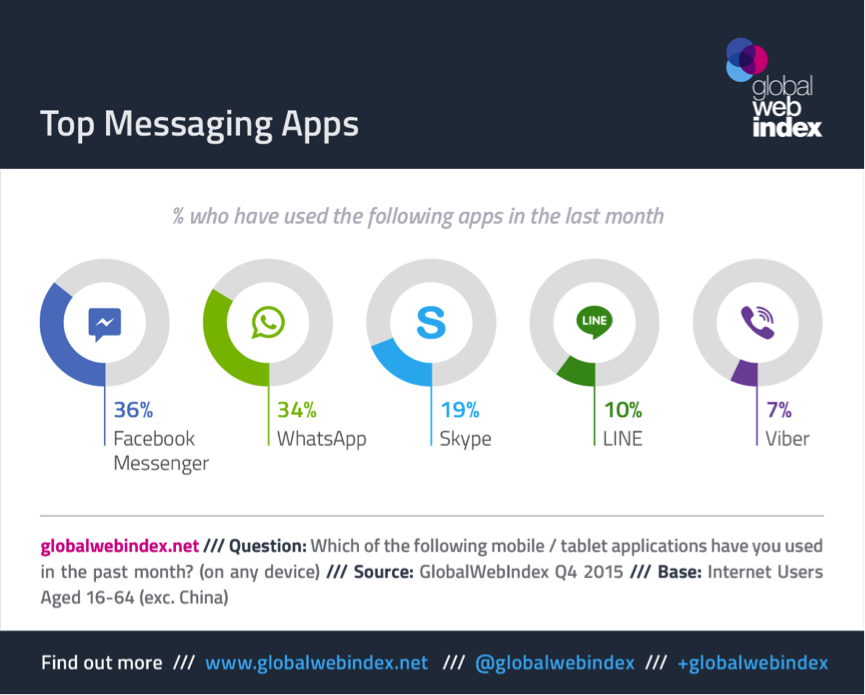

The usage stats for Line are interesting. Research firm 7Park Data says that 82% of users on Android are estimated to use the app at least once a month. Though it’s popular in these four countries, Line has been having trouble gaining traction outside these markets.

Moreover, they’ve not had much success with the e-commerce deals they’ve been experimenting with. Despite that, PitchBook says that investors are being wooed with the promise of the company’s ability to monetize and grow the app’s revenues.

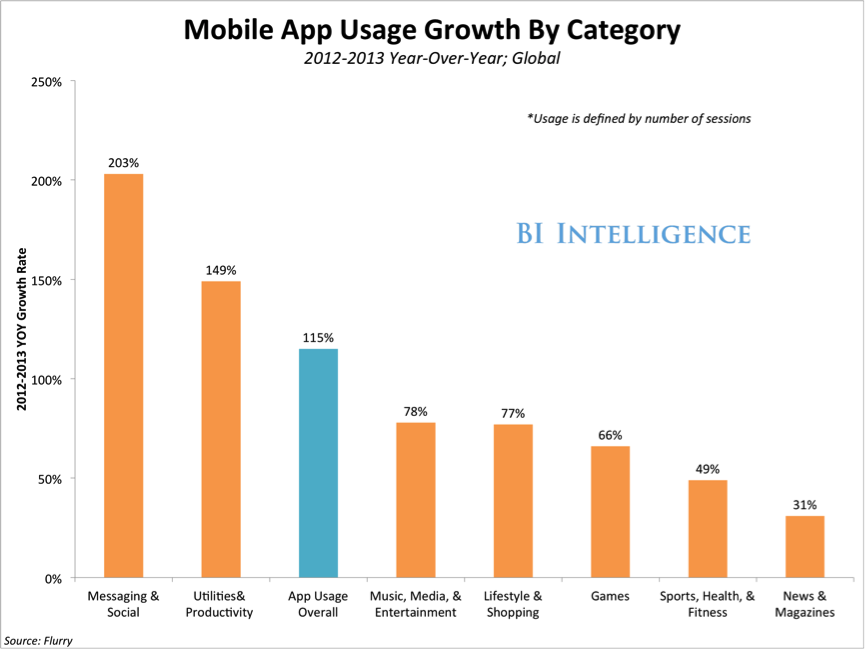

Messaging is one of the fastest growing segments in social media, and it’s growing faster than social media did during the early days of Facebook and Twitter.

And that’s not just a new phenomenon. Business Insider shows this trend starting from well before 2012.

That makes sense when you think about it because, after all, what do we mostly use social media for? Messaging, of course. Whether it’s text, a photo a video or just sharing something we saw online, the idea behind getting social is to communicate with people you know and make friends of those you don’t.

If you’re interested in investing in Line Corp. (NYSE ticker: LN), I would suggest that you wait until the initial euphoria wears off. Hyped up IPOs such as this one typically lose steam after the first few weeks, and then settle down to a more reasonable valuation.

At the current price, the company is valued at around $7.2 billion, and at the close of the last fiscal, Line’s revenues were JPY120.7 billion, or USD1.15 billion.