Tesla CEO Elon Musk announced via Twitter yesterday that if the electric car maker did not deliver vehicles on time for the customers to avail federal tax credit, it will pay up the difference.

“If Tesla committed delivery & customer made good faith efforts to receive before year end, Tesla will cover the tax credit difference.” – Elon Musk, December 23rd, 2018

Tesla is rushing to deliver as many Model 3, Model S and Model X vehicles as it possibly can before December 31st, 2018, the last day to avail the full federal tax credit of $7,500.

After that federal tax credit drops to $3,750.

Musk is saying that if the customer made a good faith effort to buy the car before the year-end, and if Tesla delivers after December 31, it will discount the price of the car by $3,750.

2018 Margins: A Fourth Quarter Priority

On 20th and 21st December, Tesla registered 1,133 Model 3 VINs and nearly all of them were Dual Motor editions.

Tesla may have prioritized higher priced All-Wheel Drive Model 3 deliveries over mid-range Model 3, to improve its fourth quarter margins, but Musk stepped-in to allay customers concern about the mid-range model 3 not making it on time to the customer.

“It will be tight, but Tesla production should have all mid-range Model 3 orders delivered by year end,” said Musk responding to a customer who was concerned about lack of delivery updates for the cheaper “mid-range” Model 3.

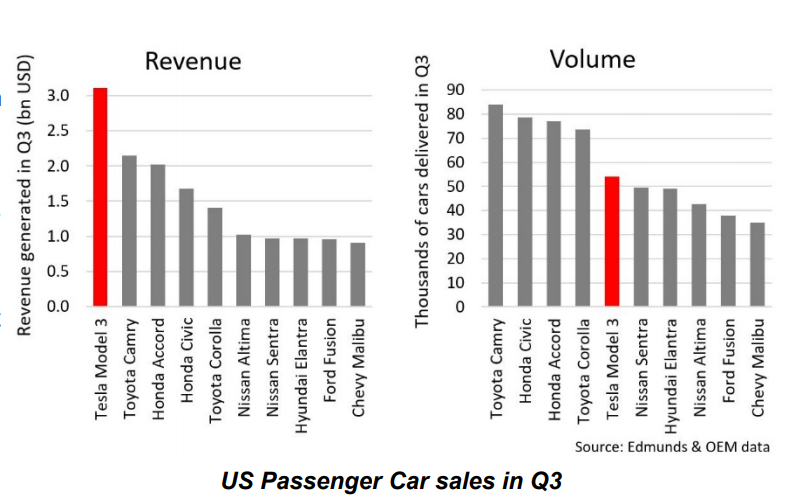

But why the big rush to deliver Model 3s in December?

The $7,500 federal tax credit is a significant amount. The tax credit drops only by $3,750 starting January 1, 2019, but it will undoubtedly have a huge impact on Tesla’s sales in the United States and put pressure on Tesla’s margins.

Tesla is not immune to Law of Demand:

“The law of demand states that quantity purchased varies inversely with price. In other words, the higher the price, the lower the quantity demanded.

This phenomenon occurs because when consumers’ opportunity cost increases, they must give something else up or switch to a substitute product.” – Investopedia

Simply put, if all things remain equal, Tesla will have to discount $3,750 after December 31st, 2018 if the company wants to sustain US demand at the current level.

If Tesla sells 23,000 Model 3, Model S and Model X in the United States in January, the company will have to set aside $86.25 million to cover for the $3,750 shortfall in federal tax credit. That’s nearly 300 million for a quarter, as big as the GAAP net profits the company reported in the third quarter of 2018.

For a company that has just turned things around with a profitable third quarter, the drop in federal tax credit is not as easy as it looks. Tesla will have to count every penny it can save, but also make sure that it does not lose out on sales because it’s counting the pennies.

That’s why Tesla is rushing to deliver as many Model 3s as it can in before the first Tax cliff.

Tesla’s Tax Cliff: The Tax Credit Time Table

| Federal Tax Credit | For Vehicles delivered |

| $7,500 | On or before December 31, 2018 |

| $3,750 | January 1 to June 30, 2019 |

| $1,875 | July 1 to December 31, 2019 |

Source: Tesla

Can Tesla Jump the Tax Credit Cliff?

Yes, they can. There are some options at Tesla’s disposal to help them tide over the federal tax credit cliff.

Reduce Model 3 listed Price

The best solution to increase Model 3 demand in the United States is – drop the price of Model 3. But it’s easier said that done.

Tesla has so far refused to launch the $35,000 standard battery Model 3 because doing so will hurt the company’s financial position as it will lose plenty of money on every unit that’s sold. According to UBS analysts, Tesla will lose $6,000 on every standard battery model 3 it sells.

Slashing prices is an option for Tesla, for now, it will remain the company’s last resort. Tesla will reduce the price in small decrements to keep a check on margins. But small decrements will only provide small sales increments.

Add another Model at the entry level

Tesla has always said that it will launch the $35,000 Model 3. So, why not launch a new model 3, a dual motor mid-range model 3 in the United States and drop the current listed price of mid range rear wheel drive model 3.

Use the dual motor version to compensate weaker margins on rear wheel drive Model 3. Sales volume increases making customers happy. Margins hold making Tesla happy

International Deliveries

This is

Early this month Tesla invited European customers to configure their model 3 and deliveries are scheduled for early Feb 2019.

Tesla has started accepting Model 3 preorders in China and priced Model 3 at unbelievable rates. The performance edition costs just $81k and the Dual Motor AWD costs $72k. Tesla is planning to start Model 3 deliveries in China by late March or April this year.

Final Thoughts

Tesla has prepared itself to counter any weakness in US sales due to the drop in federal tax credit.

International deliveries expected to begin in February 2019 will provide Tesla some breathing room to hold on to its product mix; Balance sales of dual motor editions in International markets with sales of cheaper versions in the United States.

Though Tesla can launch new models or drop the price of its cars, it’s too early for the company to commit to such a move because Tesla needs to stay extremely careful about its cash flow in the first quarter of 2019.

Tesla has a $920 million convertible debt that’s coming due in March 2019 and the company has already informed investors that it wants to pay off the debt using 50% equity and 50% cash.

The $410 million cash requirement in the first quarter may push off new launches into the second quarter or later, and limit Tesla’s ability to drop prices sharply in the United States.

For now, Tesla just wants to as many cars as it can before the clock turns January 1, 2019.

Tesla’s Christmas Rush.